Africa’s fragmented payment systems have long slowed trade and fintech growth, with businesses and consumers still struggling to move money across borders. These inefficiencies act as a silent tax on productivity and innovation across the continent.

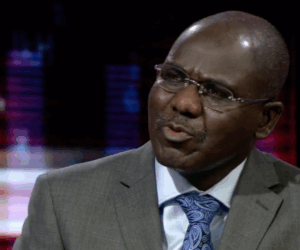

At Moonshot by TechCabal 2025, Wole Ayodele, founder and CEO of Fincra, unpacked this persistent challenge during a panel session titled “Building Africa’s Payment Rails for a Connected Continent.” Using a vivid analogy, he likened Africa’s cross-border payments to a broken messaging system — slow, fragmented, and unreliable.

“It takes five days for a message to deliver money. That is the picture of what cross-border payments and value movement look like in Africa today,” he said.

Ayodele explained that Africa’s payment landscape is defined by silos — each country operating its own rules, systems, and currencies. The result, he said, is a continent where millions remain economically disconnected, even as mobile money accounts and fintech platforms multiply.

Fincra’s solution for a connected continent

Ayodele described Fincra’s mission as building the financial rails for an integrated Africa — where money can move effortlessly across borders, currencies, and payment systems.

“Our goal is to bring hope and liberation to every African through easier cross-border payments,” he said. “Our infrastructure allows investors to deploy and repatriate funds easily, and enables businesses and consumers to settle transactions seamlessly without worrying about currency or infrastructure barriers.”

Still, he noted that unresolved challenges around regulation, technology, and collaboration continue to hinder progress toward true financial integration.

“Many people trying to build the rails for an interconnected Africa literally have nothing to build on,” Ayodele said. “Our counterparts in Europe or the U.S. build on existing infrastructure — FX, liquidity, and open banking — which are available as APIs. But in Africa, many transactions still happen through informal channels, even WhatsApp groups.”

Regulations and interoperability

While technology often dominates fintech conversations, Ayodele stressed that regulation is just as critical. He called for unified regulatory standards — especially around Know Your Customer (KYC) verification — to enable fintechs and banks to operate smoothly across multiple markets.

“We are navigating through expanding across multiple markets, compliance complexities, and promoting interoperability between countries with different regulatory systems to make payments within Africa as seamless as they are across other regions,” he explained.

He also addressed Africa’s interoperability gap, pointing out that despite over 200 million cards issued across the continent, most cannot link to platforms like Alipay or WeChat Pay; even though China is Africa’s largest trading partner, with about $380 billion in annual trade.

“Sending money to China could have been as easy as using your card,” he said. “But it is not seamless today.”

For Ayodele, true interoperability means being able to send money from a Stanbic mobile app in Nigeria to an M-Pesa wallet in Kenya with the same ease as a local transfer.

“Not just technology will solve this, but deep cooperation among fintechs, banks, regulators, and regional blocs.”