Financial Analysis

Analysis: 2023 Premium Pension Corporate and Pension Fund Accounts for the year ended December 2023

Premium Pension is one of the first set of Pension Fund Administrators (PFA) licensed by the National Pension Commission (PenCom) in December 2005.

The company ended the 2023 financial year with 794,946 RSA holders in the 7 publicly available pension funds it manages, an increase of 22,061 RSA holders from 772,885 RSA holders in 2022, a growth of 2.85%.

Additionally, assets under management of the 7 audited funds published was ₦978.35 billion, up 13.71% from ₦860.43 billion in 2022.

Performance Analysis: Premium Pension (The Company)

Premium Pension Limited’s revenue for the fiscal year ending on December 31, 2023, amounted to ₦11.63 billion, up 15.84% when compared to revenue of ₦10.04 billion recorded in 2022.

- Total expenses increased by 16.57% to ₦7.05 billion from ₦6.05 billion in 2022.

- Whilst the company grew profit after tax (PAT) in 2023 by 32% to ₦3.51 billion, growth slowed slightly from the almost 36% recorded in 2022.

- Further digging revealed that whilst revenue had grown by 15.84%, expenses grew slightly faster at 16.57% to ₦7.05 billion from ₦6.05 in 2022, leading the company’s cost-to-income ratio to also rise slightly to 60.65% from 60.27%.

- Shareholders’ funds closed 2023 at ₦8.71 billion, up 22.54%, whilst return on equity (ROE) for the year was 40.24% up from 37.33% in 2022.

Premium Pension has all 7 regulated RSA pension funds available to the public.

Premium Pension has all 7 regulated RSA pension funds available to the public.

Performance Highlights: Premium Pension RSA Funds (audited)

For the period ending on December 31, 2023, the audited unit price of the Premium Pension Fund I appreciated by 16.68%, while Fund II appreciated by 15.50%.

Fund III recorded a growth of 10.48%, Fund IV appreciated by 9.72%, Fund V by 12.97%, Fund VI – Non-Interest (Active) by 10.19% whilst Fund VI – Non-Interest (Retiree) fell by 6.09%.

Early in December 2023, PenCom, the regulator introduced benchmarks for each of the asset classes that PFA’s investment client assets. As such PFA’s performances in managing client pension funds will now be benchmarked against respective composite indices.

PenOp, the trade association for the PFA’s in March 2024 released a performance report showing the breakdown of each fund group’s benchmark for 2023.

Premium Pension Fund performances when compared to the benchmarks released are as follows:

5-year historical audited fund returns are as follows:

Premium Pension Fund I 2023 audited accounts highlights:

- Fund I performance: The fund’s audited unit price rose 16.68% in 2023, higher than the 10.71% in 2022. The fund however underperformed the benchmark by 3.70%, which returned 20.38% in 2023.

- Fund I generated an investment income of ₦133.98 million, which was up 120.22% in comparison to the investment income generated in 2022 of ₦60.84 million and ₦19.56 million in 2021.

- The cost of managing the fund, which is expressed as the expense ratio was 2.39%, which is high and much higher than the 1.80% of 2022 and the 1.37% of 2021. The fund’s expense ratio had averaged 1.70% over the last 5 years to December 2022. With this steep rise in the cost of managing the fund, the 5-year average has now risen to 1.90%.

- Fund size: the size of the fund, measured by net assets, grew 14.22% to ₦703.04 million from ₦615.53 million in 2022.

- Asset Allocation (31-12-2023): Fixed Income Instruments 72.49%, Equities 15.88%, Money Market instruments 10.84%, Cash 0.63%, Others 0.16. See the chart below comparing fund to industry asset allocation as of 31 December 2023.

- Performance ranking: The fund performance for 2022 was ranked 3 out of 16 in our 2023 Annual Report on Pensions.

Premium Pension Fund II 2023 audited accounts highlights:

- Premium Pension Fund II’s audited unit price rose 15.50% in 2023, compared to 10.87% in 2022 and 6.73% in 2021. The fund however underperformed the benchmark by 2.24%, which returned 17.74% in 2023.

- Investment income was up 54.09% to ₦67.81 billion in 2023. This was up on the ₦44.01 billion in 2022, an increase of ₦23.8 billion.

- The expense ratio for the fund fell slightly from 1.68% to 1.66%. The fund had a 5-year average going into 2023 of 1.95%, which has now fallen 1.67%, a step in the right direction for RSA holders.

