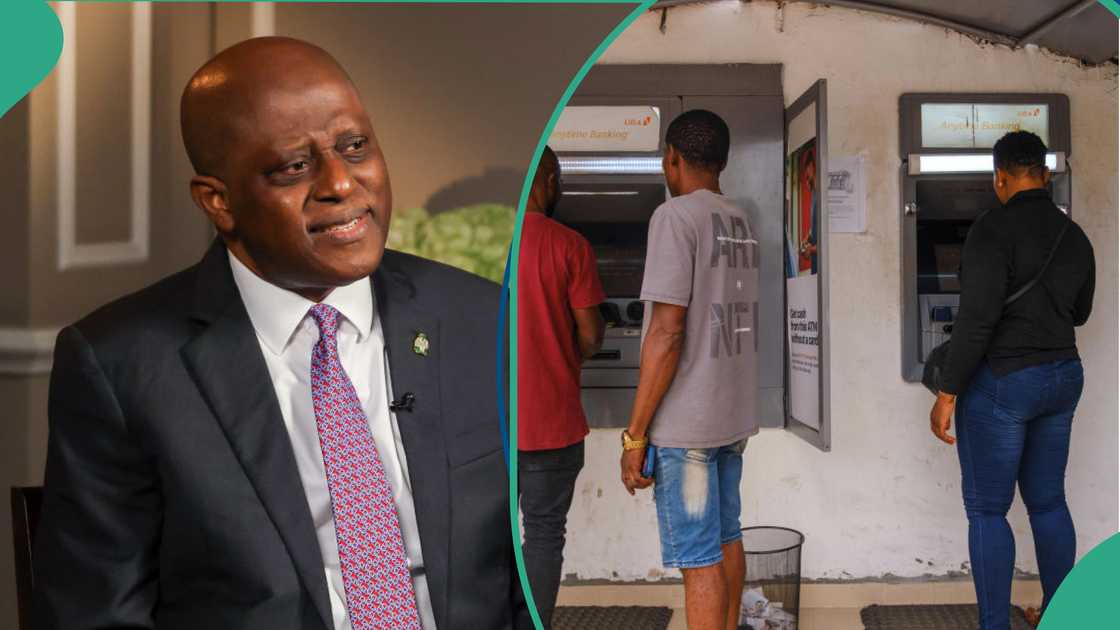

- The CBN Governor has defended the recent hike in ATM transaction fees, explaining that it is in the interest of the customers

- He explained how the new fee regime would improve access to cash and prevent customer exploitation

- The revised ATM charges could see customers pay up to N500 charges for a single N20,000 cash withdrawal

Legit.ng journalist Ruth Okwumbu-Imafidon has over a decade of experience in business reporting across digital and mainstream media.

The Governor of the Central Bank of Nigeria (CBN), Mr. Olayemi Cardoso has shared reasons for the recent hike in Automated Teller Machine (ATM) transaction fees.

Cardoso explained that with the new charges, the banks would be better positioned to upgrade ATM services and improve access to cash.

He added that it would also prevent exploitation customers experienced during cash shortages.

Source: Getty Images

Speaking in Abuja, after the CBN’s 299th Monetary Policy Committee (MPC) meeting on Thursday, Cardoso explained that the banks now have the burden of enhancing service efficiency.

CBN raises ATM transaction fees

The Central Bank of Nigeria reviewed ATM transaction fees with N20,000 withdrawals now attracting N100 charges from other banks, and zero charges from own bank.

According to a Frequently Asked Questions document released on Thursday, February 13, customers withdrawing less than N20,000 from another bank’s ATM will still face a standard charge of N100 per transaction.

This directive, according to the CBN circular, aims to streamline ATM usage and deter customers from making multiple small withdrawals to circumvent fees.

The new fees are expected to take effect on March 1, 2025. Justifying the decision, Cardoso assured customers that it would improve their access to cash.

The CBN governor recalled the Christmas period when customers experienced cash shortages and stated that the increase was one of the solutions devised.

He said;

“The banks must be incentivised to ensure regular ATM availability so that people can access their money conveniently. While the situation has improved significantly, more needs to be done to make cash withdrawals seamless. If we are planning for the future, certain costs must be absorbed, and this is one of them.”CBN explains how to avoid ATM charges

Source: Getty Images

According to the CBN, any withdrawals done in ATMs other than the bank’s ATM will attract a charge of N100 per N20,000 transactions.

The apex bank said charges in off-site ATMs, that is in locations like malls, shopping centres, and other places will attract N100 charges and a surcharge of N500.

In its recently released FAQs on the new policy, the bank said that customers can avoid the charges by using their bank’s ATMs, which attract zero charges or patronise Point-of-Sale (PoS) operators who charge 2.5% for every N10,000 transaction.

He noted that people can choose to open an account with the bank most accessible to them to avoid the charges, and access cash easily.

Cardoso insisted that it will encourage expansion of ATM services, and gradually close the loops that had been left open for exploitation.

CBN hikes ATM transaction fees

In related news, Nigerians are being forced to go cashless as the Central Bank of Nigeria has ended free ATM withdrawals.

In a recent move to review bank ATM charges, CBN announced an end to the three free withdrawals-a-month policy.

Customers could end up paying charges as high as N500 for N20,000 cash withdrawals from another bank ATM.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng

1 day ago

27

1 day ago

27

English (US) ·

English (US) ·