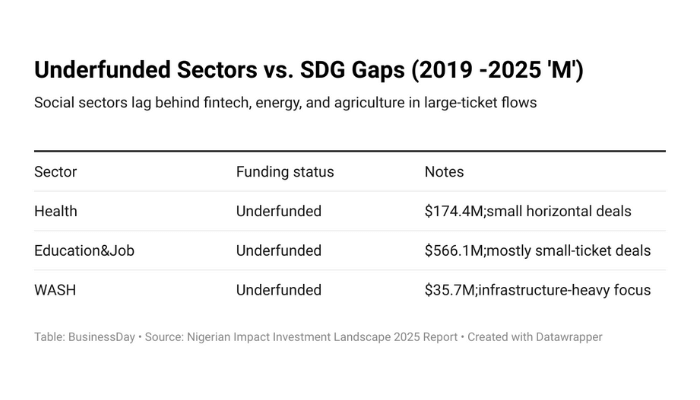

…Health, education, WASH, creative industries, care economy miss large-ticket flows

Nigeria’s private equity and venture capital market has deployed about $3 billion across 404 deals from 2019 to 2025, but the capital flows remain heavily concentrated in fintech and energy, leaving five key sectors, like health, education, water, sanitation and hygiene (WASH), creative industries, and the care economy, structurally underfunded and largely bypassed by large-ticket investments, according to the Nigerian Impact Investment Landscape 2025 report from the Impact Investors Foundation and NABII.

Fintech leads with $294.6 million in total investments across all stages, followed by agriculture and food systems at $187 million and logistics and transport at $71.3 million. Early-stage deals absorbed $706.7 million overall, while growth stages took $440.6 million, reflecting a focus on scalable models in urban centers.

Health attracted $174.4 million, education and jobs $56.1 million, and energy and water, including WASH, $35.7 million, but these figures represent only a fraction of the total, with large deals clustering in core infrastructure rather than social services.

The report highlights systemic gaps where capital is not flowing effectively. Health, education, and WASH are identified as the most underfunded Sustainable Development Goals, with 2020-2024 seeing a high frequency of small, horizontal deals but large tickets concentrating in energy and core infrastructure.

Social services and WASH remain structurally underfinanced, leaving sectors like outcome-based structures and pooled vehicles as potential tools to bend the curve toward guaranteed local currency issuance by 2030.

Creative industries and the care economy fare even worse, receiving minimal attention in the deal pipeline.

Gender inclusion and 2x capital flows are clustered in financial services and consumer agribusiness, while manufacturing, renewables for micro, small and medium enterprises, creative industries, and the care economy remain comparatively underfinanced.

The absence of a gender-labelled Nigerian Exchange bond, inconsistent bank-level gender tagging, and short-term, foreign exchange-exposed products for women-led micro, small and medium enterprises further limit scale in these areas.

Read also; Cloud market hits $106.9bn in Q3, 28% YoY growth

This underfunding is exacerbated by broader market mismatches. Most small and medium enterprises seek financing between 10 million naira and 500 million naira, equivalent to $10,000 to $500,000, but face acute shortages of foreign exchange and local currency access, along with a scarcity of flexible financial instruments like mezzanine or revenue-based financing.

Pipeline quality is low, with only about 15 percent of small and medium enterprises deemed investment-ready due to weak governance, poor financial reporting, and limited scalability.

Ticket sizes are concentrated between $100,000 and $500,000, with limited large-ticket deals, signaling a preference for incremental investments over transformative ones.

Accelerator disbursements from 2019 to 2025 totaled $19 million in the form of pre-seed, seed, and early-stage local currency instruments, underscoring an active but underpowered early ecosystem.

Geographically, Lagos and the South-West capture 65 to 70 percent of total flows in the $4.97 billion mapped startup investments from 2019 to 2025, while the North and North-West receive 10 to 12 percent, mainly in agriculture and microfinance.

Abuja and other regions show emerging activity in policy, housing, and energy, but the urban-fintech-heavy pattern leaves impact capital in education and fast-growing frontiers like energy and agriculture spreading beyond Lagos.

Private capital catalyzed by local currency guarantees is increasingly flowing, with the InfraCredit 2025 investor report noting diversification into power, transport, manufacturing, information and communications technology, logistics, gas processing and distribution, urban infrastructure, job-intensive sectors, and renewables.

Green-labelled bonds from sovereign and corporate issuers are channeling proceeds into renewables, energy efficiency, and climate-adaptation projects under Nigeria’s Sustainable Bond Framework.

Nigeria accounts for an estimated 15 percent of Africa’s private capital transaction volume and remains the largest destination for impact investment in West Africa, though its share of global impact investing asset under management exceeding $1.2 trillion remains fragmented.

The rise of domestic fund managers implementing gender-lens, micro, small and medium enterprise, agriculture, health, and climate-focused strategies offers a path forward.

Initiatives like Alitheia IDF’s $100 million asset under management, gender-focused private equity fund targeting 45 million firms from 2020 to 2024, Aruwa Capital’s private equity Fund II aiming for $35 million with 90 percent women-led in 2024, and InfraCredit’s 1.51 billion naira green infrastructure bond recognized as the best social bond in Africa in 2024 signal growing traction.

However, without scaling local currency guarantees and addressing data fragmentation, the ecosystem risks missing opportunities in these five underfunded sectors.