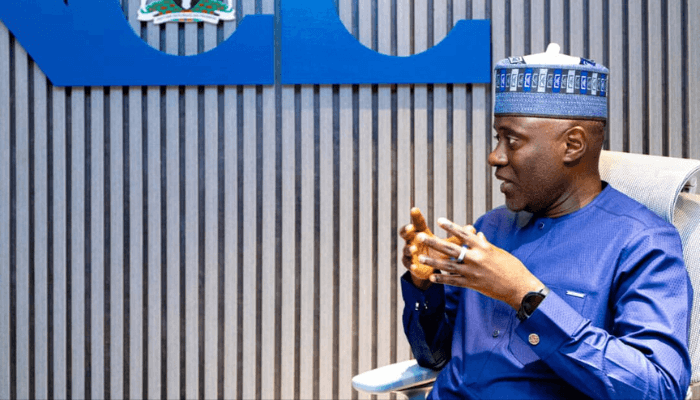

In continuation of an exclusive interview with Bashir Ibrahim Hassan, General Manager of BusinessDay for Abuja and northern Nigeria, Dr Aminu Maida, Executive Vice Chairman/Chief Executive Officer of the Nigerian Communications Commission (NCC), takes a look at the various challenges buffeting the telecommunications sector in Nigeria, highlights the unique initiatives being deployed to address these challenges, and suggests some hard decisions that the government, through policies, must take to sustain the sector.

“Looking ahead, the next phase goes beyond connectivity. Our goal is a robust, resilient, safe, and secure internet for all citizens, businesses, and government. That will require a revised National Telecommunications Policy. Work on this, led by the Federal Ministry of Communications, Innovation and Digital Economy, will begin in Q4 this year.”

What is the scope of Nigeria’s policy environment for the telecommunications sector?

This is a good place to start. Nigeria’s telecoms journey rests on a clear policy-to-law pipeline. It began with the National Telecommunications Policy (NTP) 2000, which paved the way for the Nigerian Communications Act (2003)—the law under which the NCC, as you know it, operates today. NTP 2000 liberalised the market and, with strong political will, transformed connectivity: we moved from about 500,000 fixed lines to almost 80 million active lines in under a decade. Competition drove innovation and affordability; even with recent tariff adjustments, the average price per minute remains below the approximately ₦50 per minute level at the dawn of the GSM era. That policy shift also catalysed adjacent sectors like digital payments.

Now building on that foundation, several newer policies shape today’s landscape: the Revised National Policy for SIM Card Registration (2021), which we completed implementation of last year and is now just an ongoing business-as-usual process; the National Policy on 5G, which enabled the commercial launch of 5G services; and the Nigerian National Broadband Plan (2020–2025), which expires this year—which, by the way, we have already begun engaging our Ministry on for a third iteration. There is also the National Cybersecurity Policy (2021), which led to the establishment of the sectoral Cyber Incident Response Team (CSIRT) under the NCC, and in fact, we are now finalising a telecoms sector cybersecurity framework. We also have the National Child Online Protection Policy, which guides how we safeguard users online, and the National Policy for the Promotion of Indigenous Content in the Nigerian Telecommunications Sector (2021)—a pivotal, long-term agenda to deepen local participation across the value chain.

“Over the next year, you will see us push hard on network reliability through tighter QoS standards across the entire value chain, including with co-location service providers, alongside CNII operationalisation and real accountability via public performance dashboards—so service quality is visible, comparable, and ultimately improves.”

So, where are we today in terms of progress with these policies?

I’m glad you are asking this. Nigerians may not realise, but a lot of progress has been made with policies in our sector. Most significantly, we have dismantled monopolies and built a competitive market over the past two and a half decades. The industry has built broadband networks, which have led to local digital ecosystems emerging, most notably digital payments and e-commerce. Internet consumption continues to grow exponentially—streaming, short-form video, virtual meetings, online learning, online shopping, and the list goes on. In that sense, the NTP 2000 has largely been delivered and, in many areas, exceeded what it originally envisaged.

