0

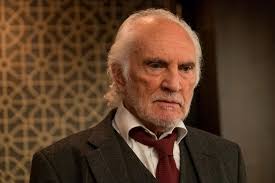

ÇHRIS EBONG

The Chief Client Officer (CCO) of AXA Mansard Insurance Plc, Rashidat Adebisi, has called on Nigeria’s insurance operators to match the landmark Nigerian Insurance Industry Reform Act (NIIRA) 2025 with disciplined execution, noting that the credibility of Nigeria’s insurance industry will not be judged by the size of its balance sheets alone but by how many Nigerians it protects.

Speaking on BusinessDay TV’s Morning Show, Adebisi said recapitalisation and risk-based capital standards represent an historic opportunity to reposition the sector but stressed that capitalisation or digitization reform without execution excellence will not change the customer’s experience nor boost investors’ confidence.

While acknowledging the steep compliance requirements of the reform law, Adebisi drew parallels to Nigeria’s banking recapitalisation in 2004, which cut the number of banks from 89 to 25 but tripled industry capitalisation and deepened customer trust.

“We must replicate that trajectory in insurance as well. The NIIRA presents before our industry an opportunity to play a major role in Nigeria’s ambitious $1tr economy because this is a reform that addresses issues around demand, supply and our operations dynamics.

It’s empowering us to do more and seeks to bolster customers’ confidence and trust in our industry,” she said.

On the introduction of a risk-based capital framework, Adebisi described it as “a customer protection tool first, and a regulatory tool second.” By aligning capital buffers with actual underwriting risks, insurers will have to pay extra attention to product design, pricing discipline, and invest prudently. “Policyholders can now have greater confidence that their insurer is not biting off more than it can chew,” she said.

Addressing fears that consolidation could squeeze out smaller firms, Adebisi explained that mergers and acquisitions are a natural path to stronger, more stable players. “Consolidation should not be seen as loss, but as rebirth for a stronger industry. We will see fewer but stronger insurers with the scale to invest in technology, improve claims turnaround, expand distribution, and compete regionally.”

“Insurance penetration in South Africa is around 17percent of GDP, in Kenya about 3 percent, and in Ghana close to 2 percent. Nigeria sits at less than 1percent. If NIIRA is executed well, insurance could unlock long-term funds for infrastructure, provide risk cover for MSMEs, which make up more than 90percent of Nigeria’s businesses, and strengthen investor confidence in the financial system”.

“Regulators have given us the framework. Now it is on us, the operators, to rebuild trust with our customers, invest in digitisation, and deliver inclusive products,” she concluded.