- The fund size grew 17.04% in 2023 to ₦448.83 billion from ₦383.47 billion in 2022, whilst asset Allocation as of 31 December 2023 were allocated to the following asset classes: Fixed Income Instruments 79.47%, Equities 12.85%, Money Market instruments 5.314%, Cash 0.50%, Others 1.87%. See the chart below comparing funds to industry.

- Performance ranking: The fund performance for 2021 was ranked 4 out of 16 in our 2023 Annual Report on Pensions.

Premium Pension Fund III 2023 audited accounts highlights:

- Fund III’s audited unit price rose by 10.48% in 2023, compared to 10.13% in 2022 and 7.62% in 2021. The fund outperformed the benchmark by 0.22%, which returned 10.26% in 2023.

- Investment income for fund III was up 15.40% to ₦44.64 billion in 2023 up from ₦38.68 billion in 2022.

- The expense ratio for the fund rose slightly to 1.56% from 1.53%. The fund had a 5-year average going into 2023 of 1.42%, which has now risen to a 5-year average of 1.55%. This was due to the very low initial ratio in 2018, which was when the fund launched.

- Premium Pension’s Fund III grew 11.62% in 2023 to ₦402.07 billion from ₦360.20 billion in 2022, while asset Allocation as of 31 December 2023, closed the years in the following asset classes: Fixed Income Instruments 91.37%, Equities 3.32%, Money Market instruments 4.79%, Cash 0.44%, Others 0.08%. See the chart below comparing funds to industry.

- Performance ranking: The fund performance for 2021 was ranked 8 out of 16 in our 2023 Annual Report on Pensions.

Premium Pension Fund IV 2023 audited accounts highlights:

- Fund IV’s audited unit price rose 9.75% in 2023, compared to 10.59% in 2022 and 8.82% in 2021. The fund outperformed the benchmark by 1.27%, which returned 8.48% in 2023.

- Investment income for the fund was ₦11.78 billion in 2023, up 3.15% from ₦11.42 billion in 2022.

- The fund’s expense ratio rose to 0.94% from 0.83%, continuing its rise for the 4th year in a row. The fund had a 5-year average going into 2023 of 0.84% and remained so.

- Fund IV’s fund size grew almost 7.68% to ₦119.51 billion, from ₦110.99 billion in 2022. This is the slowest growth for the fund in the last 7 years, having maintained double-digit growth in the last 6.

- Asset Allocation for the fund closed 31 December 2023 with investments in the fund allocated to the following asset classes: Fixed Income Instruments 89.08%, Equities 1.17%, Money Market instruments 7.46%, Cash 2.29%, Others 0.00%. See the chart below comparing funds to industry.

- Performance ranking: The fund performance for 2021 was not ranked in our 2023 Annual Report on Pensions as accounts were not made public.

Premium Pension Fund V 2023 audited accounts highlights:

- Registered Fund V RSA holders: Premium Pension had 6,784 Fund V RSA holders as of 31 December 2023, up from 6,628 in 2022. Total industry Micro Pension RSA holders in 2023 were 114,382, giving Premium Pension a 5.93% market share.

- Total assets in the fund as of 31 December 2023 was ₦33.93 million, up 73% from ₦19.65 million in 2022.

- Fund V’s investment income for the year was ₦3.35 million, up 96% from ₦1.71 million in 2022.

- The audited unit price for Fund V was a positive 12.97% in 2023, compared to 10.29% in 2022. The fund outperformed the benchmark by 5.19%, which returned 7.78% in 2023.

- Asset Allocation: As of 31 December 2023, investments in the fund were allocated to the following asset classes: Fixed Income Instruments 28.58%, Money Market instruments 63.96% and Cash 7.46%. See chart below comparing funds to industry.

- The fund performance for 2022 was ranked 5 out of 13 in our 2023 Annual Report on Pensions.

Premium Pension Fund VI – Non-Interest (Active) 2023 audited accounts highlights:

- Investment income for the year was ₦607 million in 2023, up 57% on the ₦386.07 million in 2022.

- The audited unit price of the fund had a positive performance, returning 10.19% in 2023, compared to 11.22% in 2022. The fund outperformed the benchmark by 1.71%, which returned 8.48% in 2023.

- The fund’s expense ratio rose to 1.65% from 1.37%.

- Fund size: Fund VI non-interest (Active) was ₦5.87 billion compared to ₦4.28 billion in 2022.

- Asset Allocation (31-12-2023): As of 31 December 2023, investments in the fund were allocated to the following asset classes: Fixed Income Instruments 65.33%, Equities 1.12%, Money Market instruments 28.73%, Cash 4.00%, Others 0.82%. See chart below comparing funds to industry.

