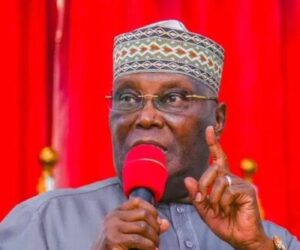

The Optiva Capital Partners, Africa’s leading investment immigration and wealth retention firm, has released its 2026 Investment Advisory and Outlook, calling on Africans to “think global, invest smart, and secure their future.” Speaking during an exclusive briefing with journalists, Franklin Nechi, chairman of Optiva Capital Partners, underscored that the coming year represents a defining moment for African investors, entrepreneurs, and families to reposition themselves for global opportunities through strategic investment immigration and wealth diversification.

“The world no longer rewards isolation, it rewards access. Mobility is the new wealth. Those who can move freely, invest wisely, and connect globally will shape the next decade of prosperity,” Nechi said. According to Nechi, the global migration and investment immigration industry has evolved from being a niche luxury to a mainstream strategic necessity, particularly for Africa’s fast-growing class of high-net-worth individuals and professionals. He noted that a second citizenship or residency now represents a pathway to greater economic resilience, international opportunity, and family security.

“A second passport is no longer a symbol of privilege – it is a shield of protection and a bridge to opportunity,” he explained.

“For entrepreneurs, it means access to global markets and investment networks. For families, it guarantees access to world-class education and healthcare. For investors, it means diversification and stability in an unpredictable world.” Nechi reaffirmed Optiva Capital Partners’ leadership as the number one name in investment immigration in Africa, built on what he described as the company’s four pillars of excellence – protection, growth, optimization, and enhancement.

Read also: Optiva Capital Partners reaffirms leadership in Africa’s investment immigration industry

“Protecting wealth means safeguarding it against currency fluctuations and market instability. Growth ensures that your money continues to earn returns through diversified investments.

Optimization means putting your money to work efficiently, so it keeps generating value even when you retire, while enhancement ensures that clients’ investments are diversified and well distributed across asset classes, currencies, and jurisdictions.” With presence and partnerships spanning North America, Europe, the Caribbean, and the Middle East, Optiva Capital Partners has guided thousands of clients in securing second citizenship, diversifying their portfolios, and ensuring intergenerational wealth protection.

Nechi emphasized that 2026 will be the year of global access, as Optiva deepens its footprint in international real estate and wealth retention investments. The firm will also continue expanding its advisory capacity to help African investors integrate global financial and residency strategies into their long-term plans.

“At Optiva, we don’t just sell programs – we deliver possibilities. We help our clients protect, grow, and optimize their wealth while securing access for their families and businesses to thrive anywhere in the world,” Nechi added.

“Our message for 2026 is clear – plan globally, act wisely, and partner with people you can trust.” Nechi concluded by reaffirming the company’s broader mission to empower Africans to engage confidently with the global economy.

“The future belongs to the borderless African – mobile, and globally connected. That is the vision Optiva Capital Partners continues to champion,” he said.