Estate planning is the structured process of organizing and managing an individual’s assets during their lifetime and arranging for their efficient transfer upon death or incapacity. It encompasses the preparation of legal instruments, such as wills, trusts, and powers of attorney, to ensure asset preservation, provide for dependents, and align asset distribution with the individual’s personal, financial, and philanthropic objectives, all in compliance with applicable laws and regulations.

Estate planning remains one of the most important but neglected areas of family life in Nigeria particularly for aging parents. Most families are often left in crisis situations when a parent, and in most cases the breadwinner, becomes incapacitated or dies suddenly with no plan in place as to how the surviving family members can have access to his assets or continue to manage his business. The consequence has been that the family becomes confused with hitherto hidden crisis suddenly resurrecting leading to court battles, strained family relationships, or even the loss of hard-earned property and investments.

This article aims to essentially provide a concise but thorough step-by-step overview of what estate planning entails for elderly parents in Nigeria, the key factors to be considered, and the ways in which families can begin the process in a culturally sensitive and legally correct manner.

Why Estate Planning?

Aging inevitably comes with higher risks to health and diminished abilities to manage one’s finances or be involved in the day-to-day management and negotiation of complicated property issues. Forward and thoughtful planning process gives aging parents the chance to make intelligent decisions regarding:

• How their assets are carefully organised and eventually passed on to their beneficiaries.

• Who acts on their behalf should they no longer be able to do so or be involved in the day-to-day running of the business.

• How would their dependents, spouse, or children be taken care of financially.

• How do they ensure that the family cohesion is maintained and that family conflicts are avoided when they pass on.

In many jurisdictions, including Nigeria, improperly constituted Estate Plan has resulted in numerous court cases involving land, cash, businesses, and pensions. In the absence of properly arranged and documented Estate plan, some members of the family or institutions forcefully takeover these assets which are neither documented nor legally transferred to them. All these could conveniently be avoided with proper Estate Plan.

Estate Plan for aging parents in Nigeria need not be complex, although it must be concise, thoughtful and purposeful. The overriding aim and principle should be to ensure the wishes of the parent are respected, and their beneficiaries are not left in confusion or disputes when the Settlor passes on.

One of the first and most important steps in estate planning is the preparation of a valid legal will. This is the most traditional way of giving assets to loved ones. A will is a short statement of the maker’s wishes regarding how his or her assets should be distributed upon death. Although not exhaustive, some of the most common assets that may be disposed of in a will include property, bank accounts, vehicles, investments, pensions, personal belongings and digital assets.

A properly written will provides protection from inheritance disputes and minimizes interference from customary, traditional, or statutory claims that may conflict with the deceased’s true intentions. It ensures that the distribution of assets is carried out according to the testator’s wishes, not left to chance or contested interpretations.

Given the complex nature of wills, especially in a culturally diverse legal environment like Nigeria, it is strongly advised that Settlors seek legal counsel when preparing and executing a will. This ensures that the document carries the full force of law, is free from ambiguity and less likely to be challenged.

It is possible that some aging parents may not be disposed to writing a Will (often regarded as remembrance of death).

In which case, a Settlor could consider setting up a Trust especially where the estate is more complex say, with multiple spouses, young children, or vulnerable family members. A Trust allows assets to be held and managed on behalf of beneficiaries, typically through a licensed Trust company. In Nigeria, Trust Companies are registered and regulated by the Nigerian Securities and Exchange Commission (SEC) and have a legal obligation to administer the trust in good faith, ensuring the fulfillment of the terms as specified by the Settlor over the years. Trusts are particularly helpful when money disbursement, property administration, or wealth accumulation for the subsequent generation needs to be carried out professionally and gradually distributed.

Another significant part of the estate planning process is beneficiary naming on retirement accounts, life insurance policies, cooperative contributions, and other such financial instruments. Under the Nigerian Pension law, the named Next-of-Kin takes no benefit of the amounts standing to the credit of the deceased’s Retirement benefits. The Will must specifically name the beneficiaries in a formal Will. Parents should thus scrutinize and regularly update their estate plan to ensure that there are no lacunae that could be exploited by persons waiting to pounce on their assets once they pass on.

Apart from ensuring that assets are distributed to named beneficiaries either in the Will or Trust instruments, there is also the concern of decision-making in the event of sickness or incapability. A power of attorney can be utilized in appointing a person that is acceptable and trusteed by the Settlor to make legal, financial, or even medical decisions on behalf of the parent when the parent become incapacitated or is unable to manage his/her affairs. This instrument can become exceptionally useful in the management of day-to-day affairs such as accessing bank accounts, settling bills, or dealing with property, and needs to be balanced in terms of adopting a preventive approach versus an aftereffect one.

While relating with others, it is possible that a parent may have entered into contracts or agreements that either increased his/her assets or imposed liabilities on them or claims against their assets. It is therefore important that they are encouraged to document every asset that may have accrued from such relationships or liabilities that they may have been exposed to. Parents need to be encouraged to maintain an up-to-date list of all that they own: land, buildings, shares, pensions, cars and of any debts payable to or owed by them. That document, whether kept in paper form or electronically, helps family members and executors to ascertain whatever assets the deceased has, or liabilities owed when family members review his/her affairs. Having such clear and concise assets list would ultimately prevent disputes or conflicts from family members or those claiming against the estate.

Finally, although frequently overlooked and left to the discretion of family members, it is useful for parents to give guidance or direction either in the Will or Trust instrument regarding their funeral wishes, such as the nature of the funeral, where they wish to be buried, and what cultural or religious practices they would like their families to adopt, follow or outrightly avoid. Although intensely personal, providing the needed guidance or direction will not only help to soften the emotional trauma that the family is subjected to at that trying moment but also minimize the risk of argument as to how the deceased wants to be buried or the nature of the funeral celebrations.

The above, all ccollectively brought together in a brief, written plan are the basis of an empathetic estate planning process. They not only give comfort to elderly parents but also give their families the clarity and organization needed to manage the future with understanding, dignity and harmony.

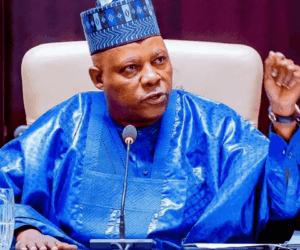

his piece was contributed by BUNKAYA GANA,

MANAGING DIRECTOR/CE GREENWICH TRUSTEES LIMITED.

He can be reached on 08033335436 or [email protected]