Debt is reshaping startup financing in Africa, offering founders faster capital and ownership retention, but experts caution that the rising reliance on loans can undermine innovation if not balanced with equity.

With a high inflation rate and currencies weakening in markets like Nigeria and Kenya, debt-heavy startups could find themselves squeezed between rising costs and fixed repayment terms, leaving little room for experimentation or bold bets.

Africa’s startup scene is undergoing a major shift. For years, equity dominated fundraising, with high-profile venture rounds powering fintech, mobility, and e-commerce players across the continent. But in 2025, the story is different as debt emerges as a lifeline, giving founders a way to grow without giving up ownership.

In the first half (H1) of 2025, African startups raised $1.35 billion, a 78 percent increase from the $800 million generated in the same period of 2024. What stands out is debt’s rising share of this capital.

Debt on the rise

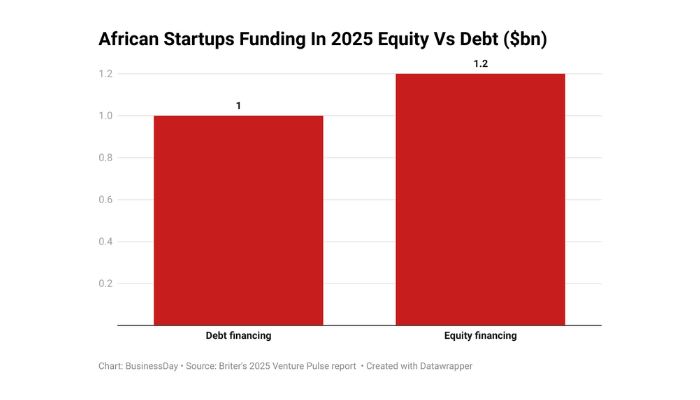

According to Briter Intelligence, debt financing crossed the $1 billion mark in August, 2025, for the first time, nearly matching equity’s $1.18 billion and accounting for roughly half of total startup capital, up from less than 15 percent in 2021-2022, when equity dominated over 80 percent of funding.

Read also: Nigeria’s 22 startups in Africa’s top 100

Seven of the top 10 most-funded African startups in Briter’s 2025 Venture Pulse report leveraged debt to accelerate growth, particularly in asset-heavy sectors like cleantech and logistics. These companies are d.light in Kenya; Sun King, in Kenya; ZEPZ, South Africa; Wave, Senegal; Burn, Kenya; CrossBoundary Energy, Kenya and Navy in Egypt.

“Debt funding unlocks equity funding for a lot of businesses. Pure equity investors don’t want their money to go into areas that won’t ensure scale. Debt lets startups raise capital, turn it over, pay it off, and retain ownership, paving the way for more equity deals,” Samuel Frank, investment associate at Sahara Impact Ventures, told BusinessDay.

Nigerian firms leverage debt

In Nigeria, the shift is palpable. Y Combinator-backed B2B payments platform Waza exemplifies this, securing $5 million in venture debt from Timon Capital as part of an $8 million mixed round to pilot trade finance and expand beyond Ghana and Nigeria.

Agri-tech pioneer ThriveAgric, which aids smallholder farmers, drew on a $56.4 million debt facility in 2022 from local banks and USAID to enter Ghana and Zambia, where revenues subsequently grew five-fold over the following year.

Bfree raised $3 million in debt financing from Verdant Capital in July 2025 to support its digital credit recovery and debt management services, while Agriarche secured $500,000 in debt financing from Sahel Capital to expand its agricultural logistics and storage network.

Similarly, Rivy (formerly PayHippo) raised $2 million in debt financing as part of a $4 million Pre-Series A round to support its pivot to clean energy financing for SMEs, with Moove tapping $10 million in venture debt from funds and accounts as part of a larger financing round in August 2023.

CredPal equally raised a combination of equity and debt funding, with the debt portion provided by undisclosed financial institutions to fund its expansion in Africa.

Other Nigerian startups with debt funding include: Remedial Health, which raised $12 million in a Series A round that included $4 million in debt from various lenders to scale its pharmaceutical operations; FairMoney is increasingly using commercial papers to finance its loan book; Sycamore, a growing list of Nigerian startups are turning to the local debt market, with Sycamore exploring raising N1 billion (approximately $1.5 million) through the local debt market. Lumos likewise raised $50 million in debt financing to expand its off-grid solar solutions, amongst others.

These cases highlight debt’s appeal in asset-heavy sectors like agriculture, solar and logistics, where predictable cash flows align with repayment structures.

Read also: High debt service costs squeeze capital projects

“Debt lets us scale without selling our vision,” said Maxwell Obi, Waza CEO, emphasising how it supports processing volumes amid cross-border trade demands.

At GITEX Africa, Briter Bridges’ Dario Giuliani stressed: “There is a growing demand for debt as an asset class. Startups need working capital that equity alone can’t provide, particularly in high-growth industries like climate tech and logistics.”

The Nigerian debt boom aligns with regional momentum. The FCMB-TLG Private Debt Fund, Nigeria’s first naira-denominated private debt vehicle approved by the SEC in May 2024, achieved first close at N10.4 billion (about $6.4 million) in Series 1, oversubscribed by 104 percent, with 17 investors including pension funds.

Fully deployed by mid-2025, it financed five mid-market firms in agriculture (a cocoa exporter), healthcare, and clean energy (a solar provider), targeting UN Sustainable Development Goals-aligned sectors. Series 2, pending SEC approval, aims to replicate this in high-impact areas.

The double-edged sword

Despite the momentum, debt carries risks. Volatile exchange rates, high inflation, and political shocks can make repayments unpredictable.

Muthoni Njakwe, a Kenyan CPA, said: “Never take up a loan to start a new business, because new businesses are full of uncertainties. What if it doesn’t work out, which is a real possibility? A fresh business has no track record, no guaranteed cash flow, yet loan repayments start immediately. Most businesses also take at least six months to pick up. How will you repay the loan in the meantime? That pressure alone can kill a good idea before it even matures”

On his part, Patrick Igwe of FSDH Merchant Bank added that debt suits companies with strong revenue streams but can quickly burden early-stage startups.

A balanced approach

Njakwe advises startups to start small, adding that, “Test the waters. Use savings, reinvest profits, and grow step by step. Once your business proves it can generate steady revenue, then, and only should you think about outside funding. Debt is not for experimenting. Debt is for fueling growth.”

For Joy Mabia, a venture capital support and startup visibility strategist, the question is not whether debt is good or bad, it is how startups use it.

In an interview with BusinessDay, Mabia said, “Debt financing offers speed and flexibility. With equity harder to secure, debt allows founders to access capital without heavy dilution. Also, lenders are increasingly offering innovative instruments tailored to startups, such as revenue-based financing. For many, debt is becoming the ‘bridge’ capital between equity rounds.”