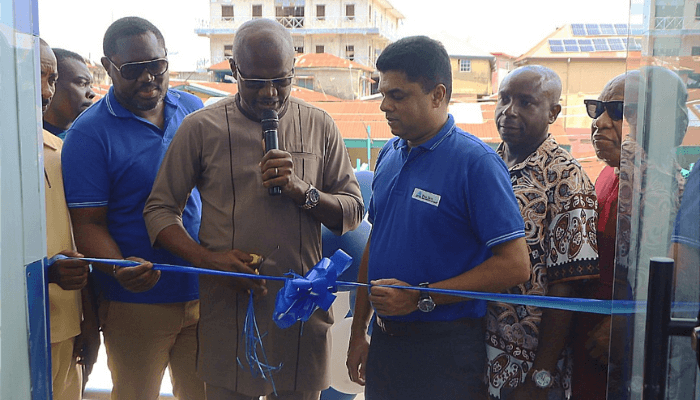

L-R: Richard Tyotule, COO, Fina Trust Microfinance Bank (MfB), Stephen Emenike, chairman, Odunade market, and Bevan Perera, MD/CEO, Fina Trust MfB, during the opening of Odunade Market branch of Fina Trust Microfinance Bank in Orile on Thursday , 5October 9, 2025.

…Opens new branch in Odunade market

Bevan Perera, MD/CEO, of Fina Trust Microfinance Bank (MfB) says the bank will leverage technology to deepen its market penetration of the small and medium scale (SMEs) segment of the Nigerian economy.

“So, we need to bring a mixture of initial digital experience to the people, so that this bridge of physical financing and the digital is mixed together in a way that it could be done in a more sustainable and profitable manner,” Perera said at the official opening of Fina Trust MfB new branch in Odunade market, Orile.

According to Perera, the bank understands the capabilities currently available in the SME segment of the market. “Strategically located, Orile serves as a gateway between Lagos Mainland and Lagos Island, making it a key transit and commercial hub for thousands of residents and businesses.

“As we open our doors in Orile, we do so with optimism, confidence, and a deep sense of purpose. We assure you that Fina Trust Microfinance Bank is here to stay, to grow, and to serve,” he said.

Perera disclosed that the bank’s focus in Nigeria is the financial sector and looks to expand its financial offerings beyond brick and mortar. “So, we feel there is potential to grow in this market.”

He also disclosed that Sri Lanka based LOLC Group currently hold a 70 percent stake in Fina Trust Microfinance Bank. According to him, the strategic investment was made in 2018, marking LOLC’s first entry into the African market. “We believe that Nigeria is the biggest economies in Africa.”

“LOLC is also the largest tea producer in the world, with an annual output of over 100 million kilograms, and boasts a net worth of approximately USD 900 million. These achievements reflect the group’s strength, scale, and commitment to sustainable growth,” Perera said.

Richard Tyotule, COO, Fina Trust MfB, said the bank is moving to Odunade market to bridge the financial gap and bring its services closer to SMEs. “So, if the business activity warrants it, then it means that we have to be closer to our customers. So, that was the second reason why we chose this location.”

According to Tyotule, Fina Trust pivoted into the SME sector in 2024, to serve customers and businesses playing in that sector of the economy. He added that the Odunade branch of the bank was specifically opened to serve high-end value customers. “So, that was why we took this long until we had a product that was suitable for this market before we came here,” he said.