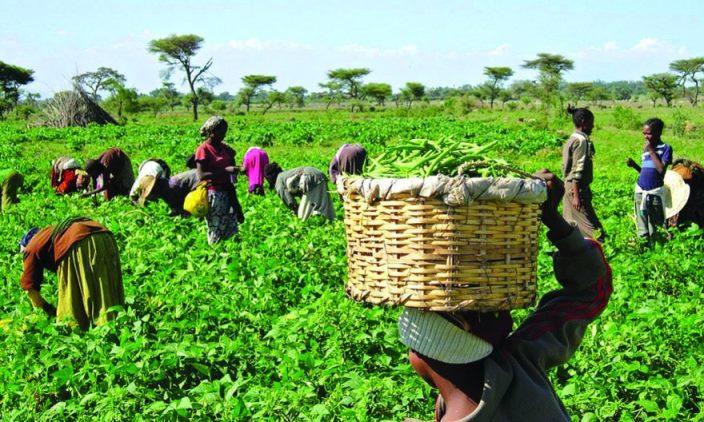

Nigerian farmers are facing some of their worst margins in years as the prices of maize, rice, and cassava fall, leaving them unable to cover rising input costs.

Despite recent foreign exchange (FX) stability and a strengthening naira, the cost of key agricultural inputs has surged. Fertiliser prices are up more than 41 percent, while seeds and seedlings have nearly doubled. Herbicides and pesticides have risen by over 20 percent, piling pressure on farmers already struggling to stay afloat.

The surge in input prices is straining farmers’ finances and forcing them to cut down on production, while abandoning the cultivation of certain crops such as maize and rice.

Abdulahi Suleiman, a maize and sorghum farmer in Maraba Gumai village in Ganjuwa Local Government of Bauchi, said he spent N1.4 million on the cultivation of a hectare of maize but got N630,000 after selling the 26 bags harvested.

Read also: Farmers chasing urban profit fuel food inflation in rural Nigeria

“I got only 45 percent of my investments after selling my maize harvest because of high input costs,” he noted. “I am glad that food prices are dropping so people can feed, but I also want the cost of farm inputs to reduce as well so farmers can be profitable,” he noted.

Suleiman warned that he may not farm next season if prices continue to trail production costs.

“I will not grow food for commercial purposes in the dry season if the pricing situation does not improve.”

Bala Ahmed, another farmer in Jega Local Government Area of Kebbi State, said he realised only 40 percent of what he invested in rice cultivation owing to high input cost and crashing market prices.

He noted that he won’t be able to farm in the dry season if he is unable to get cheap credit to finance his farm operations next year.

Lower prices of food products

Since January 2025, the cost of a basic food basket has reduced, bringing respite for households. Food inflation, which accounts for the bulk of household spending, eased to 13.1 percent in October 2025 from 39.8 percent in December 2024, the lowest over seven years.

Adesina Laja, an agribusiness expert, noted that the trend may not last. With food prices falling and the cost of producing food spiralling, he said farmers, especially smallholders without access to affordable credit, risk losing their capital and may not plant next season.

Laja, a former consultant to the Federal Ministry of Agriculture, said those who continue farming will likely reduce their output, deepening rural poverty. Without urgent intervention, he warned, the recent drop in food prices will be unsustainable and Nigeria’s food security could face threats next year.

Nigeria ranks 115th out of 125 countries on the Global Hunger Index. The World Food Programme and the Food and Agricultural Organisation warn that 31.8 million Nigerians, mostly children, are in desperate need of food in 2025.

Laja urged the government to ensure farmers have access to cheap credit and subsidised inputs to scale production in order to be profitable. “It is good that food prices are declining. However, the government has to support farmers with cheap finance so they can grow at scale and be profitable.”

Ibrahim Kabiru, national president of the All Farmers Association, said that farmers are glad that food prices are declining, but are calling for the reduction of inputs to remain in business.

Read also: NADF, FCMB partner to support women cassava farmers in Oyo

“It is now the buyers’ market and not the sellers’ market,” Kabiru said, while referring to farmers’ current situation in the country.

He noted that the government needs to subsidise the cost of farm inputs to sustain the current food price drop and the easing cost of living crisis in the country.

Another agric expert, who does not want his name mentioned in print, urged the government to move beyond executing a Guaranteed Minimum Price (GMP) mechanism to re-activating the National Food Reserve Agency to mop up excess grain at a floor price that covers the average economic cost of production for farmers.

“Farmers who have lost capital this harvest cannot self-finance the dry season. They need a lifeline to stay in business. The Central Bank of Nigeria (CBN) should de-risk the ‘Harvest Advance’ loan product,” he added.