Caverton Offshore Support Group PLC has hinted on the plan to carry out a business restructuring programme that will cut across all its subsidiaries to enhance performance and profitability.

This as some shareholders have highlighted the need to raise fresh capital through rights issues or public offerings to improve liquidity and support the group’s turnaround strategy.

These were some of the outcomes of the group’s 2024 Annual General Meeting (AGM) held on Friday November 21, 2025 led by the group’s board of directors.

The group’s chief executive officer, who dropped the hint of at the virtual AGM, noted that the planned restructuring programme will touch the board as well as all the subsidiaries of the group to enhance efficiency and boost profitability.

Responding to questions from shareholders on the group’s financial performance in 2024 and the plans for the years ahead, he said 2024 was a difficult year for businesses in the country which includes Caverton.

“We are going through a massive overhaul in our businesses. Cost is being pruned in the helicopter business. Improved revenue is certain,” he assured.

Speaking on other new measures being taken to improve the group’s revenue and to return it to profitability, he disclosed that Caverton’s partnership with The National Agency for Science and Engineering Infrastructure (NASENI ) to drive its drone business is ongoing while the fixed wing Cargo business will commence in first quarter of 2026, this he said will help improve the group’s revenue.

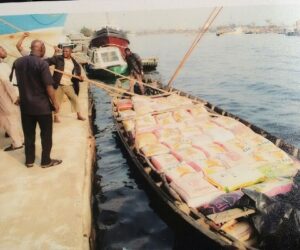

He added: “ On the Marine Business and partnership with Lagos State government, Makanjuola said the company had built 15 boats for Lagos State government out of the targeted 25. And the Electric ferry ( 30 seaters) will be delivered soon. Speaking further, the CEO said that earlier this year in Abuja, the company collaborated for the formalisation of NNPC shipping joint venture UNITY Shipping Worldwide, a joint venture that brought together NNPCL, Caverton and Stena Bulk, a Swedish shipping company.

To address the gender balance, Caverton Marine Limited, the shipping subsidiary of Caverton Offshore Support Group last month appointed the former Euronav London general manager, Pauline Sessou-Diop, as its new chief commercial officer.

The newly appointed CCO is expected to lead the firm’s commercial and business development strategy, with a particular focus on eco-efficient fleet expansion across oil, gas, and bulk marine transportation.

Her role will also emphasize strengthening Caverton’s footprint in the West African market.

Chairman, Caverton Offshore Support Group Plc, Aderemi Makanjuola, who also alluded to the restructuring plan of the group assured shareholders that the financial report which will be presented at the next AGM will be far better than the 2024 report.

Addressing the challenge of foreign exchange losses which has stalled the growth of the group in the recent times, he revealed that “we are adjusting, more dollar denominations going to naira. It’s difficult but we are moving.”

Meanwhile key shareholders association groups represented in the company expressed divergent views about the results of the company for 2024 while suggesting the way forward.

A shareholders group leader, Mrs Bisi Bakare, advocated a more gender-balanced composition, calling for the infusion of more female directors into the board.

Adio Alex, a leader of another shareholders’ group commended the board for sustaining the business despite the challenges. While he acknowledged that losses persist, he blamed it on the economic issues like exchange rate etc.

“2025 is better than the previous years but we are still rotating, not moving forward. He suggested that the group change its borrowing structure.”

On his part, Comrade Oguntoye Lawrence, a shareholder, appreciates the performance of the revenue in 2024, which is better than 2023. He noted that the Helicopter contributed to the bulk but lamented that FX wiped off the gains.

Meanwhile, two shareholders, Ajudua Patrick and Sunny Nwosu raised the need for Caverton to raise fresh capital either by Rights Issues or Public Offer to improve liquidity level of the company.

A review of Caverton’s financial performance in 2024 showed that revenue gre to N40.18 billion, up from N32.99 billion in 2023. Gross profit increased to N8.42 billion, compared to N7.16 billion in 2023.

However, a loss before tax of N53.67 billion, a sharp increase from the N12.69 billion loss in 2023.

Loss after tax stood at N53.86 billion, compared to N12.74 billion the previous year. Total assets declined to N76.16 billion, down from N79.32 billion. Shareholders’ funds ended at ( N54.61 billion), from a ( N747.64 million) in 2023.