The earlier rally in banking stocks is losing momentum as investors price in potential risks from delays in the release of banks’ half-year (H1) audited statements currently under the Central Bank of Nigeria (CBN) review.

NGX Banking Index dipped the most in August by 5.09 percent, followed by NGX Oil & Gas, which was down by 3.95 percent. The NGX Insurance Index rallied most by 44.30 percent in the review month, followed by NGX Consumer Goods Index (+8.91percent), and NGX Industrial (+1.83 percent).

The delay in getting regulatory approvals for the publication of banks’ audited H1 2025 results has prompted most lenders to seek NGX consent to file the results after the regulatory date.

Read also: Banks, industrial, oil & gas stocks dip market by 0.41%

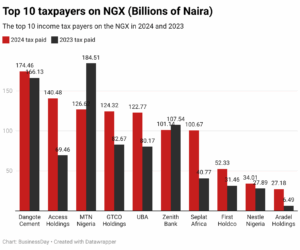

CardinalStone Research analysts said in a September 1 Model Equity Portfolio (MEP) that the MEP’s underperformance last week was largely driven by overweight positions in Zenith Bank (–5.71percent week-on-week (WoW), GTCO (–2.13 percent WoW), and WAPCO (–3.38 percent WoW), which collectively shaved about 50 basis points (bps) off returns.

“Further drag came from our underweight stance in Stanbic IBTC (+6.38 percent WoW), which gave the benchmark index an additional edge.”

The CBN had, in June 2025, directed banks to temporarily suspend the payment of dividends to shareholders, defer the payment of bonuses to directors and senior management staff, and refrain from making investments in foreign subsidiaries or embarking on new offshore ventures.

The measure, according to the apex bank, forms part of the ongoing efforts to strengthen the resilience and stability of the Nigerian banking sector.

“United Bank for Africa (UBA) Plc hereby informs its shareholders and the investing public that the bank’s half-year audited financial statements for the period ended June 30, 2025, was approved by the Board of Directors on Thursday, August 14, 2025. However, the approval of the Central Bank of Nigeria (CBN) is required before the release of the half-year audited financial statements.

“The bank has requested for an extension of the publication of the half-year audited financial statements from the Nigerian Exchange Limited (NGX) and obtained approval to publish the same on or before September 30, 2025,” according to UBA in its August 20 notice at the NGX.”

In early trading on Monday, September 1, bank stocks, except GTCO, Zenith, Stanbic, Wema, Jaiz, were on offer at the NGX.

Last week, the benchmark index (NGX-ASI) fell 0.50 percent to 140,295.49 points, marking its third consecutive week of losses. The NGX-ASI return in eight months to August 31 had stood at +36.30 percent.

“The market remains generally positive, but the pace of gains has slowed. For now, we anticipate mixed trading until the index shows a clear direction,” said Lagos-based Vetiva research analysts in their September 1 note.

GTCO requested an extension of time from the NGX to publish its H1 2025 audited financial statement for the period ended June 30, which is awaiting approval by the CBN.

Zenith Bank’s board of directors had on July 24 approved the H1 audited financial statement, but the CBN assent is required before the result is released.

Zenith Bank has also requested an extension of time from the NGX to publish its H1 audited statement and was granted a six-week extension beyond the August 29 regulatory filing date.

“We expect trading to stay mixed as investors balance profit taking with selective positioning in fundamentally strong names. With most companies having released results, attention is shifting to the banking sector earnings anticipated in the coming days, which could set the tone for market sentiment,” Coronation research analysts said in a September 1 note.

Fidelity Bank has also notified the NGX of delay in publication of its H1 financials, which is currently being reviewed and thereafter will be submitted to the CBN for regulatory approval.

Read also: Insurance stocks drag NGX-ASI down by 0.36%

Access Holdings Plc board of directors met on Wednesday, July 30, and approved the group’s 2025 half-year audited results and the payment of an interim dividend, subject to the approval of the CBN. The company said it will announce the results once approval is received from the CBN.

The CBN also noted that it had recently reviewed the capital positions and adequacy of provisioning of banks currently operating under approved regulatory forbearance frameworks, particularly concerning credit exposures and Single Obligor Limits (SOL).

“This is to inform Nigerian Exchange Limited as well as our esteemed stakeholders that Stanbic IBTC Holdings Plc is currently finalising the audit of its financial statements, following which we would also be seeking the required regulatory approvals.

“Upon receipt of all approvals, we would then release the results to the market. We are working diligently to ensure that the company’s 2025 half year results are published on or before Friday September 26 2025,” Stanbic IBTC Holding said in its August 8 notice at the NGX.

The CBN also issued this directive to all banks that are beneficiaries of credit or SOL forbearance regimes, given the imperative to bolster capital buffers, reinforce balance sheet resilience, and encourage prudent internal capital retention during this transitional period.