Tigran Gambaryan, the former head of Financial Crime Compliance at Binance and ex-US federal agent, has accused the Nigerian government of using his detention as leverage to extract a payout from the United States. His claims come amid a backdrop of deepening geopolitical tension between Nigeria and the United States.

Gambaryan posted on X on Sunday morning that Nigeria’s authorities bragged about extorting the Biden administration out of $50 million to release him.

He was reacting to a post by Binance’s founder and former CEO Changpeng “CZ” Zhao, where he shared a post from the U.S. Secretary of War referencing troop readiness amid “Trump’s planned invasion of Nigeria” if killings and persecution of Christians continue.

Reposting ‘CZ’s post (Nigeria also basically kidnapped Tigran Gambaryan, an ex-Binance employee and an ex-US federal agent, for 8 months without cause, a year ago. 🤷♂️) Gambaryan wrote, “Thanks @cz_binance. Then they bragged about extorting the Biden administration out of $50 million to release me.”

President Donald Trump, in two separate posts between yesterday and today, escalated his public rhetoric about insecurity in Nigeria, stating that unless the Nigerian government stopped killing Christians, he would halt all aid and might launch military action: “I am hereby instructing our Department of War to prepare for possible action.”

Though the posts are intertwined in tone and timing, Gambaryan’s allegation that Nigeria extorted the Biden administration for his release introduces a fresh and explosive claim: that his eight-month detention in Nigeria was not simply a legal matter but part of a diplomatic and financial tug-of-war and continued human rights abuses.

Tracing back to Gambaryan’s detention in Nigeria

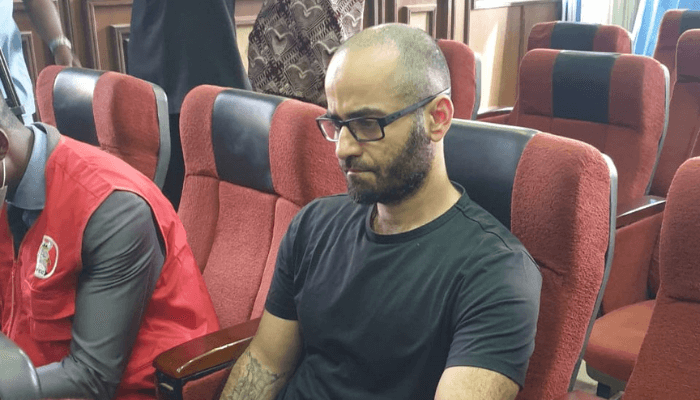

Gambaryan’s ordeal began in February 2024 when he and Binance’s Africa regional manager, Nadeem Anjarwalla, were detained by Nigeria’s Economic and Financial Crimes Commission (EFCC) after arriving in Abuja. They had been invited for discussions around Binance’s operations in Nigeria amid increasing regulatory scrutiny.

Gambaryan was charged with money laundering and tax evasion relating to funds allegedly leaving Nigeria via Binance-facilitated peer-to-peer transactions. According to Gambaryan, the Nigerian central bank’s figure of $26 billion in outflows was “complete BS” and reflected misunderstandings of trade volume rather than illicit transfers.

The detention was harsh. His family reported he could no longer walk because of a herniated disc, had been denied proper medical care, and endured solitary confinement at the Kuje Correctional Centre in Abuja.

In October 2024, the Nigerian court dropped the money-laundering charges against him, citing his worsening health and diplomatic pressure, and Gambaryan was released.

The saga left Binance navigating a minefield. Gambaryan’s claims went beyond the charges. He alleged that some Nigerian lawmakers demanded a bribe of $150 million in cryptocurrency wallets to secure his release.

The Nigerian government swiftly denied the allegations. The Information Minister, Mohammed Idris, described them as “outrageous” and part of a “deliberate misinformation campaign”. He confirmed that Binance offered $5 million as a down payment for Gambaryan’s release, but the government rejected this.

Binance, on its part, said it was relieved by his eventual release and pledged to focus on compliance and its regulatory relationships. But Gambaryan exited the firm in June 2025, marking the end of a turbulent chapter for him and the company.

Gambaryan’s fresh public claim that Nigeria extorted the Biden administration for $50 million in exchange for his release ups the ante dramatically. If true, it would suggest his detention was less about alleged financial crime and more about diplomatic bargaining involving substantial sums of money and U.S.-Nigeria relations.

The Nigerian government has not officially responded to the specific $50 million figure. Meanwhile, it is worth noting that Nigeria has been engaged in multiple financial disputes with Binance.

In February 2025, the government filed a lawsuit demanding at least $79.5 billion for alleged economic losses and $2 billion in back taxes from Binance.

Why does this matter?

For Nigeria, the case sits at the intersection of economic regulation, governance and international image. The government’s handling of Binance has raised questions about regulatory overreach, due process and the use of foreign detainees as leverage in financial negotiations.

If Gambaryan’s latest accusation proves accurate, it could mark one of the most serious corruption scandals to hit Nigeria in recent memory, involving not just economic crimes but also alleged extortion of a foreign government.

For Binance and the broader crypto industry, the episode signals the risks of operating in jurisdictions with opaque regulation and political leverage.

From a diplomatic standpoint, the case compounds the already tense U.S.–Nigeria relations.

For now, the silence from Abuja is deafening. As social media continues to buzz with outrage and speculation, the world watches to see how both Washington and Abuja respond to the latest twist in a saga that has simply refused to die.