On specific policies: NIN–SIM linkage, like I just said, is now business as usual. After several deadline shifts, we concluded its full implementation last year, ensuring all SIMs are linked to a valid and verifiable NIN. Implementation of the National Cybersecurity Policy 2021 is ongoing. Our NCC-CSIRT has been operational for a few years; following the President’s Executive Order on Critical National Information Infrastructure (CNII) last year, we have been working with ONSA on our sector’s operationalisation, and we will be issuing a sector-specific cybersecurity framework in Q4 2025. The Child Online Protection Policy (and broader online-safety work) is still at an early stage, having only been approved in February 2023 by the previous Federal Executive Council.

On indigenous content, it is too early to appraise. It needs long-term consistency and broader reforms to succeed. Realism and consistency are key: countries that now play across the entire telecoms stack got there through decades of steady policy and disciplined execution. It is a long-term play, and we are aligning the sector accordingly. As for the National Broadband Plan (2020–2025), now in its second iteration and expiring in a year’s time, there is a lot of work still to do. Some targets may not be met, and some are no longer relevant to today’s context. We have learnt the lessons, and the next five-year plan must build in agility so we can respond to a rapidly changing environment.

Looking ahead, the next phase goes beyond connectivity. Our goal is a robust, resilient, safe, and secure internet for all citizens, businesses, and government. That will require a revised National Telecommunications Policy. Work on this, led by the Federal Ministry of Communications, Innovation, and Digital Economy, will begin in Q4 this year.

Read also: Beyond coverage: Future-proofing Nigeria’s telecoms industry

To what extent was the operators’ business environment considered in the recent tariff hike, and what is the current situation?

First, some context. We are an economic regulator as set out in the Nigerian Communications Act (2003). Our tools are grounded in competition principles to create a market where both sides get value—this means that operators can earn fair returns, and consumers get high-quality, affordable services.

Generally, consumer prices rise with inflation, and we have recently seen steeper increases as the economy adjusts to necessary macroeconomic reforms. Transport, food, and other daily items have gone up—some by more than 100%—yet telecom consumer tariffs stayed largely flat for close to a decade, often without inflationary adjustments. Meanwhile, operators’ input costs rose sharply. Just consider the diesel to power generators that run roughly 40,000 sites nationwide and the imported radio equipment at these sites, paid for in foreign exchange. So what has happened is that over time, margins were eroded and the sector became less attractive for investment. CAPEX did not keep pace with demand growth; in fact, prior to our intervention, investments were dropping. This is a sector that must invest continuously to maintain quality, especially as data consumption grows. Some operators were borrowing to buy diesel! Effectively subsidising service. When there is no cost recovery and fair returns, investors simply take their money elsewhere; it’s not rocket science.

So we faced a dilemma: how do we restore investor confidence so the necessary investments can flow while ensuring consumers still enjoy affordable, high-quality connectivity? Doing nothing would have meant continued investment decline and worsening quality. The only realistic, lawful path consistent with economic regulation was to allow tariffs to move within cost-oriented bounds.

With hindsight, the NCC could have done more, earlier, to build resilience ahead of the government’s reforms: stronger infrastructure protection, more robust operator corporate governance, QoS regulations across the entire value chain, zero-tolerance for inter/intra-industry debt, and periodic tariff adjustments in line with inflation. This is why we did not rush to approve higher tariffs. We first addressed industry debts, began to tackle infrastructure vandalism, and cleaned up industry data. Ultimately, however, the long-term solution was to permit tariff adjustments within a cost-oriented framework, just as the law envisages.

And I will emphasise: the Nigerian Communications Act (2003) does not say the NCC or the federal government should set prices. Yes, the Act requires the NCC to approve tariffs, but always in the context of preventing anti-competitive conduct, not to fix prices in a deregulated market. Our role is to ensure operators do not collude to push prices up and that no player cross-subsidises to undercut rivals unfairly. We run regular cost studies to determine price floors and ceilings within which operators can compete.

Saying all of this, the good news is that we are now seeing investments return; already, we have verified commitments of over $1 billion by operators for this year alone to expand the networks, which is significantly more than what we have seen over the past two to three years in the sector.

You mentioned tighter supervision of service quality across the value chain. What has changed?

We have stepped up oversight beyond Mobile Network Operators (MNOs) to cover every layer, especially Co-Location Service Providers (CSPs), who are arguably the most critical operators in the service-delivery chain. Co-location service providers host MNOs/ISPs at outdoor sites and provide space, power, cooling, backhaul, and security on a non-discriminatory basis. They reduce deployment costs and time-to-market. In simple terms, if there is no power, there is no service, no matter how much equipment you deploy. The major players include IHS, ATC, Pan African Towers, and Eastcastle, which I am sure most Nigerians do not know about. All the MNOs except Glo use co-location services.

