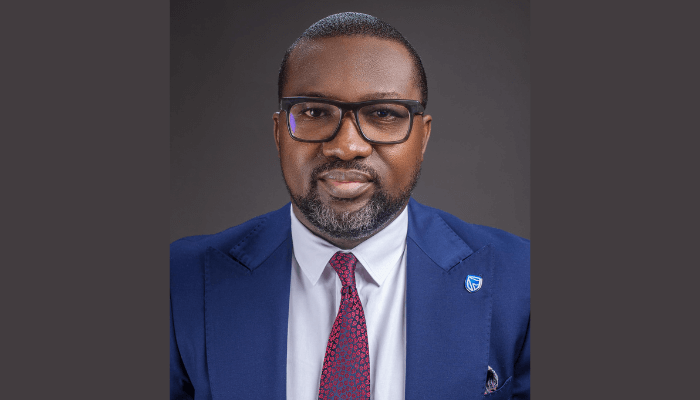

Babatunde Majiyagbe, Chief Executive, Stanbic IBTC Nominees.

In Nigeria’s evolving capital market landscape, a significant arbitrage opportunity remains untapped, mainly by institutional investors and wealth creators seeking enhanced returns amid persistent volatility. Securities lending, a sophisticated financial mechanism well-established in mature markets, stands poised to transform portfolio optimisation strategies across Africa. Stanbic IBTC Bank has established itself as the only active securities lending agent in the Nigerian market since 2015.

Securities lending facilitates the temporary transfer of financial instruments between counterparties under mutually beneficial terms. The lender earns fee income on otherwise static assets while the borrower secures needed securities by providing collaterals. This elegant structure simultaneously enhances portfolio yields and improves market liquidity; a critical factor for institutional investors with fiduciary responsibilities.

For financially intelligent investors with a strategic wealth-building mindset, securities lending represents an exceptional opportunity to extract additional value from existing holdings without incurring extra risk. It exemplifies the kind of sophisticated capital optimisation that separates market-leading returns from merely average performance.

Stanbic IBTC Bank’s decade-long leadership in this space recently culminated in a landmark expansion beyond equities into fixed-income securities. Coupled with accolades that testify to the Bank’s capabilities and expertise in this area, the opportunities being presented to investors continue to increase.

“This strategic extension represents a watershed moment for Nigeria’s capital market development,” states Jesuseun Fatoyinbo, Head of Transaction Banking, in the Corporate and Investment Banking arm of Stanbic IBTC Bank. “The fixed-income securities lending capability provides sophisticated investors with previously unavailable yield enhancement options while simultaneously strengthening market infrastructure.”

The Bank’s performance validates this approach with the facilitation of N150 million in loaned assets in 2023 and recent execution of the market’s first fixed-income securities lending transaction valued at N15 billion. Stanbic IBTC Bank has facilitated a total of N21 billion in fixed-income securities lending as of May 2025. Most notably, these transactions have begun attracting more international institutional and local interests; a critical milestone for market maturation.

Despite compelling economics, securities lending adoption has been constrained primarily by information asymmetry. Recognising this barrier, Stanbic IBTC Bank has implemented a comprehensive market education initiative to address operational friction through digital transformation.

“Our analysis revealed that investors and wealth creators prioritise efficiency, but have historically been sceptical of new financial solutions,” explains Babatunde Majiyagbe, Chief Executive of Stanbic IBTC Nominees. “We have specifically eliminated challenges and bottlenecks, providing institutional clients, International Pension Funds, International investors, Fund Managers, Brokers and more stakeholders with a seamless booking process underpinned by our unmatched experience as Nigeria’s premier custodial service provider.”

The streamlined onboarding allows qualified investors with growth-oriented capital strategies to access securities lending services.

For astute investors and the upwardly mobile demographic increasingly concerned with optimised returns and risk management, securities lending offers a sophisticated enhancement to conventional strategies. Generating incremental yield without altering underlying allocations creates previously unavailable alpha opportunities, which are particularly valuable during market uncertainty.

“Securities lending functions as a market catalyst, creating the foundation for more advanced products while enhancing overall participation,” Deji Aluko who heads Investor Services Product Management in Stanbic IBTC Nominees notes. “This capability transforms Nigeria’s market complexity and positions us as a template for continental capital market development.”

Stanbic IBTC Bank’s collaborative approach with regulatory bodies has established a comprehensive governance framework balancing innovation with appropriate risk controls. This architecture ensures compliance standards while expanding the universe of eligible assets.

“The custodial function has evolved beyond safekeeping to become a strategic enabler of capital market development,” asserts Majiyagbe. “By pioneering securities lending capabilities, we are creating a framework for investors with financial acumen across Africa to fundamentally reimagine portfolio construction techniques and accelerate asset growth.”

As Nigeria’s only active securities lending agent, Stanbic IBTC Bank provides institutionally minded investors a strategic implementation advantage by eliminating administrative burdens to entry. This frictionless experience effectively removes the final obstacle to widespread adoption of this sophisticated yield enhancement strategy that positions financially astute institutions at the forefront of Africa’s financial market transformation.