Egypt-based cleantech Tagaddod has raised $26.3 million in a Series A round led by The Arab Energy Fund (TAEF). The investment will be deployed for regional expansion across existing and new markets in Africa, Asia, and Europe.

Aside from TAEF’s investment, the round also saw participation from Tagaddod’s existing investors, such as FMO (the Dutch entrepreneurial development bank) and VKAV (Verod-Kepple Africa Ventures), a leading pan-African VC. Others are A15 Ventures, a MENA-based venture capital firm known for backing high-impact startups and re-investment from early investors.

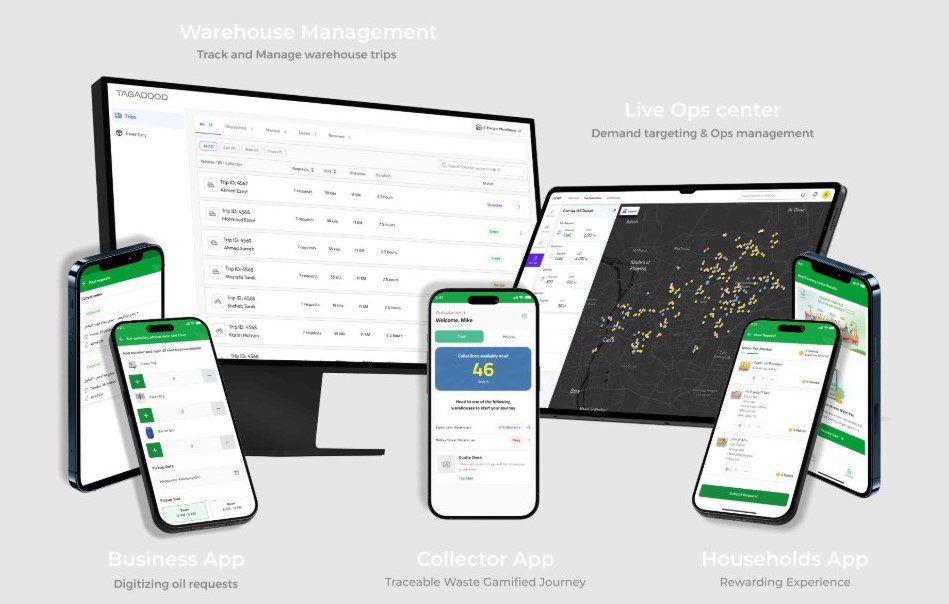

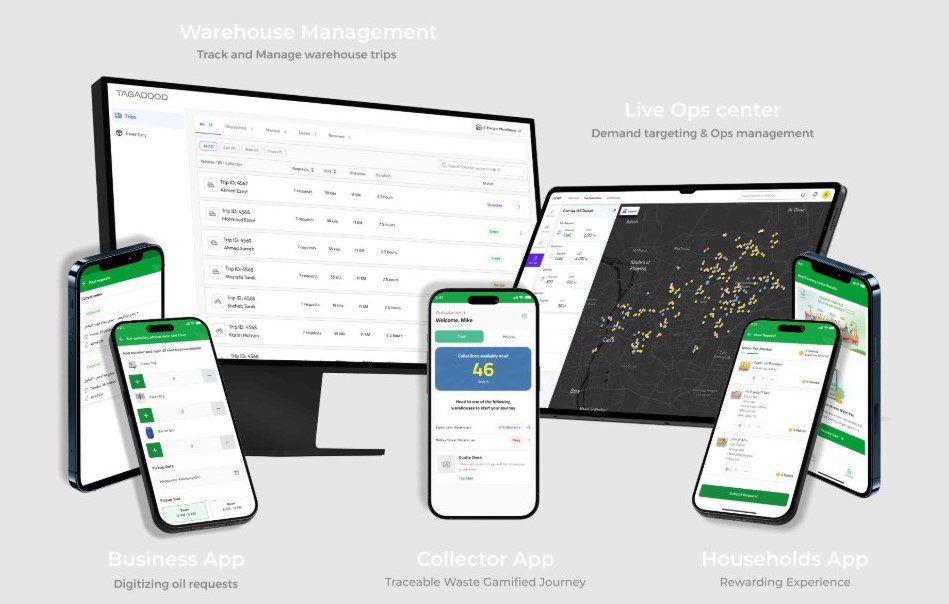

Founded in 2013 by Nour El Assal and Ahmed ElFarnawany, Tagaddod uses tech-powered initiatives for renewable waste-based feedstocks. This includes collecting, tracing and certifying materials such as used cooking oil, acid oils, and animal fats from thousands of suppliers.

Tagaddod’s mission is to be a leader in supplying renewable feedstocks to the rapidly growing biofuels and Sustainable Aviation Fuel (SAF) industries. With the latest round, the Cairo-based startup will be exploring new markets and enhancing its technology drive with the inclusion of an AI-powered analytical system.

While reacting to the development, Co-Founder and CEO of Tagaddod, Nour El Assal, said that the $26.3 million is more than just a fund but a testament to their innovation in renewable and clean technology. He added that the funding further empowers the company to build the infrastructure, technology, and supply chains needed to support a cleaner energy future.

“We are backed by partners who share our belief that renewable feedstocks are at the core of the global energy transition. This capital is not here to burn — it’s here to scale. Our focus is profitability, execution and building a business that delivers long-term value,” said Ahmed ElFarnawany, CFO of Tagaddod.

In addition, both founders noted that TAEF is an ideal partner in the sustainability drive. Backing their statement, the lead investors express that the development is a compelling opportunity to support a founder-led company operating in a mission-critical and underserved segment.

“Tagaddod’s platform reflects our commitment to backing scalable, sustainable infrastructure that accelerates the region’s transition to alternative energy, resource efficiency, and circular economic models, including our long-term goal of leadership in the biofuels space,” the company added.

For Tagaddod, the partnership is an avenue to increase investors’ confidence in its ability to be a long-term SAF supplier. To meet this target, Tagaddod is using part of the funds to increase its operational capacity, build infrastructure and more partnerships to support larger volumes of quality and export-grade renewable feedstocks.

Also Read: Logistics startup POZI raises €650,000 marking Gabon’s first international venture funding.

Tagaddod’s journey of sustainability

Since its launch in Egypt’s capital city over a decade ago, Tagaddod has risen to being at the forefront of sustainable energy innovation. In 2015, the cleantech achieved compliance with international standards and obtained ISCC certification, underscoring its commitment to sustainability.

With operations in Egypt for 3 years, the startup gained its first international expansion and drive to the global renewable market in 2016, when it exported its first biodiesel shipment to Europe. The startup gained another expansion a year later, this time in its products, by shifting focus towards implementing technology-enabled solutions for efficient used cooking oil (UCO) collection, to enhance its operational excellence.

Since then, Tagaddod has seen expansion into Jordan and the Netherlands. It also achieved significant financial milestones with a 5% net profit in 2020 and profitability, powered by advanced demand estimation clustering and auto-scheduling algorithms, in 2023.

By combining ground-level sourcing with technology and compliance infrastructure, Tagaddod bridges fragmented waste supply networks with large-scale industrial demand. And this story reflects its sustainable business model.

Looking ahead, the cleantech space opens up more opportunities for more wins. The global demand for biofuels and Sustainable Aviation Fuel (SAF) is accelerating, driven by climate regulations. While feedstock availability is becoming an issue for sustainable fuel growth, Tagaddod is positioning itself to solve this challenge.

To further cement its position as a long-term player in the global clean energy ecosystem, the company is focused on the development of digital tools that increase traceability. Consideration will also be placed on compliance with international standards.