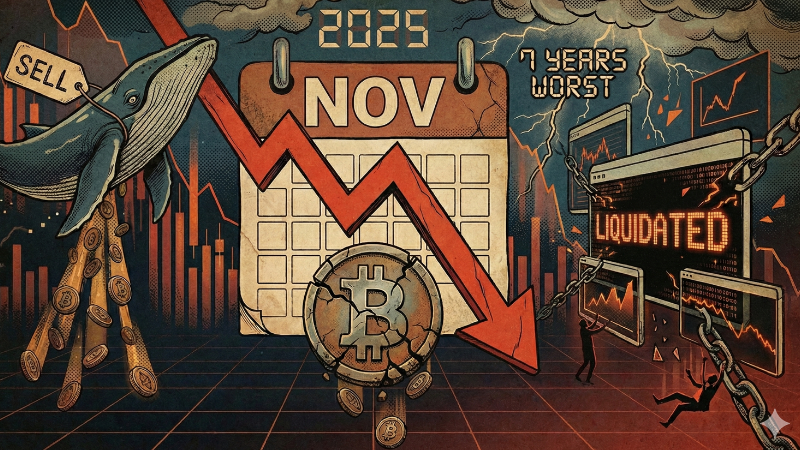

Bitcoin closed out November like a boxer staggering from a knockout punch. The world’s premier cryptocurrency plummeted 17.49%, its worst monthly drop since the brutal 2018 bear market.

According to CoinGlass, this marked the second-worst performance of 2025, edging out February’s 17.39% slide.

What started the month near $110,000 devolved into a bloodbath, with BTC dipping near $80,000, a seven-month low, before clawing back to above $90,000 last week, before finally collapsing on Sunday to roughly $86,000 – about 5% dipped within three hours.

The BTC opened November with cautious optimism, buoyed by post-halving momentum and whispers of institutional inflows. But cracks appeared fast. By mid-month, U.S. spot Bitcoin ETFs turned into a firehose of redemptions. Outflows hit $3.48 billion, the second-heaviest monthly drain since their 2024 launch.

BlackRock’s iShares Bitcoin Trust alone saw billions flee as risk-averse funds pulled back. Short-term holders realised crushing losses, with over 10,200 BTC wiped out in a single swoop.

Macro headwinds piled on like uninvited guests at a crash. Donald Trump’s expanded tariffs on China, rolled out on October 10, sparked a global risk reassessment, hammering equities and crypto alike. Then came the record U.S. government shutdown, squeezing liquidity from traditional markets and leaving Bitcoin starved for oxygen.

Fed Chair Jerome Powell’s tepid comments on rate cuts sealed the deal. Quantitative tightening dragged on, with the Fed’s balance sheet at $6.6 trillion, syphoning dollars from high-risk plays like BTC.

Even gold, crypto’s supposed rival, shone brighter, underscoring Bitcoin’s vulnerability in a flight to safety.

Bitcoin ends November in the red as whales dump

At the heart of the carnage are whales, the mega-holders with wallets bulging with over 10,000 BTC, who unleashed a torrent. These aren’t impulsive day traders; they’re OGs from Bitcoin’s Satoshi-era dawn, cashing in on gains baked in since sub-$10 buys.

On-chain data paints a stark picture: over 50,000 BTC ($4.6 billion) dumped in one week alone, the heaviest whale exodus of 2025. Long-term holders offloaded $43 billion since July, including a gut-punch from Owen Gunden, who shipped 2,400 BTC ($237 million) to Kraken in a single move.

Another Satoshi-vintage whale liquidated a 15-year stash worth $1.5 billion, signalling even the faithful were tapping out.

This whale frenzy amplified everything. Leveraged positions crumbled under margin calls, with $870 million in ETF redemptions on a single day. The 50-day moving average flirted with a “death cross” below the 200-day, a bearish omen that’s preceded bottoms before, but rarely without more pain.

You can also read: South Korean police officers fired over $186 million crypto money-laundering scheme

Hodl sentiment? The Fear & Greed Index cratered to 28, deep in fear territory. Yet, amid the rubble, voices like Michael Saylor’s strategy kept accumulating, adding thousands despite the dip, a reminder that conviction cuts both ways.

November’s rout shattered seasonal myths. History touted a 42% average November gain, skewed by 2013’s 449% moonshot. An 8.8% median whisper, and 2025 joined the losers’ club with 2018’s 36% echo.

Meanwhile, altcoins fared worse, with Ethereum down 22% and the total crypto market cap shedding $1 trillion. But Bitcoin’s scars run deepest, exposing how ETF hype masked underlying fragilities.

Looking ahead, December looms as a coin flip. History shows red Novembers often breed red Decembers, with a median -3.2% yawn. Keep eyes out for $85,000 support; a break there spells $80,000 peril, while $90,000 – $95,000 resistance could spark a Santa rally to above $100,000.

Whales’ sales, brutal as they are, often cap corrections. Bitcoin’s year-to-date is still up 7%, no small feat in a tariff-tormented world. If history holds, November’s ghosts might just haunt December, or free Bitcoin to soar in 2026. Either way, we continue to watch as the pendulum swings.