Ethiopian-owned telecom operator, Ethio Telecom, has said its full-year earning for the 2025/26 fiscal year is expected to grow by 45.4%. The company said the prospective growth for the period July 2025 to June 2026 will be driven by an increased subscriber base and higher data usage.

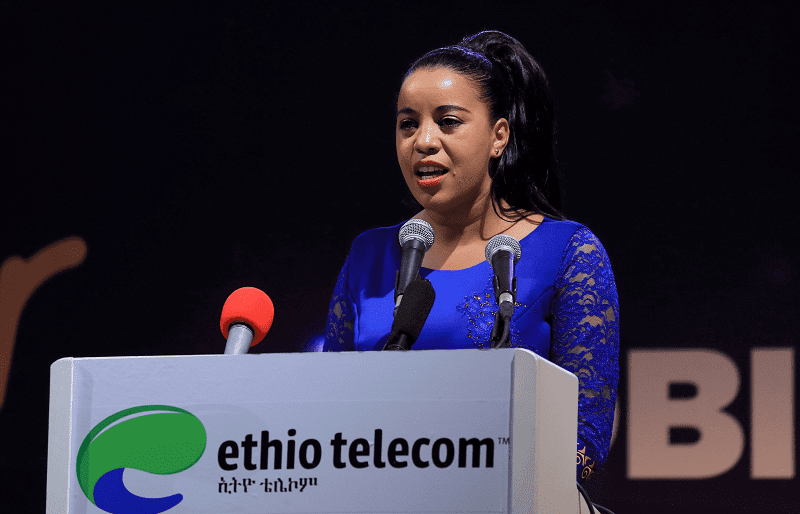

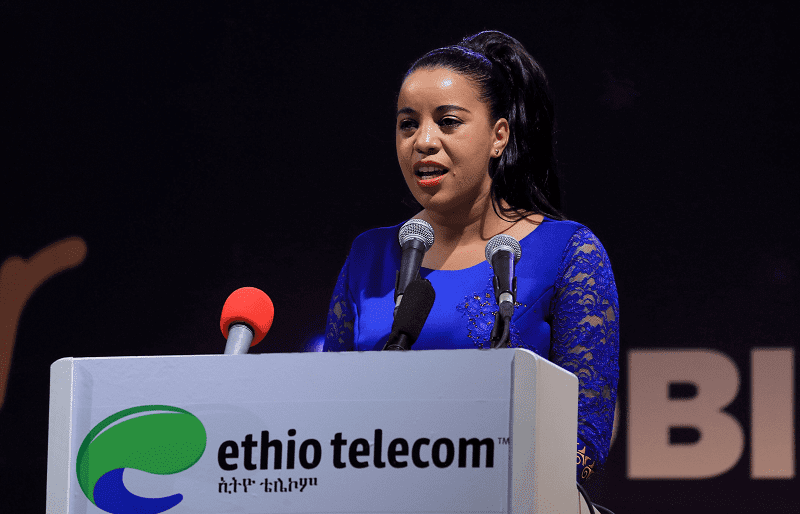

In a statement, the Chief Executive Officer, Frehiwot Tamiru, also noted that the subscriber base is projected to increase by 6% from 83.2 million to 88 million. Furthermore, Telebirr, its mobile money service, is expected to surge by 14% in customers.

Ethio Telecom’s operational performance, which further solidifies its position in Africa, comes amid reports that the Ethiopian government might divest a major stake in the company. It is expected that putting the stake up for private investment will lead to more innovation and greater efficiency.

In addition, the prospective earnings are a testament to Ethio Telecom’s success as it looks to bank on the country’s over 80.5 million subscribers. The performance is also essential in a competitive market that has a privately owned Safaricom Ethiopia PLC.

Also Read: Ethio Telecom announces 40% half-year revenue growth.

Ethio Telecom in the 2024/25 financial year

In its latest earnings result for the full year 2024/25 (July 2024 to June 2025), Ethio Telecom reported a 72.9% year-on-year increase in total revenue to 162 billion Ethiopian birr (approximately $2.8 billion). It also reported that foreign currency earnings reached $213.6 million.

During the period in review, Ethio Telecom’s subscriber base grew to 83.2 million, a 6.2% increase from the previous year. According to the CEO, the company championed the rollout of 1,683 new mobile sites, of which nearly half are located in rural areas. This contributed to the national telecom penetration growing to 73.7%.

In addition, the infrastructure upgrade increased 4G population coverage from 37.5% to 70.8%, while overall mobile network coverage reached 99.4% of the population and 86.5% of the country’s geography. The company noted that its 5G services were extended to 26 cities, and Massive MIMO technology was deployed at 306 sites.

Its mobile money service, Telebirr, registered 7.3 million new users between July 2024 to June 2025, bringing its total to 54.84 million users.

Telebirr facilitated transactions worth 2.38 trillion birr, including 13.2 billion birr in micro-loans and 11.2 billion birr in digital savings. The platform also generated USD 14.4 million through international remittance services.

The financial service reportedly facilitated transactions worth 2.38 trillion birr, including 13.2 billion birr in micro-loans and 11.2 billion birr in digital savings. The platform also generated $14.4 million through international remittance services.

Ethio Telecom also invested in Infrastructural upgrades for improved connectivity. The company added 686 kilometres of backbone fibre, bringing the total to 22,673 kilometres, and increased Optical Distribution Network (ODN) capacity to 951,982 connections. Its data and cloud centre witnessed an upgrade to 5 megawatts.

Issues surrounding stake sale

Discussion relating to Ethio Telecom’s planned stake divestment recently witnessed another turn as the Ethiopian government has now paused its decision to sell 35% of Ethio Telecom to foreign investors. This was a move expected to be a pivotal step in the country’s economic reform.

Reports explained that the government is assessing the situation and claimed not to be in a rush. The government is weighing how much stake should be allotted to private nationals and foreign investors.

Ethio Telecom held a monopoly, serving a population of about 120 million, before a consortium led by Kenya’s Safaricom won the country’s first private telecoms licence and started commercial operations in 2022. This move was considered a big part of the government’s efforts to open up the economy.

Since Safaricom’s entry, it has put Ethio Telecom on its feet for competition. The Kenyan-based telecom operator’s M-Pesa product accumulated a significant percentage of Ethiopian subscribers. With Telebirr, Ethio Telecom is fighting back with cheaper bundle offerings.