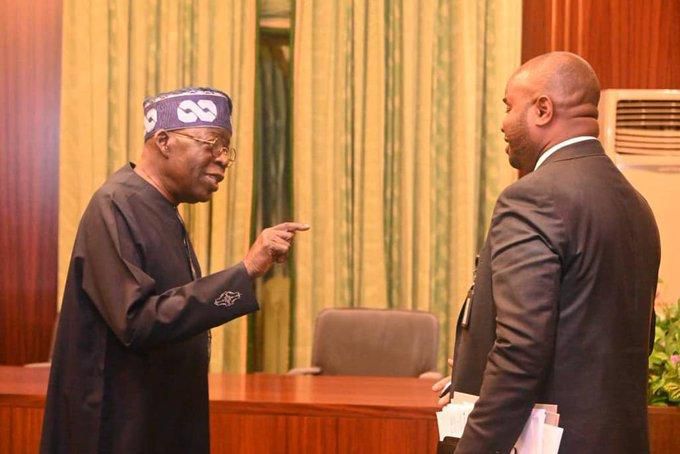

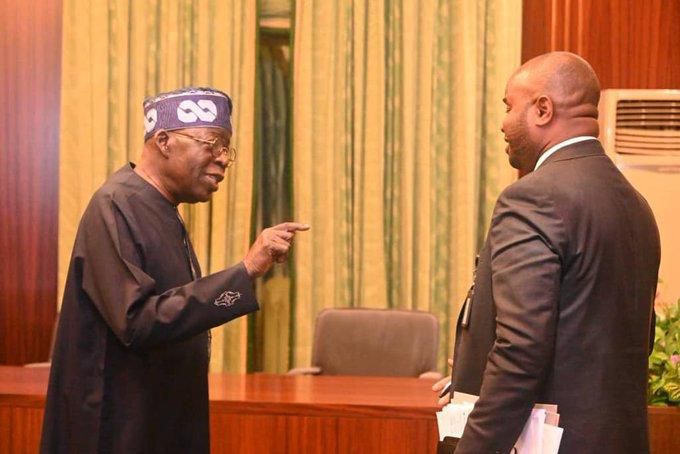

Executive Chairman of the Federal Inland Revenue Service (FIRS), Dr. Zacch Adedeji, says President Bola Tinubu’s sweeping tax reforms are at the heart of Nigeria’s push to rebuild its finances and strengthen economic stability.

Adedeji stated this on Friday, November 14, 2025, while delivering the maiden Distinguished Lecture Series at the University of Ilesa, Osun State, hosted by the Vice Chancellor, Prof. Taiwo Olufemi Asaolu.

Revenue Challenge Is an Opportunity — Not a Crisis

Speaking to an audience of academics, policymakers, students and industry experts, Adedeji said Nigeria’s revenue difficulties should be seen as “an opportunity for bold reforms rather than a crisis.”

ALSO READ: Nigeria’s 2025 Tax Law: Facts vs fear as expert debunks misinformation

His lecture, titled “Economic Resilience in an Era of Dwindling Revenue,” examined the global pressures reshaping public finances — digital disruption, rising debt, climate impacts, and overlapping global economic shocks.

He said the Tinubu administration is responding with reforms built on stronger institutions, diversified revenue streams and a modern, technology-driven tax system.

Four pillars for a resilient economy

Adedeji outlined four key pillars Nigeria must strengthen to remain competitive:

-

Fiscal flexibility

-

Policy coherence

-

Institutional strength

-

Human capital adaptability

He stressed that growing non-oil revenue and modernising taxation are central to Nigeria’s resilience strategy, especially as global economic models evolve.

Automation, TaxPro Max Upgrades and Tighter Compliance

The FIRS chairman highlighted several reforms currently underway, noting that Tinubu’s tax agenda is rooted in efficiency and transparency.

These include:

-

Automation of tax administration

-

Expansion and optimisation of TaxPro Max

-

Better taxpayer identification systems

-

Collaboration with state governments to reduce fragmentation in the tax ecosystem

According to Adedeji, these initiatives will make tax administration smoother, more transparent and more user-friendly for individuals and businesses.

Universities Urged to Drive Policy Innovation

ALSO READ: PULSE EXPLAINER: How to use Nigeria’s new personal income tax calculator—with practical examples

Adedeji also called on Nigerian universities to take a more active role in shaping the country’s economic future, particularly in the areas of digital taxation, revenue strategy, and diversification.

He described higher institutions as “engines of innovation” capable of supporting government reforms through data-driven research and evidence-based policy models.

“Our universities must help build the knowledge base that will guide Nigeria’s transformation. Their partnership is essential for sustaining competitiveness,” he said.