Capital inflows to Nigeria hit $5.6 billion in the first quarter of 2025, the National Bureau of Statistics (NBS) data shows. The inflows represent significant gains from diverse reforms instituted by the Central Bank of Nigeria (CBN) to make the country an attractive destination for local and foreign investors. For many stakeholders, the $3.1 billion inflow to the banking sector, representing 55.44 per cent of the total capital inflows, shows how financial sector stability is buoying investors to the domestic economy.

There is rising interest from domestic and global investors in Nigeria assets, as seen in the latest capital inflows to the country.

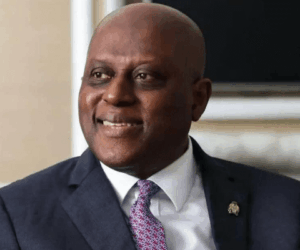

The rising investors’ interest is linked to fallout of crucial reforms instituted by the Central Bank of Nigeria (CBN) under the Olayemi Cardoso leadership.

SPONSOR AD

Upon assuming office in October 2023, the apex bank leadership had prioritised reforms to rebuild Nigeria’s economic buffers and strengthen resilience.

CBN’s policies, including the currency reforms, led to investment inflows from abroad, and reduced interventions in the domestic forex market.

The unification of exchange rates and the clearing of over $7 billion FX backlog raised the country’s investment outlook, with multilateral organizations, like the World Bank describing it as bold intervention to improve the economy’s sustainability in the long run.

Also, Nigeria’s sovereign risk spread has fallen to the lowest level since January 2020, erasing the premium accumulated during the pandemic and subsequent strain on its economy. All these are deliberate efforts to woo investors and sustain capital inflows to the economy.

Assessing reforms impact on FX inflows

These reforms have led to a surge in capital inflows into the Nigeria economy. The inflows rose to $5.6 billion in the first quarter of 2025, the National Bureau of Statistics (NBS) report has shown. The inflows represent 67.12 per cent jump from $3.4 billion recorded in the same period of last year.

The latest “Nigeria Capital Importation Q1 2025” report released represents a 10.86 per cent surge from the $5.1 billion reported in the fourth quarter of 2024.

“In Q1 2025, total capital importation into Nigeria stood at US$5642.07 million, higher than $3.37 billion recorded in Q1 2024, indicating an increase of 67.12 per cent. In comparison to the preceding quarter, capital importation increased by 10.86 per cent from $5.08 billion in Q4 2024,” the report stated.

The NBS also stated that portfolio investment ranked top with $5.2 billion, accounting for 92.25 per cent, followed by other investment with $311.17 million, accounting for 5.52 per cent.

The report indicated that, “Foreign Direct Investment recorded the least with $126.29 million accounting for 2.24 per cent of total capital importation in Q1 2025.”

According to the NBS, the banking sector took the lead with the highest inflows in Q1 2025.

The report stated, “The Banking sector recorded the highest inflow with $3.1 billion, representing 55.44 per cent of total capital imported in Q1 2025, followed by the Financing sector, valued at $2.09 billion (37.18 per cent), and Production/Manufacturing sector with $129.92 million (2.30 per cent).”

The report further noted that capital importation during the reference period originated largely from the United Kingdom with $3681.96 million, showing 65.26 per cent of the total capital imported.

In an emailed note to investors, Managing Director, Afrinvest West Africa Limited, Ike Chioke, explained that Portfolio Investment (92.2 per cent of total capital) dominated flows, rising by 30.1 per cent quarter-on-quarter and 150.8 per cent year-on-year to $5.2 billion.

The bulk of the FPI flows was to Money market instruments (up 162.2 per cent year-on-year to $4.2 billion), while Bonds (up 108.5 per cent) and Equities (up 137.7 per cent) attracted $877.4 million and $117.3 million respectively.

Rebased GDP presents new opportunities

Nigeria’s hope of achieving a $1 trillion economy by 2030 will gain significant support from the banking sector.

