2

LAGOS – The raging dispute between First Bank of Nigeria Limited (FBN) and General Hydrocarbons Limited (GHL) over a failed credit relationship has taken a dramatic turn following explosive allegations that the sole arbitrator who dismissed GHL’s $718 million claim against the bank is a major shareholder in the institution at the heart of the arbitration.

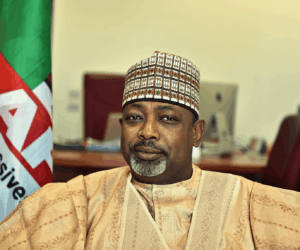

Fresh revelations which was made public by a group of whistleblowers in Nigeria’s capital market have placed retired Supreme Court Justice, Kumai Bayang Akaahs, under intense scrutiny, raising fundamental questions about impartiality, disclosure obligations, and the integrity of Nigeria’s arbitration process.

The matter, which many had considered concluded after Justice Akaahs dismissed GHL’s claims in October 2025, now appears far from over. Legal experts say the new allegations, if proven, could unravel the entire arbitration and lead to the setting aside of the award under the Arbitration and Conciliation Act (ACA) of Nigeria.

Whistleblowers Raise Alarm: “A Conflict Hidden In Plain Sight”

In a detailed statement released to the media, a group calling itself the Stock Market Whistleblowers—comprising licensed stockbrokers under the Securities and Exchange Commission (SEC)—alleged that Justice Akaahs owns 595,057 units of shares in First HoldCo, the parent company of First Bank.

They insist the former Justice should never have accepted the role of sole arbitrator in a high-stakes case involving a company in which he is a significant shareholder. At the very least, they argue, he was required by law to disclose the interest.

“We were very bemused to learn that Justice Akaahs was the sole arbitrator of the GHL vs First Bank arbitration,” the whistleblowers wrote.

“How could that be?… Little wonder he dismissed all the claims of GHL against FBN.”

According to the group, the retired jurist made fresh purchases of First HoldCo shares during the period of the arbitration. On April 7, 2025, he allegedly bought 148,888 units, bringing his total shareholding in the institution to over half a million units.

The whistleblowers provided what they described as “preliminary evidence,” including tables of all shares held by Justice Akaahs, his First HoldCo portfolio breakdown, and the dates of his most recent transactions.

Beyond First HoldCo, they listed holdings across several blue-chip companies, including MTN Nigeria, UBA, GTCO, Zenith Bank, Daar Communications, Lafarge Africa, Ecobank Transnational and Dunlop Nigeria.

But they argued that the scale of his First HoldCo holding— which they say is the largest in his portfolio—created a clear and direct conflict in a case where First Bank was a party.

Inside The Arbitration: A Decision Now Under A Cloud

Justice Akaahs, who retired from the Supreme Court in 2019, was appointed sole arbitrator in February 2025. Over eight months, he presided over the multi-hundred-million-dollar dispute between GHL and First Bank.

On October 28, 2025, he delivered a sweeping decision dismissing all of GHL’s claims, citing the oil firm’s alleged failure to prove breach of contract.

Until these allegations surfaced, the award had been viewed as yet another example of an arbitration system increasingly preferred for resolving high-value commercial disputes in Nigeria.

But analysts say the new disclosures strike at the very heart of arbitration’s foundational principles—neutrality, independence, and party confidence.

LegalCommunityReacts:“ThisIsaSerious Red Flag”

Multiple legal experts who spoke to journalists warned that the allegations, if validated, could invalidate the award entirely.

The Arbitration and Conciliation Act imposes a strict duty on arbitrators to disclose any circumstance likely to give rise to “justifiable doubts” about their independence or impartiality, both before and during arbitration.

A senior arbitration lawyer explained: “It is not about whether the arbitrator thinks he can be fair. It is whether a reasonable person, knowing the circumstances, might reasonably question his impartiality. Shareholding in a party’s parent company is one of the clearest grounds that should have been disclosed.”

Section 34 of the ACA allows a court to set aside an award if it is contrary to public policy—or if the arbitrator’s conduct suggests bias, corruption, or a breach of due process.

Failure to disclose a conflict, experts say, can be considered a denial of the right to a fair hearing, especially where a party might have challenged the arbitrator’s appointment had the information been known.

A Clash Between Reputation And Responsibility

Justice Akaahs, a respected jurist who spent decades on the Bench, has yet to publicly respond to the allegations. However, those familiar with the conventions of arbitration note that arbitrators—particularly former judges—are expected to exercise heightened sensitivity to issues of perceived bias.

Analysts say even if the retired Justice believed his shareholding was too small to influence his judgment, failure to disclose it is itself a serious breach.

A professor of arbitration law noted: “The legitimacy of arbitration rests on transparency. When that breaks down, the award becomes suspect—even if the decision itself was legally sound.”

He added that any purchase of shares during an ongoing arbitration involving a related party would raise especially grave concerns.

What Happens Next?

With the whistleblowers promising more disclosures, the legal and financial sectors are bracing for a storm.

If GHL chooses to challenge the award in court—something experts now consider likely—the allegations could become central grounds for seeking to have the award set aside.

Courts generally avoid interfering in arbitral awards, but they intervene where public policy, impartiality, or due process is compromised.

A litigation expert said, “If the evidence holds, this award is in real danger. A court may view the nondisclosure as a breach of both the law and natural justice.”

There may also be regulatory consequences. The SEC and Nigerian Exchange (NGX) could launch inquiries into the whistleblowers’ claims, particularly if they involve unusual trading patterns by the retired Justice.