- Performance ranking: The fund performance for 2021 was ranked 4 out of 13 in our 2023 Annual Report on Pensions.

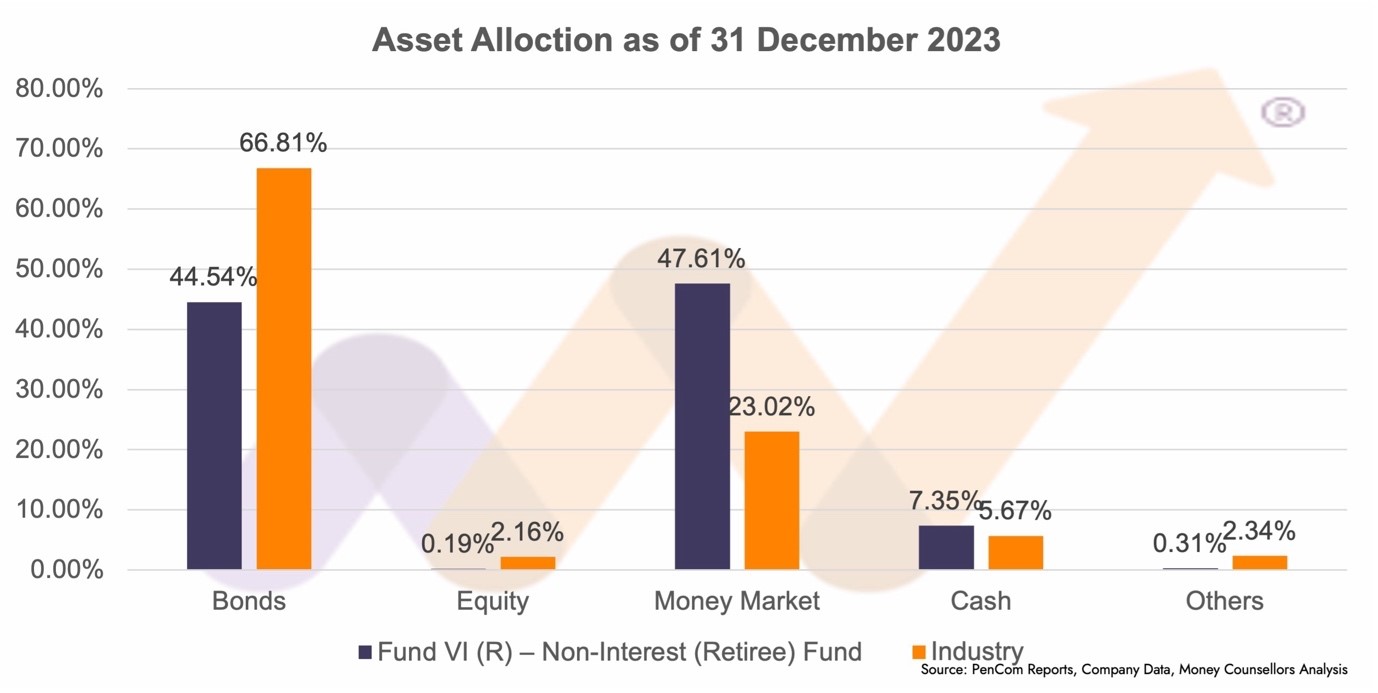

Premium Pension Fund VI – Non-Interest (Retiree) 2023 audited accounts highlights:

- Investment income for the year was ₦142.69 million in 2023, up 69% on the ₦84.43 million in 2022.

- The fund’s audited unit price fell by 6.09% in 2023, compared to a positive returns of 11.67% in 2022. There was no benchmark performance published for Fund VI non-interest (Retiree).

- The fund’s expense ratio rose to 0.93% from 0.81%.

- Fund size: Fund VI non-interest (Retiree) was ₦1.34 billion compared to ₦859 million in 2022.

- Asset Allocation: As of 31 December 2023, investments in the fund were allocated to the following asset classes: Fixed Income Instruments 44.54%, Equities 0.19%, Money Market instruments 47.61%, Cash 7.35%, Others 0.31%. See chart below comparing fund to industry.

- Performance ranking: The fund performance for 2021 was ranked 3 out of 8 in our 2023 Annual Report on Pensions.

Watch out for our 2024 report detailing all fund rankings for 2023 in the 2024 Money Counsellors Annual Report on Pensions (MCARP 2024). Download the 2023 report here.

This article was written by Michael Oyebola. For more information and analysis, visit moneycounsellors.com