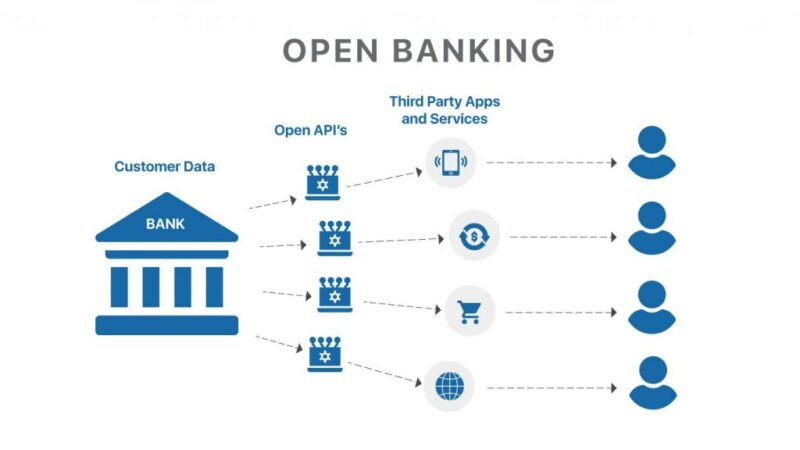

The Central Bank of Nigeria (CBN) has correctly observed that the success of Open Banking lies in creating an ecosystem that is both cooperative and competitive. For Nigerian Financial technology firms, this framework is a strategic imperative that unlocks data-driven growth and access to capital.

The regulatory groundwork was laid in 2021 with the issuance of the Regulatory Framework for Open Banking in Nigeria. This document provided the essential legal basis for the secure and standardised sharing of customer data between financial institutions and licensed third-party providers (TPPs).

Building on this foundation, the CBN subsequently released the Operational Guidelines in 2023, which further facilitated secure data sharing. This framework introduced a tiered structure for data and services, establishing specific access requirements based on the data’s sensitivity, thereby promoting secure exchange and strengthening the digital banking ecosystem.

The core of the CBN’s initiative is to transform the financial services landscape through controlled data sharing. As articulated by Chai Gang, the Deputy Director for Payments Systems Policy Department at CBN, during a panel session, Open Banking is primarily a mechanism to create more innovation within financial services by enabling Application Programming Interface (API) and data sharing.

This innovation is permitted between a wide range of players, such as regulated and non-regulated institutions, API providers, API consumers, and fintech startups, allowing them to access and utilise customer data to build more customer-centric financial services.

Read also: CBN’s Open Banking system hasn’t launched yet, here is why

Open Banking as a catalyst for fintechs

Open Banking is the foundation upon which the next generation of financial solutions will be built. The system transforms the ecosystem from a fragmented landscape of custom integrations to one of standardised interoperability.

Previously, every partnership with a bank required a bespoke, time-consuming, and expensive technical integration. The CBN’s framework, however, mandates a single set of APIs, effectively creating a plug-and-play environment.

This standardisation significantly reduces the barriers to entry and the cost of scaling, allowing Fintechs to concentrate their resources on innovation rather than infrastructure. A Third-party provider can leverage the APIs to launch sophisticated services more rapidly, such as advanced Personal Finance Management (PFM) apps that aggregate all user accounts, or intelligent credit scoring engines that use complex machine learning algorithms on aggregated transaction data.

This access to rich, consensual data enables Fintechs to move beyond basic payments and offer niche, hyper-personalised services to underserved segments, driving the national agenda for financial inclusion.

Read also: ATM: FCCPC to monitor banks’ implementation of 48-hour issues resolution rule

Why it matters to Nigerian business owners

The primary benefit of Open Banking to Nigerian business owners is its power to address the chronic problem of access to affordable credit. Traditional lending practices struggle with the lack of reliable, consolidated financial data, leading to high-risk assessments and collateral requirements that sideline most SMEs.

Open Banking revolutionises this by enabling the secure, customer-permissioned sharing of financial data across multiple institutions via standardised Application Programming Interfaces (APIs).

This allows a business to present a holistic view of its creditworthiness. By consolidating transaction history, account balances, and cash flow across different bank accounts into a single, verified data stream, a business can demonstrate consistent revenue and financial health, even without lengthy paper trails.

Second, Open Banking drives operational efficiency. Business owners can utilise integrated financial management apps that automatically reconcile accounts, manage payroll, and categorise expenses in real-time by linking directly to their bank data.

Regulatory safeguards for CBN opening banking

The Central Bank of Nigeria (CBN) has made customer consent the bedrock of its regulatory framework to ensure data privacy and consumer protection within the Open Banking ecosystem.

Chai Gang, Deputy Director for Payments Systems Policy Department at CBN, explained that the system is fundamentally built on the customer’s authority over their data. “Data can’t be shared without the consent of the data owner. Underscoring the CBN’s alignment with the requirements of the Nigerian Data Protection Commission (NDPC, formerly NITDA),” he said.

He elaborated that the implementation is designed to make the consent process both automated and transparent. Crucially, the customer retains the right to control this permission at all times.

“The customer will also have the ability to say, I’m not interested anymore. The customer can decline or withdraw at any point in time,” Chai said.

Beyond proactive consent, the CBN is building a robust mechanism for accountability and risk mitigation, recognising that any system has its risks.

Chai confirmed that the regulator is developing a mitigation strategy to deal with instances of abuse. The system includes an inherent layer of security designed to ensure complete traceability of data usage. This is achieved through the use of tokenisation around the consent management process, which creates a unique identifier.

How to leverage the Open Banking Opportunity

To capitalise on the anticipated phased go-live, both groups must take immediate, proactive steps.

- Nigerian fintechs must focus on accreditation and compliance. They should actively engage with the Open Banking Registry (OBR) and the CBN’s operational guidelines, ensuring their security protocols and consent mechanisms are robust and transparent, as trust is the ultimate currency in a data-sharing economy. Their competitive edge will depend on how creatively they can use the newly accessible data to solve complex customer problems, not simply on which banks they connect with.

- Business Owners need to prioritise digital formalisation. Since the system relies on structured transaction data, businesses must ensure all sales and expenses flow through formal, verifiable accounts rather than cash.

- They must also be ready to consent wisely, understanding exactly which data points they are sharing and the specific benefit they will receive in return, whether it is a lower interest rate, faster payment processing, or a better budgeting tool.

By understanding the core mechanisms and preparing for the system’s operational requirements, Nigerian Fintechs and business owners can position themselves to be the primary beneficiaries of this transformative regulatory initiative.

Read also: What the ₦1.2m daily POS limit means for daily banking in Nigeria