Breaking News

BREAKING: New CBN circular permits IMTOs to sell FX directly on Nigeria’s official window

The Central Bank of Nigeria (CBN) has permitted eligible International Money Transfer Operators (IMTOs) to sell foreign exchange (FX) on Nigeria’s official window.

This directive, effective immediately, is part of CBN’s plan to ensure greater remittance flows through formal channels and improve the efficiency of the foreign exchange market.

The circular read: “As part of CBN’s commitment to the smooth functioning of the foreign exchange markets and enabling greater remittance flows through formal channels, the Bank has implemented measures that will enable eligible International Money Transfer Operators (IMTOS) access Naira (NGN) liquidity through the CBN. These measures are aimed at widening access to local currency liquidity for the timely settlement of diaspora remittances.

“Henceforth, eligible IMTO operators will be able to access the CBN window directly or through their Authorized Dealer Banks (ADBS) to execute transactions for the sale of foreign exchange in the market.”

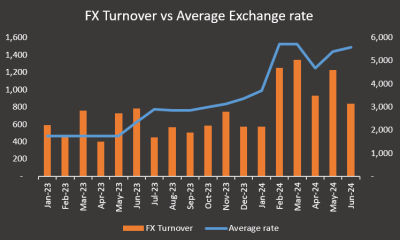

This move by the CBN comes at a time when the official market is struggling with FX liquidity. For about a month, the value of FX turnover on the NAFEM window has been between the range of $83 million and $390 million.

A similar move was made last month as the CBN allowed International Oil Companies (IOCs) to sell 50% balance of their repatriated export proceeds to authorized forex dealers.

Guidelines for trading

- The CBN’s circular, signed by Dr W. J. Kanya, Acting Director of the Trade & Exchange Department, outlines several key points for compliance by IMTOs and Authorized Dealer Banks (ADBs).

- One of the notable guidelines is the option for same-day settlement for transactions executed and confirmed before 12 noon on a trading date. This measure is expected to expedite the process and ensure quicker liquidity for remittance beneficiaries.

- Additionally, the pricing for these transactions with the CBN will be determined based on prevailing NAFEM rates, ensuring transparency and adherence to a market benchmark.

- The circular also emphasizes that this market segment will follow the existing arrangement for authorized dealers with Foreign Portfolio Investment, aligning it with the primary market securities auctions.

- To maintain accountability and transparency, all participants are required to submit regulatory returns to the CBN daily. These returns must contain comprehensive information on the sources of funds.

- Furthermore, IMTOs are instructed to confirm their partner banks and advise standard settlement instructions to ensure the smooth implementation of these measures.

More Insights

In January 2024, the CBN issued a circular that removed the previous cap on exchange rates quoted by IMTOs.

Before the circular, IMTOs were required to quote rates within a permissible range of -2.5% to +2.5% around the previous day’s closing rate of the Nigerian Foreign Exchange Market.

By the end of January, the apex bank further released revised guidelines for the operations of IMTOs. The apex bank increased the application fee for an IMTO licence from N500,000 in 2014 to N10 million in the revised guidelines. This is an increase of about 1,900% in about 10 years.

The CBN also established a minimum operating capital requirement for International Money Transfer Operators (IMTOs) at $1 million for foreign entities and an equivalent amount for local IMTOs.

Also, IMTOs were barred from purchasing foreign exchange from the domestic market to fulfil their obligations.

However, with this new circular, it appears that this ban has been lifted, and IMTOs can now trade on the official market.

The apex bank earlier reached an agreement with International Money Transfer Operators (IMTOs)to set up a Collaborative Task Force to double remittance inflows into the country. The task force formed to double remittance inflows into Nigeria reports directly to Yemi Cardoso, the Governor of the CBN.

Last month, the CBN granted 14 new Approval-in-Principle (AIP) to IMTOs, according to the Bank’s Acting Director of Corporate Communications, Mrs. Hakama Sidi Ali.

The move to allow IMTOs to sell foreign exchange on Nigeria’s official window is a significant step towards improving remittance flows into the country. This move is also expected to widen access to local currency liquidity, making it easier for recipients to convert their remittances into naira.

With all diaspora remittances expected to terminate in naira, the CBN ensures that the inflows match with the corresponding foreign currency receipts, fostering an efficient exchange system.

Also, the move holds significant implications for the official FX market. Enabling IMTOs to access naira liquidity directly through the CBN or via ADBs, will likely enhance the supply of foreign exchange in the official market, reducing pressure on the parallel market and helping to stabilize exchange rates.