So to regulate Quality of Service (QoS) properly, we updated our primary QoS instrument last year. The previous version focused on MNO Key Performance Indicators (KPI) only. The update brings all licensed operators in the service chain, including co-location service providers, into scope with clear KPIs. We also moved from state-level averages to granular LGA-level measurement and revised penalties to reflect current economic realities. For co-location service providers, the key KPI is power availability. If you look at QoS data when diesel prices spiked, QoS dipped because some providers had to adjust refuelling cycles. You know site maintenance is cash-flow intensive—the industry consumes roughly 40 million litres of diesel monthly. Another critical KPI is Mean Time to Repair (MTTR) for faults like generator failure or fibre damage. We set timelines for how quickly we expect these repairs to happen, and we are already seeing improvements in power availability and MTTR. By the way, all this KPI data is published on the NCC website.

Infrastructure disruption remains a problem. How are you addressing it?

There are intentional disruptions like theft, vandalism, and access denial due to disputes and avoidable ones, like fibre cuts from roadworks, that better coordination could significantly reduce. People often do not realise the consequences: a vandalised site can knock multiple sites offline; a burnt manhole can disrupt services over a wide area.

Luckily, we now have the right framework to act. The President’s Executive Order on Critical National Information Infrastructure (CNII) last year designated 13 sectors, including telecoms, as CNII, making intentional damage to telecoms infrastructure a criminal offence and providing a platform to work more closely with security services. We are receiving very strong support from the National Security Adviser to operationalise CNII in our sector; whenever we discuss the topic, he shows so much passion and commitment.

So, how are we going about it? Our approach is multi-tiered. We have amended co-location guidelines to include minimum security checklists (human, physical, and technological). We are running a national awareness campaign in Pidgin, Yoruba, Hausa, Igbo, and English to explain the real-world impact of vandalism and access denial. And we are building collaboration frameworks with public works authorities to cut avoidable damage, especially to fibre.

Fibre typically follows road corridors connecting communities and avoiding complex private right-of-way negotiations, but poor coordination during road construction causes repeated cuts. Federal highways are under the Federal Ministry of Works; state roads are under state ministries. We are putting MoUs in place with the Federal Ministry and priority states (Abuja, Lagos, Kano, and Kaduna) to establish a shared digital platform. The platform will work like this: work agencies will upload project plans; NCC and fibre owners will have visibility; and affected operators will receive timely notifications to relocate or activate secondary routes. India has shared lessons from a similar model, and we are confident this will help. I have personally dealt with a case where a contractor on a federal road claimed they did not even know how to contact the affected operator—that is exactly the coordination gap we are closing.

We are also mediating disputes between service providers and landlords/communities/state agencies where possible; not everything needs to end up in court. And where dialogue fails, we will work with ONSA and relevant authorities, though we hope force remains the exception. People must understand: disrupting telecoms can mean a hospital loses access to critical information or someone in distress cannot call for help.

But let us wrap up on policy and the future. If the goal is affordable, high-speed data for every Nigerian citizen and enterprise, how do we get there? We need fibre-to-buildings—homes, schools, businesses, public institutions—connectivity. We already have about 30,000 km of fibre in Nigeria, but most of it is for connecting mobile base stations, because fibre is essential to achieve 4G/5G speeds. I am fortunate to have home fibre; I use close to 1 TB a month across work, video calls, and streaming, and it costs me less than half of what the same usage would cost on a mobile network. This is not unique to Nigeria; globally, fixed fibre is cheaper per GB than mobile, because fibre is the most cost-effective technology for high-speed data. It is largely passive infrastructure, cables, ducts, and poles, and consumes significantly less power compared to active radio gear. Yes, you have to dig and manage the right-of-way, but it is undeniably the way forward. As, after all, the name “mobile” implies, it is designed for mobility, while most data consumption happens indoors.

This is where government policy has now caught up. The 90,000 km national fibre project being championed by the Honourable Minister of Communications, Innovation and Digital Economy, Dr Bosun Tijani, can materially expand access to affordable, high-quality data connections. It will also support local industry; for example, Coleman in the South-West manufactures fibre-optic cables locally.

