Nigeria’s pension industry is entering a new era of diversification as the National Pension Commission (PenCom) updates its investment regulations to enable Pension Fund Administrators to enhance contributors’ returns.

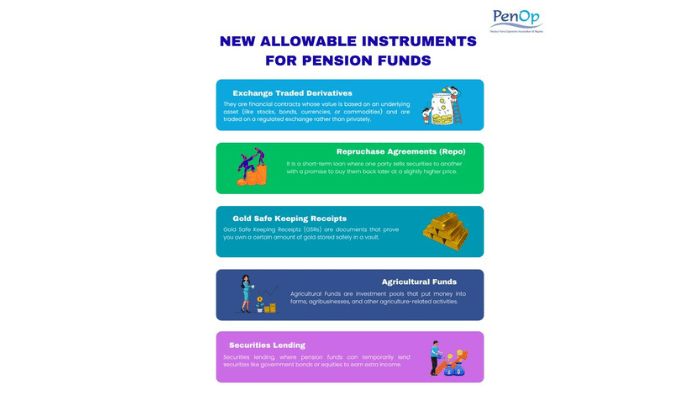

The revised rules reduce over-dependence on federal government securities and allow pension fund administrators to explore a wider range of instruments, including exchange-traded derivatives, gold safekeeping receipts, agricultural funds, and repurchase agreements.

The latest iteration of investment regulations reflects the changing investment landscape, according to analysts at Pension Fund Operators Association of Nigeria (PenOp).

“With a focus on reducing the exposure to federal government securities, PenCom have allowed pension funds to invest in more exotic financial instruments, the analysts said.

Read also: Pension revolution for the ‘Japa Generation’

Exchange Traded Derivatives (ETDs), one of the instruments, allow funds to profit or protect against market swings without buying the actual stocks or bonds.

Exchange-traded derivative contracts, according to Fintelligents, are traded in regulated exchanges. They mostly consist of options and futures and can be used to hedge or speculate on a wide range of assets like currencies, interest rates, etc.

The standardisation of contracts is a core element of exchange-traded derivatives. This implies that the terms and conditions are defined by the exchange specifically. The Exchange decides the expiry date, the settlement process, the size of the lot, and, in particular, the underlying instruments on which the derivatives may be formed. This also helps to ensure that securities are cleared and settled efficiently and enables credit guarantees to be issued through the clearinghouse.

Exchange-traded derivatives, therefore, foster liquidity and transparency by offering market-based price quotes. As an alternative approach to standardisation, over-the-counter derivatives are traded individually and customised to meet each party’s requirements, thereby minimising transparency.

Read also: New pension rule opens window for ‘side hustles’ savings

Repurchase Agreements (Repos) are like short-term, safe loans where banks pay interest on money you lend, secured with assets.

It is a transaction in which one party sells securities to another with an agreement to repurchase them at a specified future date and price, PenCom said.

Gold Safe Keeping Receipts (GSRs) let you invest in gold without physically holding it, helping diversify your pension.

Agricultural Funds invest in farms and agribusinesses, letting your money grow while supporting Nigeria’s food production. Securities lending, where pension funds can temporarily lend securities like government bonds or equities to earn extra income.