On September 4 at CcHub’s iHub in Nairobi, I met Samuel Njuguna, co-founder and CEO of Chumz, a savings startup that uses behavioural psychology and gamification to help people save. Njuguna told me the project began as “a thing on the side” before it became a licenced business in early 2022.

“We were struggling with the whole culture of savings and investment,” he said, detailing how the company started. “We had been reading a lot about behavioural psychology and behavioural economics, which talks about how you enable people to move from a point of intention to action. That habit gap is what we thought we could solve.”

What started in 2019 with surveys and small user feedback is today a savings and investment platform with more than 300,000 users in Kenya, licenced by the Capital Markets Authority (CMA).

Behaviour first

The app’s premise is built on nudges, where people can link savings to events in their lives, turning financial discipline into something more concrete.

Njugana gave an example of football fans, who can use a feature called Super Fund. “You can save based on how the team you support is performing. So you can say whenever Arsenal wins, you’ll be saving KES1000 ($7.7),” Njuguna explained. The app notifies you ahead of matches and updates you when results come in.

Another feature ties savings to spending. “Whenever I spend money in a restaurant or in a pub, [it] tells me to save,” he said. When you pay through mobile money, the app triggers a reminder to save a set amount.

For those who struggle with impulse spending, the Vault feature locks money away for at least nine months, earning interest but remaining inaccessible until the lock period ends.

Users can also opt into timed reminders, like a daily nudge at 4 PM to save a small amount. “You can set the kind of notifications you have. You can opt in, you can opt out,” he added.

Njuguna added that Chumz is not a fund manager, but it aggregates user money and channels it to licenced investment firms. In Kenya, that partner is Nabo Capital. In Rwanda, the app’s second market, where it operates as Tunzi, it works with BK Capital, the investment arm of the Bank of Kigali.

The model is designed to scale across borders, and Chumz’s platform handles savings rules and user interactions, while local fund managers invest the pooled money. That portability has opened expansion talks in West Africa, possibly in Nigeria.

How Chumz earns revenue

Chumz primarily earns revenue from agency charges. “We are also known as an intermediary service provider or an aggregator. We aggregate funds from the public, and then we partner with a fund manager for investment. The fund manager does pay us an agency fee,” Njuguna explained.

The app also charges a small transaction fee on withdrawals, and earns from interest differentials between what fund managers pay and what users receive.

Chumz says it has more than 300,000 registered users in Kenya and is targeting 800,000 by 2026. Njuguna did not disclose how much users have saved over the last three years.

Most users who save on Chumz are young people, and many are women, although Njuguna did not provide the exact number of this demographic. “We have seen young mothers using it to save for maternity plans. We have seen people save for prosthetic arms and legs. We have seen people save for vacations,” Njuguna disclosed.

The company has not raised money, but it began with one local angel investor. “I wouldn’t term it as a VC-backed company. We just got one seed capital, someone who was joining us. From that point, we have been growing organically,” he said.

The competition for attention

I also wanted to know who Chumz considers its closest rivals in the spirit of understanding its unique business model. Njuguna said that the startup does not see only other savings apps as competition.

“The way we see our competitors, it’s anything that’s competing for your pocket,” Njuguna said. That includes betting apps, lending products, or daily spending temptations.

Instead of discouraging these habits outright, Chumz tries to reframe them.

“We have savings channels that utilise things like football, because we know a lot of people are into betting. What we’re saying is, can you have the same fun experience around football, but then you’re saving for your own goals?”

The app also borrows from bargaining culture, where if you negotiate a discount, it can prompt you to save the difference. “If your T-shirt was going for KES 800 ($6) and you bought it for KES 600 ($4.7), that’s KES 200 ($1.55), the app should trigger you to save,” he explained.

Njuguna sees four pillars in personal finance — credit, savings, insurance, and investments, with payments connecting them. Chumz has focused on savings because it sets the foundation for everything else.

“If you do savings right, people can invest, they can pay off the insurance, and they can have a good credit score based on their savings,” he said. The longer-term plan is to add more products once the savings layer is solid.

Expanding across Africa

Chumz is already in Rwanda under the name Tunzi, which comes from the Kinyarwanda word ubutunzi, meaning wealth. A wider rollout is under discussion.

“We are very keen to be in other markets. West Africa is a very big market for us. We are open to partnering with financial institutions or fund managers who are willing to work with us,” Njuguna said.

Each rollout requires a local partner to handle funds. The Chumz platform then connects users to those managers through mobile money and app-based rules.

“We are doing behavioural psychology and gamification to move people from intention to action. Between intention and action, there is a habit gap. That habit gap is what we are tackling.”

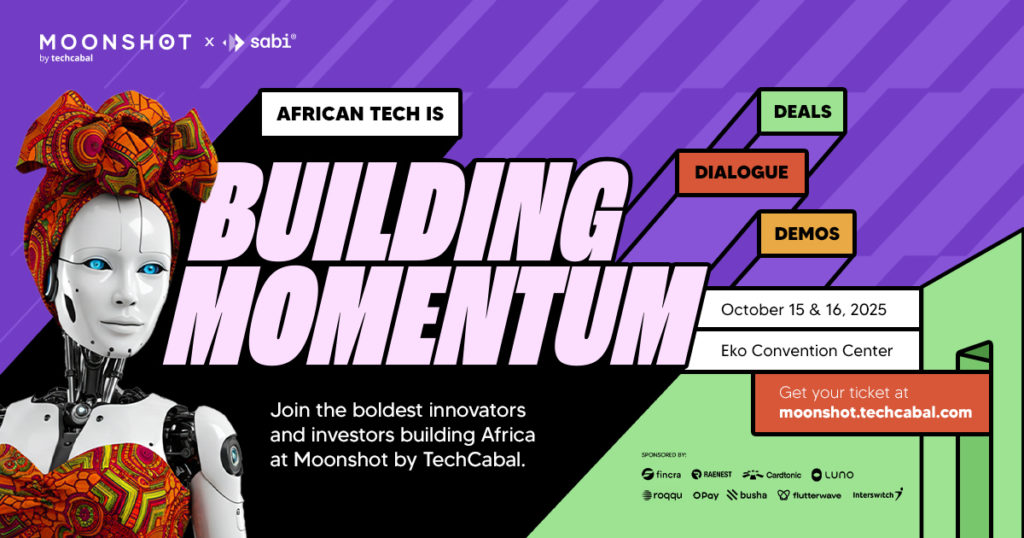

Mark your calendars! Moonshot by TechCabal is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Get your tickets now moonshot.techcabal.com