Nigeria’s cement makers recorded their best half-year performance ever in 2025 as price adjustments, operational efficiency, and a more stable naira drove earnings to new highs.

Dangote, BUA, and Lafarge Africa saw their combined net income rise to N834.01 billion in the first six months of 2025. That’s more than triple the figures they earned in the same period last year.

Cement makers in Nigeria are benefiting from high demand as the government builds the 700-kilometer Lagos-Calabar coastal highway and rural roads. Real estate projects are also surging, with the sector now accounting for a third of the nation’s gross domestic product.

Read also: I was making N7,000 a day trading cement, says Dangote

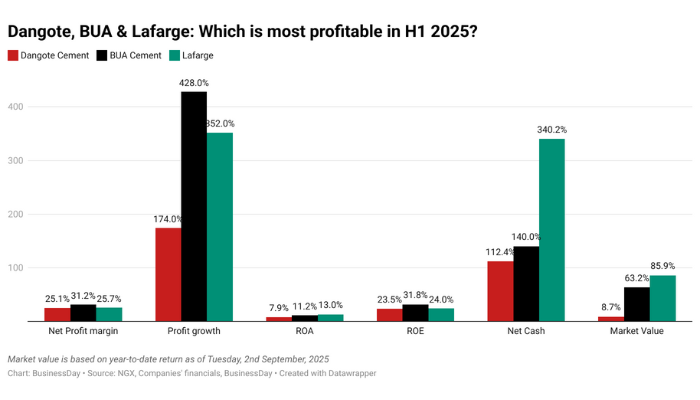

While the demand for cement is high, Nigerians are paying more, which has led to a profit jump of more than 200 percent in six months. But in this rise in income among the three leading manufacturers, BusinessDay analysed the trio’s financials to ascertain which is most profitable using metrics such as profit margin and growth rate, Return on Equity (ROE), Return on Asset (ROA), net cash flow in terms of growth, and year-to-date market value.

Net profit (margin & growth)

Dangote Cement led the pack in terms of absolute net income, growing profit about four times to N520.45 billion in the six-month period ended June 2025.

That run is followed by BUA Cement as post-tax profit grew from over N34 billion to N180.9 billion while Lafarge Africa’s income surged more than four-fold to N132.67 billion in the period under review, effectively maintaining the third position in absolute numbers.

But in terms of which made the most profit using margin and growth rate, Nigeria’s third richest man, Abdul Samad Rabiu’s BUA Cement emerges first with net profit margin of 31.17 percent and year-on-year growth rate of 428 percent.

Lafarge Africa follows with 25.66 percent in margin while growth hit 352 percent. The cement factory controlled by Africa’s richest man had a 174 percent growth in profitability on a year-on-year basis with margin at 25.14 percent.

“Dangote is still the king because of sheer size and cash flow. And the shift to CNG trucking is cutting costs in a way that makes its lead more durable,” said Nathan Olaniyi, a capital markets & business strategy specialist.

“BUA looks the shiniest in terms of margins, printing over 30 percent in the first half and even guiding toward a record N250 billion profit for the year. Some of that glow is from the new capacity they have been adding, so the returns will probably normalise by year-end.

“Lafarge is the comeback story. Profits bounced back hard once FX losses stopped pulling the firm down, and the cement maker is running a tighter, more efficient operation than a lot of us expected.”

Read also: NGX-ASI down by 1.46% as Dangote Cement, other stocks moderate rally

Return on Equity

Return on Equity (ROE) measures how efficiently a company generates profit from the money shareholders have invested.

With an ROE of 23.50 percent, Dangote Cement makes about N23.50 in profit for every N100 of shareholders’ equity, while Lafarge delivers roughly N24.00 on the same amount. BUA Cement leads the pack with 31.80 percent, meaning it earns nearly N32 for every N100 invested by its shareholders.

The higher the ROE, the better a company is at turning investor capital into profit, making BUA’s performance a signal of stronger profitability relative to its peers.

Return on Asset

Return on Assets (ROA) shows how effectively a company uses its total assets to generate profit.

Dangote Cement posted an ROA of 7.87 percent, meaning it earns about N7.87 for every N100 worth of assets it controls. BUA Cement reported 11.23 percent, indicating it generates over N11 from the same amount, while Lafarge achieved 13 percent, the highest among the three, translating to N13 in profit per N100 of assets.

This suggests Lafarge is the most efficient in turning its asset base into earnings, ahead of BUA and Dangote.

Net cash flow

Net cash flow growth on a year-on-year basis reflects how much a company’s cash generation has expanded compared to the previous year.

Dangote Cement recorded a 112.40 percent increase, more than doubling its cash inflow, while BUA Cement saw a sharper rise of 140 percent. Lafarge, however, outpaced both rivals with a remarkable 340.20 percent growth, indicating its cash flow more than quadrupled year-on-year. The figures highlight Lafarge’s stronger cash-generating momentum relative to its peers.

YtD market value

Though Dangote Cement leads in terms of market capitalisation with over N8 trillion, more than BUA and Lafarge combined, it trails in terms of market sentiment with a year-to-date gain of 8.65 percent. The stock currently sells at N520 as of Friday, September 9, 2025.

BUA Cement on the other hand surged 63.20 percent, signaling stronger market confidence in its growth prospects. Lafarge topped the list with an 85.90 percent rally, underscoring robust investor sentiment and positioning it as the sector’s best-performing stock so far this year.

Read also: Equities market up 0.50% as investors hunt for BUA Cement, others

The divergence in gains suggests that investors are rewarding companies with stronger earnings momentum and cash flow growth.

Cement makers set for a record-setting 2025

Cement makers are set to record their best year yet, supported by capacity expansion, improved cost management, price adjustment and a stable macroeconomic environment.

Analysts at Cordros Rersearch see Dangote Cement hitting crossing a trillion naira net profit by the end of 2025. That would be almost double of the earnings recorded last year with turnover seen climbing to N4.3 trillion.

BUA Cement is also said to grow its income by almost five-fold to N394.48 billion in FY 2025 with revenue hitting N1.2 trillin driven by high prices, according to CardinalStone Research.

“Looking to the full year, the picture is in some way clearer. Dangote should hold margins in the mid-20s and still produce the biggest profit pool, supported by scale and cost discipline,” Olaniyi noted.

“BUA and Lafarge look like they will finish in the upper-20s on margin, with BUA leaning on new plants and Lafarge on efficiency and cleaner FX.”

While the full year overall profitability still belongs to Dangote due its size, production capacity and returns, BUA and Lafarge will probably look stronger in terms of margins come year-end.