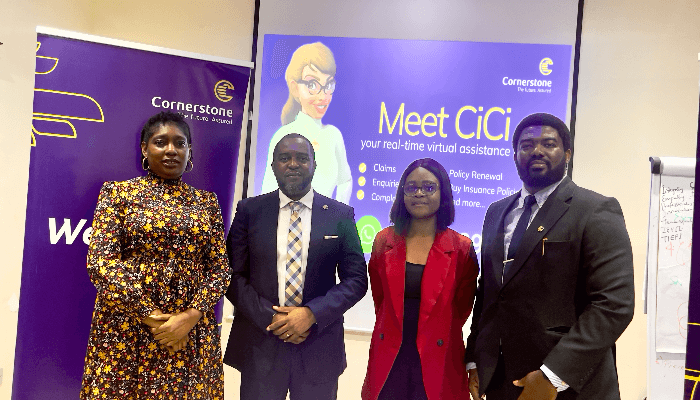

L–R: Cordelia Ekeocha, group head, Marketing & Corporate Communications; Jafar Elamah, head, Digitisation and Projects; Esther Akunyi, e-business Analyst; and Oluwarotimi Adediji, deputy chief Technology Officer, at the recently held Cornerstone Insurance Plc Media Parley in Lagos.

Underwriting firm, Cornerstone Insurance Plc is taking a bold leap into the future of customer service with the launch of Cici, its new AI-powered chatbot.

By integrating Cici into its service model, Cornerstone Insurance is reinforcing its commitment to innovation, compliance, and customer satisfaction.

Stephen Alangbo, managing director/ CEO of Cornerstone Insurance Plc, stated that the evolution of its chatbot from a static knowledge base to a Generative AI-powered solution reflects her commitment to redefining customer engagement in the insurance industry.

“With Cici, we’ve moved beyond pre-set answers to deliver intelligent, context-aware conversations that are fast, accurate, and personalised. This transformation not only enhances the customer experience but also improves operational efficiency, scalability, and compliance.”

At Cornerstone Insurance Plc, we view technology like Cici as a vital partner in making insurance simpler, smarter, and more accessible for everyone, Alangbo said.

Oluwarotimi Adediji, deputy chief technology officer, speaking during the media presentation of Cici in Lagos explained that one of the many benefits of this innovative approach is the significant improvement in customer experience.

According to him, Cici delivers fast, accurate, and personalized responses to both policyholders and prospects. He further noted that the chatbot enhances operational efficiency by reducing the load on call centers and increasing first-contact resolution rates. It is also scalable, capable of adapting to new products, services, or regulatory updates with ease.

Jafar Elamah, head of Digitisation and Projects, noted that Cornerstone is undergoing a transformation aimed at improving service delivery.

According to him, the company is moving away from traditional manual data input to a more advanced, AI-driven model through Cici. “Speed, accuracy, availability, and customer satisfaction are at the heart of this transformation. AI is a game changer for us because our customers and prospects will experience a smarter, more responsive insurance provider,” he said.

Esther Akunyi, e-business Analyst and trainer of the Cici chatbot, added that the system continually improves with use. “The AI behind Cici gets better each day, as it learns from interactions to become more efficient and reliable,” she explained.