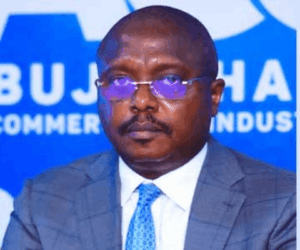

…says Nigeria’s FATF delisting major boost for investors, banks

Olayemi Cardoso, governor, Central Bank of Nigeria (CBN), on Tuesday said ₦4.69 trillion from past interventions remains unpaid, limiting the central bank’s ability to deploy unorthodox policy measures to support the economy even if there was need for non-conventional approach.

Speaking in Abuja after the two-day Monetary Policy Committee meeting, Cardoso explained that outstanding debts from earlier interventions dating back to 2010 were weighing on the bank’s capacity to engage in new programs.

“I think it’s important to give context, because it is oftentimes very, well misunderstood. Now we did a survey, a small study of interventions in the central bank, and we came out with certain numbers, which showed that interventions came to total amount of N10.93 trillion… Now out of that… we still have outstanding of N4.69 trillion, which represents about 43 per cent of those interventions. Since we have come, we have been able to rein back about N2 trillion,” he said.

Cardoso described the unpaid portion as “a humongous amount of money” that “really and truly ties our hands in terms of additional interventions… you go in a direction that will easily destabilise your economy, as indeed happened in the past.”

Read also: CBN keeps MPR steady to sustain inflation gains, stability

He said the bank is now focusing on its role as a catalyst and using its convening power to encourage private actors to step into development spaces. “What we want is the incentive for them to be creative, innovative, come up with new products, think outside of the box. Those are add-ons that we as central bank believe we are doing and will continue to do,” Cardoso said, adding that moral hazard was a key concern. “If you take money, it is money to be returned. It’s not money that you take and put in your pocket and walk away.”

“So when we say we have pulled back from those interventions, we had no choice… But we are not resting. We are reaching out to others and seeing how we can support them, to be able to make a meaningful impact in that sector, and do it in a way that makes sense and is a win-win for everybody. That is the key,” he said.

Cardoso also hailed Nigeria’s removal from the Financial Action Task Force (FATF)grey list as a major boost for investor confidence and the banking sector. “The removal of Nigeria from the grey list is way beyond just a compliance issue. In actual fact, that is the easy bit… But it has a lot of implications for Nigeria and Nigerians,” he said.

He credited close collaboration among Nigerian agencies—including the CBN, NFIU, SEC, EFCC, and Ministry of Finance—for securing the exit. “This was cited as the number one issue that they could see: close collaboration between all the different agencies. And the Vice President of the Federal Republic himself came, personally chaired the event and committed that Nigeria exit that particular grey list. So it is not something to be taken lightly,” Cardoso added.

The governor said leaving the grey list strengthens Nigeria’s global credibility and encourages foreign banks and investors to engage more actively. “Once you’re off that list, it makes [international banks] more likely to want to deal with you, and pricing becomes more competitive… For those who bring inflow, the IMTOs, the international remittances… you find that international financial actors are more willing and able to negotiate pricing with you and to ensure that they deal with you as they will deal with others.”

He argued that FATF compliance would benefit Nigeria’s financial system and promote stability. “It contributes significantly to the bottom line of all the different economic actors, and for our country itself, it promotes financial system stability,” Cardoso said.