Cryptocurrency adoption has continued to skyrocket in Nigeria, a testament to how Nigerians are increasingly seeing digital currency as the future of the digital payment system. With the rising number of investors, experts believe regulations are needed to keep out the bad players.

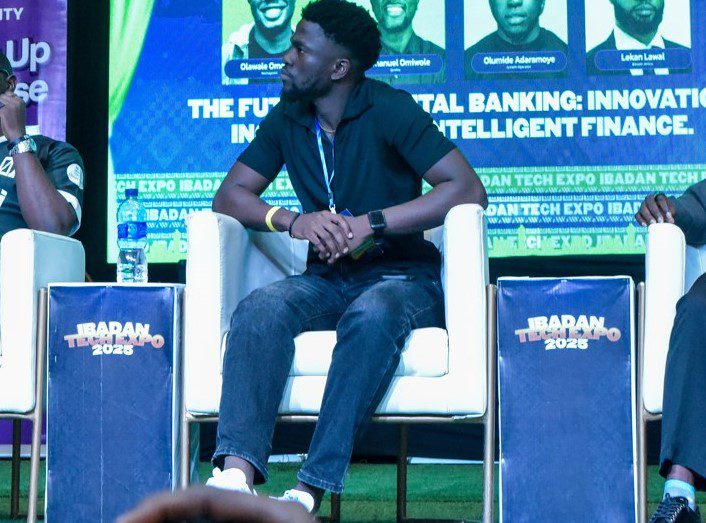

During a panel session at the Ibadan Tech Expo, Emmanuel Omiwole, a Performance Marketing Specialist at Quidax, explained that the Securities and Exchange Commission (SEC) is using regulations to control digital currency. He noted that such a move is needed in a country witnessing a continuous surge in crypto investors.

“You cannot develop an innovative technology without regulations. What the regulation is doing is to keep out the bad players in the industry,” he said.

Between July 2023 and June 2024, Nigeria’s crypto economy recorded about 59 billion dollars in transaction value, making Nigeria the second biggest in the world for adoption, only behind India. According to the August 2025 report by Breet, 85% of these transactions were valued under $1 million, signalling strong retail participation.

In awareness of these numbers, the SEC is trying to control the crypto market and stamp out Ponzi Schemes with its regulations. The Investment and Securities Act’s (ISA) adoption marked a pivotal step in the strengthening of the commission’s regulatory framework.

Emmanuel Omiwole pointed out that most times, crypto traders and innovators don’t want to deal with the government or its regulations. He noted that they feel these policies have the potential to suppress their ideas and kick them out of the game.

Over the last 10 years, the global market has witnessed a revolution, with countries such as El Salvador and the Central African Republic already accepting the digital asset as a legal tender. And in Nigeria, there has been a geometric increase in cryptocurrency users, investors and trading platforms.

According to the Breet report, around 22 million Nigerians, equivalent to 10.3% of the population, held cryptocurrencies as of August 2025. This compares to just 0.4% a decade earlier. Significantly, twenty-two million users reflect a major leap in adoption and indicate that the Nigerian digital asset market is growing.

Also Read: Tinubu’s crypto literacy push: Nigeria needs policy clarity before judicial training – Expert

Crypto: potentials of blockchain technology for instant transfer

In August 2024, the SEC granted an ‘Approval-in-Principle” to two Digital Assets Exchanges, including Quidax Technologies Company and Busha Digital Limited. This marks the first set of crypto licensing in Nigeria. Despite its clampdown on major crypto exchanges such as Binance and OKX in 2024, the SEC showed a willingness to collaborate with local crypto companies.

The ARIP framework applies to virtual asset service providers and token issuers that carry on business activities in Nigeria or offer services to Nigerian consumers, including platforms that facilitate the offering, trading, exchange, custody and transfer of virtual/digital assets.

Notably, the innovation that crypto and blockchain technology present has been tagged as a ‘great’ opportunity for commercial banks to employ in their payment systems. The tool, according to Emmanuel, has the potential to enable banks to process instant transactions primarily by eliminating intermediaries, automating processes, and utilising a transparent and decentralised ledger.

For instance, he noted that intercontinental transactions (cross-border payments) take hours before confirmation. However, he pointed out that the adoption and regulation of digital currencies will help banks to facilitate this type of transaction.

However, the actualisation and implementation of this strategy lies in the collaboration between the CBN (which caters for the money market) and the SEC (which regulates the capital market).

“There’s this scepticism around on what the framework is that CBN and SEC are supposed to do. But at the end of the day, they just have to come to that synergy to collaborate, not ask for maybe a trade or not,” he added.

For now, the SEC might still need to strike a balance on the regulation of crypto before the Nigerian financial system can witness an acceptance of digital assets in banking transactions.