Nigeria’s statistician-general, Adeyemi Adeniran, had explained how the economy fared in the rebased Gross Domestic Product (GDP) report. He said: “In nominal terms, the rebased GDP for 2019 stood at N205.09 trillion N213.63 trillion in 2020, N243.30 trillion in 2021, N274.23 trillion in 2022, N314.02 trillion in 2023, and N372.82 trillion in 2024”.

The NBS noted that in 2019, the rebased nominal GDP at basic prices represented an increase of 41.7 per cent over the nominal GDP of 2019 of the old base year (2010), 39 per cent in 2020, 38.7 per cent in 2021, 36.1 per cent in 2022, 34.6 per cent in 2023 and 35.4 per cent in 2024.

“The results show that the structure of the Nigerian economy has changed significantly with a rise in the share of agriculture and services sectors and a fall in the share of the industries sector in nominal terms, indicating a shift in the structure of the Nigerian economy than earlier reported,” the NBS said.

Adeniran further explained that the rebasing allows the country to better reflect the realities of the economy. “It’s not just about a bigger number but about accurate, timely data that supports smarter policy and economic planning,” he said.

Banking sector to the rescue

A well-recapitalised banking sector is undeniably crucial for the growth of the domestic economy. Hence, Olayemi Cardoso, Central Bank of Nigeria (CBN) governor, advised banks to prepare for a new round of recapitalisation to ensure they have the necessary capital to support the Federal Government’s plan to achieve the $1 trillion Gross Domestic Product (GDP) target by 2030.

He said that President Bola Ahmed Tinubu’s economic plan aims to reach a $1tr GDP by 2030, emphasising that the current bank capitalisation is insufficient to support such a large economic scale.

Cardoso asked: “Will Nigerian banks have sufficient capital relative to the financial system’s needs in servicing a $1tr economy in the near future? In my opinion, the answer is “No!” unless we take action. That action was the ongoing recapitalisation of banks, meant to prepare them for expansion and attract big ticket transactions to support economic growth”.

The Policy Advisory Council report on the national economy, had set an ambitious goal of achieving a GDP of $1 trillion, with clearly defined priority areas and strategies.

Adeniran revealed that incorporating new and emerging sectors, consumption baskets update, and data collection refining methods helped produce a more complete picture of national output.

Aliyu Ilias, developmental economist, noted that several sectors have previously remained uncaptured in official data, particularly entertainment. “By rebasing our GDP now, we have included those areas properly. This new visibility will make Nigeria appear much stronger to foreign investors, which will naturally help us attract more capital,” he said.

He explained that the exercise will also reveal untapped economic potential and guide government resource allocation. “It will show where we are strongest structurally, such as in mining or other emerging sectors. That insight will help the government focus its efforts more strategically,” he said.

“Finally,” he added, “it will support economic policy formulation, helping us align our strategy with the reality on the ground. We will know exactly where to put more effort.”

Ilias explained that while this statistical adjustment does not instantly generate new revenue, it creates a more reliable framework for fiscal planning, investment strategies, and development interventions.

For him, by aligning economic data with current realities, the government and private sector can more effectively target policies that stimulate job creation, improve productivity, and sustain long-term growth.

Seun Onigbinde, Director of Civic Technology Group BudgIT, said the previous rebasing underscored the substantial impact of policy changes in the services and ICT sectors, such as telecommunications deregulation and banking sector recapitalisation. “Rebasing of the GDP must reflect changes in the economy, which are a product of public policies over time,” he added.

Rebasing is also critical for domestic policy. It allows the government to better assess tax collection efficiency, measure sectoral contributions, and design social programmes that are data-driven and results-oriented.

Gabriel Okeowo, country director for BudgIT, said, “Rebasing allows planners to be more intentional about solving Nigeria’s biggest problems: poverty, infrastructure gaps, and job creation.”

Lagos-based economist, Nelson Adedeji, explained that despite the bump in GDP size, the rebasing was never a silver bullet.

“We must acknowledge that genuine economic growth extends beyond statistical adjustments. For ordinary Nigerians to experience meaningful improvement in living standards, the President Bola Tinubu administration must complement GDP rebasing with substantive policies addressing infrastructure deficits, security challenges, agricultural productivity, manufacturing capacity, and the overall ease of doing business,” he stated.