Could we have been further along? Possibly. About a decade ago, regional Infraco licences were awarded to build wholesale fibre networks. When I reviewed our files at NCC, the Infraco licensees had delivered less than 10,000 km. Meanwhile, the country already had 30,000-plus kilometres of backbone fibre linking major cities and several thousand kilometres of metro fibre. The 90,000 km initiative and other players that will build fibre networks will expand both backbone and metro networks.

But an important regulatory intervention by the NCC is also underway. We have launched a Wholesale Fibre Study, which is likely to open up existing backbone, and any built in the future, on comparable, transparent terms so that backbone owners and Internet Service Providers (ISPs) can interconnect more easily. This should be concluded by mid-2026. We believe this intervention will be key to building dense metro fibre networks nationwide. We are also looking at growing the number of smaller ISPs nationwide; today, they are mostly concentrated in Lagos and Abuja. We need more ISPs that will build metro networks and deliver last-mile services to homes, schools, businesses, and public institutions, thereby increasing choice and competition. Lastly, on this, we are also advocating for the states’ governments to waive Right of Way (RoW) charges to encourage the deployment of fibre, and so far in the past two years, five states have totally eliminated RoW charges, making it 11 states with zero RoW charges.

My last question: we’re seeing more NCC data in the public domain. Is this part of a broader strategy?

I am glad you noticed. Yes, it is a deliberate shift. The traditional “command-and-control” model, where you write a rule and enforce it to the letter, has limits in a complex, fast-moving industry with over a thousand licensees. It can be rigid, costly, and ultimately slow innovation.

While we will continue to use “command-and-control”, over the past two years, we have begun to complement this with information disclosure and transparency, and we will gradually tilt more towards this. We are publishing accurate, timely, accessible information on industry performance, consumer satisfaction, network performance, and more, so the public, investors, and consumers can make informed decisions. Transparency fosters accountability, encourages voluntary compliance, and lets the market reward good behaviour and expose bad practices. Operators compete not just on price or coverage, but on ethics, quality, and governance.

How has this worked in practice?

In 2017, when we revised teledensity using an updated population estimate of approximately 190 million, the figure dropped by about 10 percent. It was not a “headline-friendly” move, but it signalled data integrity.

When a major operator defaulted on interconnect charges, we approved partial disconnection and issued a public notice. The result: a drastic reduction in intra-industry debt.

After last year’s subscriber-database audit, we found significant discrepancies and took the bold step of publishing the true numbers. That strengthened public trust in our data.

Under our Tariff Simplification Guidelines, operators must publish a standard disclosure table for every tariff plan—so consumers can compare like-for-like across operators. Operators must now also notify customers of major outages and log them on our public Major Outage Reporting Portal.

In early Q4 this year, we will launch a Network Performance Map on our website, showing location-level performance using crowdsourced data. From Q4 as well, we’ll publish Quality of Experience (QoE) and network performance reports for MNOs and ISPs based on the same data.

We are also revamping industry statistics to add new metrics and deeper insights.

We have also released updated Corporate Governance Guidelines for the industry. Transparency is its guiding principle: it emphasises stronger leadership structures, board independence, ESG/CSR reporting, mid-year and annual compliance reports to be made public, and the appointment of a regulatory officer in every licensed company. Together, these measures strengthen transparency and accountability and help safeguard the sector’s long-term sustainability.

Final question: As we wrap up (yes, this is really the last one!), what should Nigerians – consumers, industry, and government – expect from the NCC over the next 12–24 months?

(Laughs.) I know you said the previous one was the final question, so think of this as the “bonus data” at the end of the bundle.

Three things: reliability, affordability, and transparency.

Over the next year, you will see us push hard on network reliability through tighter QoS standards across the entire value chain, including with co-location service providers, alongside CNII operationalisation and real accountability via public performance dashboards—so service quality is visible, comparable, and ultimately improves. On affordability, our focus is on enabling sustainable cost recovery and faster fibre build-out; our wholesale fibre study, which is concluding by mid-2026, would unlock more fibre build and open backbone access on fair, comparable terms. That combination is how we hope to bring high-speed, high-quality data to more homes, schools, hospitals, MSMEs, and public institutions at a better value. And on transparency, we will keep publishing clear, timely data from outage notices to QoE maps, to consumer satisfaction reports, to operator compliance reports and tariff disclosures so consumers and investors can make informed decisions.