By Williams Uguru

The Ebonyi State Government under the leadership of Rt. Hon. Francis Ogbonna Nwifuru had during its Executive Council meeting of October 8, 2024, unanimously approved adoption of the e-ticketing operations and automation of the collection of Internally Generated Revenues (IGR) in the State. This was to curb the incursions of criminal elements who had consistently sabotaged the sector, leading to a reduction of the state’s IGR to an all-time low of less than N1billion per month. This ugly development had prompted the Governor to charge the Board of Internal Revenue and their contractors to adopt every valid and lawful measure to ensure that the state adopted and operated the e-ticketing operations system like their counterparts in the South East.

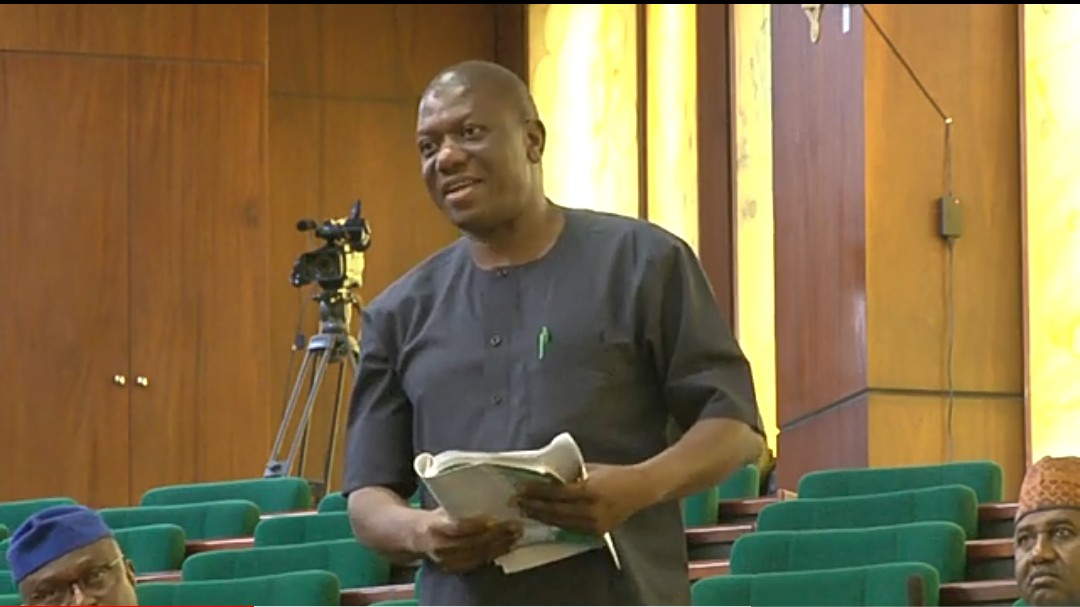

Following the Governor’s directive, the Board of Internal Revenue Service headed by a former Speaker of Ebonyi State House of Assembly, Rt. Hon. Christopher Omo Isu immediately swung into action the next month. The EBIRS on November 4, 2024, official launched the e-ticketing system of operations to enable accurate tracking and recording of revenue and consequently ensure higher collection rates, thereby curbing revenue leakages.

In addition, the Chairman had in a press conference informed that the adoption of the e-ticketing system will improve efficiency as the manual nature of the current revenue collection process in the State had led to significant administrative burdens on government personnel, insisting however, that “an e-ticketing system will streamline operations, automate processes and eliminate manual errors, resulting in increased operational efficiency.”

On the exclusive features of the e-ticketing system and the benefits for the State’s IGR, Omo Isu said: “the transparency and accountability which this contemporary e-ticketing system will bring to the revenue collection in the State makes it the best for our system and at a time when government is battling to contend leakages. Its security is also top-notch as it features advanced data encryption techniques where all data and transactional information and sensitive data are kept in utmost confidentiality.”

