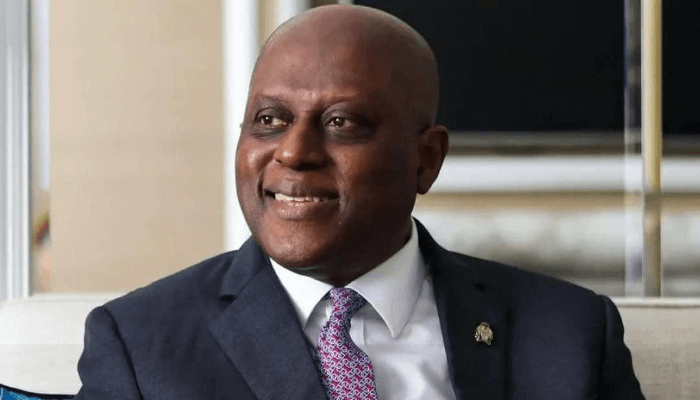

Olayemi Cardoso, governor, Central Bank of Nigeria (CBN) has welcomed S&P Global Ratings’ which lifted the country’s outlook to “positive,” describing the move as validation for a reform agenda that has redefined policy direction and begun restoring market confidence.

Speaking at a strategic session in Abuja shortly after the announcement, Cardoso said the CBN’s recent measures are anchoring stability across financial markets and helping rebuild credibility after years of volatility. He framed the revised outlook as evidence that investors are taking note of the government’s efforts.

Cardoso told participants that the CBN had “brought stability to the economy and become a beacon of hope,” emphasising that policy consistency remains essential as global headwinds challenge emerging-market economies.

Read also: S&P upgrades Nigeria’s outlook to ‘positive’ in boost for investor confidence

His remarks followed S&P’s statement on friday in which the ratings agency said, “The monetary, economic, and fiscal reforms being implemented by Nigerian authorities will yield positive benefits over the medium term.”

The upgrade marks the latest endorsement from major rating houses. Moody’s moved Nigeria up a notch in May to B3 from Caa1, citing stronger external and fiscal positions, while Fitch last month kept its B rating and stable outlook. Together, the affirmations underline how investors and external monitors are responding to the reforms launched in 2023 under President Bola Tinubu, who ended the decades-old petrol subsidy and dismantled currency controls that had constrained investment.

Those decisions triggered short-term pain, including inflationary pressures and a weakened consumer environment, but they also created a more transparent pricing regime and opened the door for foreign capital to re-enter the market.

Analysts say the momentum is encouraging, though challenges remain. Nigeria still faces a fragile revenue base, persistent inflation and heavy reliance on oil earnings in a period marked by geopolitical tension and uneven global demand. Implementation risks also persist; previous reform cycles have faltered as political pressure mounted.

Yet the “positive” outlook signals that S&P sees enough traction in the current policy mix to justify optimism about medium-term recovery. Analysts also say investors would be watching closely to determine whether Nigeria can sustain reform discipline through the 2025 budget cycle and beyond.

To plug fiscal shortfalls, the government continues to rely on debt markets, and last week raised $2.35 billion in a hugely-oversubscribed Eurobond sale to support the 2025 budget, complementing domestic borrowing programs that have expanded in recent months.

The issuance suggests that global appetite for Nigerian paper is slowly improving—even as higher interest costs underscore the urgency of further fiscal consolidation.

Cardoso insisted that authorities would stay the course, saying the latest assessment shows Nigeria is “on the right path” as the reforms mature and credibility deepens across global markets.