…says CBN firm on single-digit inflation goal

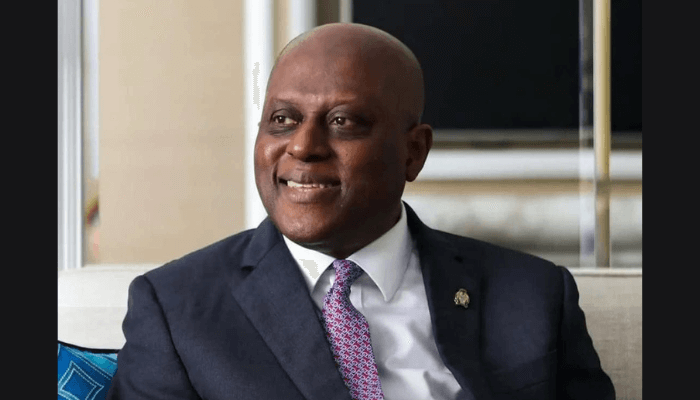

Olayemi Cardoso, Governor of the Central Bank of Nigeria (CBN), on Tuesday, reaffirmed the regulator’s firm stance on the directive requiring Nigerian banks to fully exit regulatory forbearance before resuming dividend payments.

Speaking during the post-Monetary Policy Committee (MPC) meeting press briefing in Abuja, Cardoso emphasised that full compliance with the CBN’s conditions is essential before banks can return to their pre-restriction operational status.

Addressing concerns over ongoing restrictions placed on certain banks due to outstanding prudential and financial health issues, Cardoso reminded stakeholders that the forbearance framework—which includes limits on offshore investments, dividend distributions, and executive bonuses—is always intended as a temporary relief mechanism to help stabilise the banking sector during turbulent times.

Read also:Half-year results signal cooling of banks’ FX windfalls

“The issue of forbearance has been an ongoing conversation since we took the sergeant of responsibility at the Central Bank,” Cardoso said. “We are steadfast on the date that we have given with respect to the ending of forbearance.”

The forbearance strategy was first introduced in 2020 during a period of financial sector instability that threatened systemic risk within Nigerian banks. The regulatory relaxation provided banks with crucial breathing room to shore up their balance sheets, address non-performing loans, and improve liquidity positions.

However, with Nigeria’s macroeconomic outlook improving and banks actively participating in recapitalisation efforts, the CBN has signaled a decisive move to restore full regulatory discipline and compliance.

Cardoso noted with satisfaction that several banks had already started aligning their operations with the new rules ahead of schedule. “Those who comply are very welcome to go back to the regime that was in place before we came up with this particular strategy. And those who are not, well, they still need to be asked,” he added, implying stricter oversight for laggards.

Beyond the banking sector, Cardoso highlighted the CBN’s overarching monetary policy objective of taming inflation and driving it down to single digits—a goal that remains non-negotiable despite mounting political pressures as the country approaches the 2026 pre-election period.

He described recent inflation trends as “encouraging” but cautioned against complacency. “We are pleased that we are seeing consecutive disinflation…this is the fifth time, consecutive. But I want to say that our goal is for single digits inflation,” Cardoso said. “That is something that we are very resolute on, and we will not stop until we get there. So I want to make that abundantly clear.”

According to official data, headline inflation slowed to 20.12% in August from 21.88% in July, marking the fifth consecutive monthly decline. Nonetheless, the governor acknowledged the risks associated with the political cycle, which historically tends to weaken fiscal discipline and reform momentum—factors that could potentially undermine monetary policy gains.

“We see data. We analyse data. We see things that many don’t see,” Cardoso said. “We are building resilience. We are building the buffers. We are looking at the situation, and we are reacting where we have to react—and at the time we need to do so.”

He further underscored the importance of policy coordination between the CBN and the ministry of finance, pointing to this partnership as key to recent successes in inflation moderation and market stability.

“Exchange rate stability is key. If we are going to continue to moderate inflation the way we have, exchange rate stability is key. Fiscal discipline is key,” Cardoso said, noting that the apex bank is closely monitoring the inflationary impact of FAAC (Federation Accounts Allocation Committee) disbursements and excess liquidity within the financial system.

The governor reassured investors and the public that the CBN remains focused on preserving the hard-won macroeconomic stability achieved in recent months and signaled a continuation of vigilant, data-driven policy enforcement.

On the foreign exchange front, Cardoso struck an optimistic tone about Nigeria’s reserves, which recently surpassed $43 billion—the highest level for several years. He attributed this to growing confidence driven by reforms, increased transparency, and the adoption of a more market-oriented exchange rate regime.

Read also: Banks’ underwhelming half-year results drag market down

Responding to a question on year-end projections for reserves, Cardoso described the upward momentum as sustainable and pointed out Nigeria’s uniquely high domestic focus on foreign reserves. “It is a time for us to reflect because everybody in Nigeria looks at foreign reserves,” he said. “Many times in countries it is outside people that do. In Nigeria it is actually the Nigerians, which is very unique in many ways. Everybody goes to bed looking at the foreign reserve figure, wakes up looking at the exchange rate figure.”

He also highlighted efforts to boost inflows through diaspora remittances and expanded foreign exchange market participation. One notable success, the governor noted, was the implementation of the non-resident Bank Verification Number (BVN) framework, which has more than doubled remittance inflows since its launch.

With investor confidence gradually returning and new foreign exchange management tools now in place, Cardoso projected reserves would maintain a “very, very positive upward trajectory” throughout the remainder of the year and beyond.

Reflecting on his two years at the helm of Nigeria’s apex bank, Cardoso described the period as both challenging and transformative. He said the CBN has made significant progress dismantling opaque systems and restoring institutional credibility and trust.

“When I came to the Central Bank, one of the things that disturbed me at the time was a lot of people used to come here. And I used to wonder what they came to do,” he said. “By the time I leave the Central Bank of Nigeria, you won’t have to come here for anyone. You won’t have to know anybody to do your transactions.”

This vision of a more open, accessible, and transparent central bank has driven reforms to foreign exchange allocation, financial services, and policy implementation. Cardoso pointed to innovations like improved card functionality for Nigerians traveling abroad and new products emerging from Nigerian banks as signs of growing confidence in the system.

Looking ahead, Cardoso emphasised the imperative to “build even better.” He noted that the next phase of reforms will focus on enhancing regulatory leadership and expanding institutional knowledge to sustain the CBN’s role as a credible, forward-looking financial regulator.