He had promised that with the incorporation of the new technology into their operations, the Board was more than ever determined with fresh zeal and vigour to fulfil its core mandate, promising the State’s Executive Council to rejig the entire revenue system of the State for the benefit of the government and the entire people of Ebonyi State.

Since the official flag-off of the e-ticketing operations via automation in the collection of Internally Generated Revenue for commercial motorcycle and tricycle (Keke) operators in Ebonyi State on November 4, last year, by the Board of Internal Revenue, there is an undeniable fact that there has been a significant improvement in some local government headquarters like Edda and Afikpo with a high level of cooperation amongst the keke and okada riders. The turnout of operators in embracing the new system in these places have been impressive and commendable.

It is heartwarming that about two months later, the board was able to accomplish several of its lofty dreams and ideas. To list but a few, with IRS Consult Ltd, the State’s IGR Consultant, the Board automated the entire revenue system. This has brought about the digitization of all revenue collection chains and led to full automation of the Ebonyi State Internal Revenue Service, (EBSIRS).

Consequently, the board has fully implemented and deployed technology from the point of enumeration to assessment, billing to demand notices, payments to receipting, profiling to tax cards and finally to tax clearance certificates with the successful completion of the domain name registration; (www.ebsirs.eb.gov.ng) with the NITDA.

Other milestones include the central billing system, the tax management system, the Treasury Single Account (TSA) payment method, the assessment/enumeration application system, the integrated vehicle administration system and the Ebonyi State Revenue Inspector.

Keen watchers of the positive developments and strides accomplished by the Board have predicted that with the adoption of the e-ticketing system for both commercial motorcycle, tricycle operators and other automated sectors, will not only improve the State’s revenue growth profile but ensure full enumeration of the sector into the State’s tax net. This will also be assisted with a Personal Income Tax (PIT) recovery of all stakeholders within the sector. The move has long become imperative as the current revenue generated from this sector is appallingly less than N20 million annually. This sad reality is eventually being improved upon with the enforcement of the e-ticketing system innovation.

It is worthy of note that all these achievements were accomplished just within one year of the inauguration of the Board by the Governor of Ebonyi State.

However, there have been lots of challenges and encumbrances to the success of the e-ticketing system adoption as some of the stakeholders who feel entitled to the proceeds of illegal IGR collections by posing as ‘contractors’ operate without licenses or approvals from government are hell bent on short-changing the government and Ebonyi people with their illicit operations. The government of the ever pragmatic and focused Governor Nwifuru must wade in at this point to checkmate these racketeers by ordering immediate prosecution of apprehended illegal revenue agents and their collectors no matter how highly placed they may be or who’s ox is gored.

Also of prime importance is the need for the Governor to wade into the internal conflicts of interests among the leadership and members of the State’s Board of Internal Revenue Service and ensure there is absolute order and decorum in their operations and activities. There must be orderliness, mutual respect and commitment on the part of each and every leadership and member of the Board to drive the vision of the State government towards accomplishing its lofty economic development and growth objectives. Perennial issues such as revenue leakages and other acts of sabotage should be exterminated.

For if the Board succeeds with its charged mandate, Ebonyi, which is still the only State in the region yet to adopt the e-ticketing system and automation will achieve the Board’s set revenue target of generating over N48 billion annually thereby surpassing the N2.5billion monthly revenue as required from the board.

The larger implication of this lofty dream is that the State’s allocation from the Federal Government will also increase and there would be adequate financial resources at the disposal of the government to actualize its numerous infrastructural and other developmental projects.

This direction is the best way to go, not only for the government and its officials but also for the common man who means well for the economic prosperity and progress of Ebonyi State.

As the board drives the full enforcement of the e-ticketing operations system and other automated revenue sectors in the Abakaliki urban capital city and the rest of the 13 Local Government Areas of the State, beginning this month, all hands must be on deck to ensure full compliance with officials and agents of the State’s Board of EBSIRS and its consultants, IRS Consult.

Uguru wrote from Abakaliki, Ebonyi State

2 weeks ago

18

2 weeks ago

18

English (US) ·

English (US) ·