M-KOPA Kenya, the Kenyan arm of the Pan-African fintech company, announced that it has unlocked over $1.6 billion (KES 207 billion) in credit and served 4.8 million customers traditionally excluded from formal finance since 2010. This is a testament to the company’s contribution to bridging digital and financial inclusion across its five markets.

In its first Kenya-focused Impact Report, M-KOPA noted that it has remained dedicated to supporting everyday earners with access to the internet and smartphones, and also contributed to the country’s economy. In the period under review, the company has supported 4.5 million smartphone users with digital access, including 2.1 million first-time smartphone owners.

M-KOPA Kenya’s General Manager, Martin Kingori, noted that Kenya has been the beating heart of the company’s journey in Africa, with a significant contribution to its growth trajectory.

“Our 2025 Impact Report demonstrates how inclusive financing, responsible lending, and digital innovation are transforming lives at scale. What matters most is the lives progress of everyday earners – 9 out of 10 report an improved quality of life, and more than half are now earning more,” he said in the latest report.

In terms of how its smartphone offerings have created access to opportunities, the report revealed that 67% of customers use their M-KOPA device for income generation, while 64% stated that they can now easily meet household goals. Another 52% claimed they now earn more since joining the platform.

Through its ‘More than a Phone’ feature, a branded smartphone that offers an all-encompassing daily life experience, the company has provided customers with access to credit, insurance, and digital services, along with flexible daily life repayment options.

A significant percentage of consumers also experienced the all-encompassing features for the first time. For instance:

- 47% are first-time smartphone users

- 37% accessed their first formal loan

- 68% received their first health insurance cover.

While it enhances customers’ financial and digital experience, M-KOPA is also making an impact on the Kenyan economy. In 2024 alone, the company paid $29.2 million (KES 3.79 billion) in taxes, while its local procurement of $156.7 million (KES 20.3 billion) contributed to the East African country’s economy.

The fintech company also helped alleviate Kenya’s unemployment figure as it employed 1,320 staff and supported 14,000 sales agents. Not only are most of the employees young, but the employment was also their first step into the labour market.

M-KOPA’s Nairobi assembly plant, reportedly Africa’s largest, has now supplied 2 million smartphones, standing as a facility that reinforces Kenya’s technological and manufacturing industry.

Also Read: M-KOPA co-founder accuses board of share price manipulation.

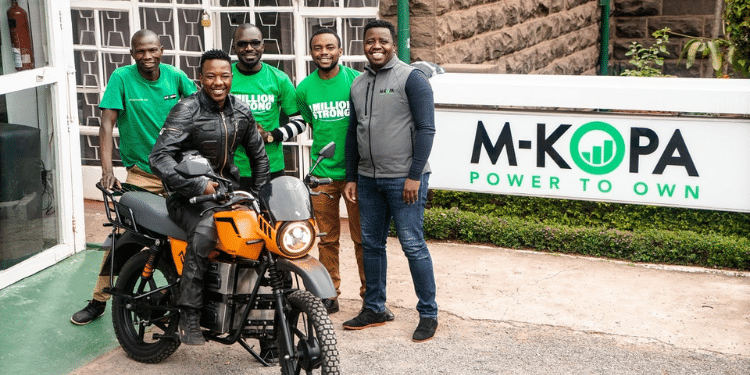

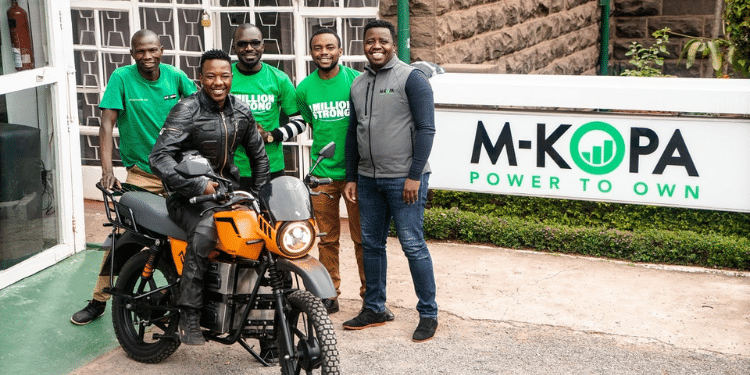

M-KOPA’s Boda Boda

The company’s continued care for “Every Day Earners” extends to providing electric motorbikes on a flexible daily repayment plan.

Tagged ‘Boda Boda’, M-KOPA is making electric mobility affordable for riders and has now provided over 5,000 electric motorbikes. With the offer, riders can now save an average of $5.63 (KES 730) per day through reduced fuel cost and fewer repairs.

Aside from the fact that electric motorbikes cut harmful pollutants by over 90% compared to petrol bikes, Kenyan Boda Boda riders saw an impact such as:

- 66% reported higher earnings since switching to electric.

- 47% can now afford essential household expenses.

- 41% are now investing in their children’s education.

Brian Njao, General Manager of Mobility, noted that reaching 5,000 electric motorbikes demonstrates how M-KOPA’s financing model works across asset classes. “Whether it’s a smartphone or an e-motorbike, we’re solving the same challenge—making expensive, income-generating assets accessible to people earning day by day.”