The Federal Competition and Consumer Protection Commission (FCCPC) has established Monday, January 5, 2026, as the final deadline for all digital lenders to adhere to the Digital, Electronic, Online, and Non-Traditional Consumer Lending Regulations, 2025.

The rules, which came into effect on July 21, 2025, under the Federal Competition and Consumer Protection Act, aim to bring transparency, fairness, and accountability to Nigeria’s rapidly growing digital lending sector.

The FCCPC has published comprehensive guidelines to assist lenders in fulfilling the requirements. These instructions clarify the documentation needed, the submission procedures, and include updated forms based on feedback from stakeholders. Lenders with pending applications can now submit additional information proactively, without having to wait for a formal request.

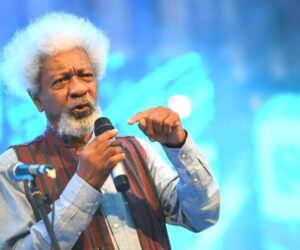

Executive Vice Chairman Tunji Bello stressed the importance of the deadline via an X post. He said compliance is not just a legal obligation but a way to protect consumers and ensure sustainable growth in the sector.

“All operators, including lending platforms, partners, and intermediaries, must meet their obligations by January 5, 2026. We have given ample time for adjustment, and the new guidelines make it easier to comply,” Bello said.

The FCCPC warned that enforcement begins immediately after the deadline, with non-compliant entities facing operational restrictions, partner disengagement, and other legal sanctions.

What happens if lenders don’t comply to the new FCCPC regulations

Operators that fail to follow the regulations risk serious consequences. Enforcement actions could include:

- Suspension or revocation of operating licenses

- Ceasing partnerships with non-compliant platforms

- Financial or legal penalties under the law

The guidelines and forms are publicly available on the FCCPC website, and the commission will continue to maintain a transparent review process for all applications

Nigeria’s digital lending industry has expanded quickly, providing readily accessible loans via apps and online platforms. However, this growth has led to irresponsible lending practices, exposing consumers to hidden fees and exploitative terms.

Also read: 492 loan apps now registered under FCCPC’s ₦100m rule

By enforcing compliance, the FCCPC aims to protect borrowers, enhance transparency, and build trust in the fintech sector, while also promoting fair competition among lenders for the benefit of businesses and consumers.

Full compliance promises clearer loan terms, fairer rates, and safer platforms for Nigerian consumers, while requiring lenders to upgrade internal processes. However, these regulations may pose challenges for some operators, particularly smaller fintech startups, potentially slowing operations until compliance is achieved.

For now, the countdown has begun, and the sector must get ready before January 5, 2026, to avoid penalties and ensure continued growth in Nigeria’s evolving digital lending market.