e-Hailing drivers in Edo State, under the umbrella of the Amalgamated Union of App-based Transporters of Nigeria (AUATON), have condemned the Federal Government’s imposition of a 5 per cent fuel tax on petroleum products like PMS and diesel. This was contained in a strongly worded statement sent to Technext by the State Chairman, Comrade Russell Eghaghe.

Describing it as both alarming and unacceptable, Comrade Eghaghe stressed that it was bad enough that fuel prices have risen spectacularly over the years. However, imposing a tax on the already exorbitant price of the commodity, a staple for drivers operating in e-hailing, was simply condemning the public to penury.

“The proposed tax levy on petrol and fuel is both alarming and unacceptable, particularly in light of the recent price hikes we are all experiencing. It is baffling that our government would consider imposing additional taxes on fuel, Compressed Natural Gas (CNG), which is marketed as a waste product. This move will inevitably increase costs for all of us, raising a critical question: how are we, the working class, expected to cope with the financial strain that is already overwhelming many households?” the statement reads.

FG’s fuel tax and the burden on drivers

Recall that on June 26, 2023, President Bola Ahmed Tinubu signed the Nigeria Tax Administrative Act into law. The Act, which the government says aims to boost non-oil revenue and promote fiscal sustainability, has continued to draw criticisms. This is due to controversial tax reforms, which also include the 5 per cent fuel tax set to take effect from January 2026.

See also: ‘There’s a thin line between genuine crypto traders and fraudsters’ – EFCC Chairman

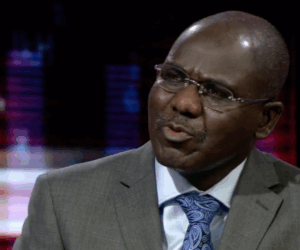

The presidency, however, insists that the revenue accrued from the fuel tax will be ploughed back into the system for the benefit of the people. Making the argument, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, said the revenue will be used to boost transport infrastructure across the country.

“The intention is to earmark and dedicate the revenue from this tax into providing transport infrastructure that can reduce the cost of transporting items, logistics, and overall bring down inflation for Nigerians,” Mr Oyedele said.

The transporters, however, do not believe the fuel tax will amount to any good for them. On the contrary, the AUATON chief, Comrade Russell Eghaghe, said the new tax would put immense pressure on the livelihood of the drivers.

“The rising cost of living is a reality that we cannot ignore. We currently lack an effective price regulatory body to monitor the dynamic pricing activities of goods and services, leading to vendors inflating prices at their discretion. This situation puts immense pressure on our livelihoods,” he said.

He therefore urged fellow transporters to unite in opposition to the detrimental policy. He urged them to come together to express their concerns and advocate for meaningful change.

Contrary to reports that enforcement of the new 5 per cent fuel tax is set to commence on January 1 2026, the presidency has clarified that the timeline being circulated is inaccurate and the enforcement will only take effect when Nigeria’s Finance Minister Wale Edun decides on a date.

“What is in the new tax law is that this surcharge will take effect on a date in the future based on an order to be released by the Minister of Finance. And we do know that the Minister of Finance is responsible enough to determine when it is appropriate to do so,” the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, said.

Regardless of the enforcement date, prominent Nigerians are condemning the fuel tax, insisting it would lead to untold hardship. The Petroleum Products Retail Outlets Owners Association of Nigeria, PETROAN, said the law, if enforced, could cause its members to close businesses.

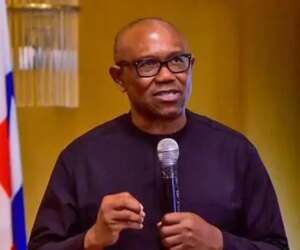

Similarly, the presidential candidate of the Labour Party in the 2023 election, Peter Obi, condemned the tax. He noted that the subsidies on CNG promised by the Bola Tinubu administration have quietly disappeared, and instead of easing hardship, the government has increased the burden on Nigerians.