Salve,

Victoria from Techpoint here,

Here’s what I’ve got for you today:

- Kenya’s payment pipes just got tax protection

- Omoni Oboli just changed the game for Nollywood

- Orange takes the lead as Maroc Telecom loses ground

Kenya’s payment pipes just got tax protection

Kenya’s payment system might just have gotten its biggest legal shake-up yet. On October 24, the Tax Appeals Tribunal ruled that the Kenya Revenue Authority (KRA) can’t charge the usual 16% VAT on companies that connect banks, mobile money operators, and payment providers. In short, the people who make digital payments work behind the scenes just won a major victory, and it could change how Kenya taxes financial infrastructure going forward.

At the centre of it all is Kenswitch, a company that links ATMs and point-of-sale systems across banks. KRA had argued that Kenswitch’s services counted as ICT operations and should therefore be taxed. But the tribunal disagreed, ruling that Kenswitch’s work falls under financial services, and financial services are VAT-exempt. This ruling effectively saves the company millions and draws a new line between what’s “tech” and what’s “finance.”

For those who don’t know, firms like Kenswitch are the invisible traffic controllers of Kenya’s payment network. Every time you tap your card or use mobile money, they handle the handshake between your bank and the merchant’s bank. They’re not selling software; they’re making sure your money moves. And now, legally speaking, they’re part of the financial system, not just another ICT vendor.

The ruling doesn’t just affect Kenswitch. Two other licensed switch operators — PesaLink and Switchlink Africa — are breathing easier too. They’ve also been under pressure from KRA’s push to tax digital intermediaries. Now, they’ve got legal clarity and, arguably, a little more room to focus on what they do best: keeping Kenya’s payment ecosystem connected and efficient.

But the bigger story is what this means for Kenya’s planned national payment switch, a unified system that will let anyone send money between any bank or wallet. If switching services is VAT-exempt, the national switch might enjoy similar benefits, which could make transactions cheaper and smoother for everyone. It’s a win for interoperability and possibly a blow to KRA’s efforts to expand its tax base.

Still, this fight is far from over. KRA’s push shows how regulators across Africa are struggling to keep up with the fast-blurring line between financial services and technology. For now, Kenya’s switch operators have some breathing space, but it also leaves one big question: how will the government fund its digital economy without slowing it down?

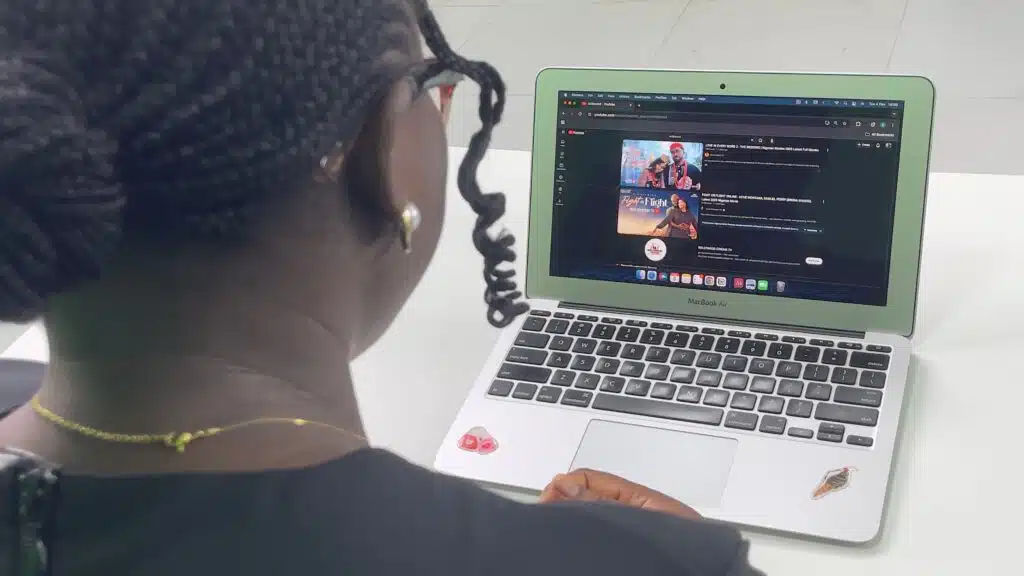

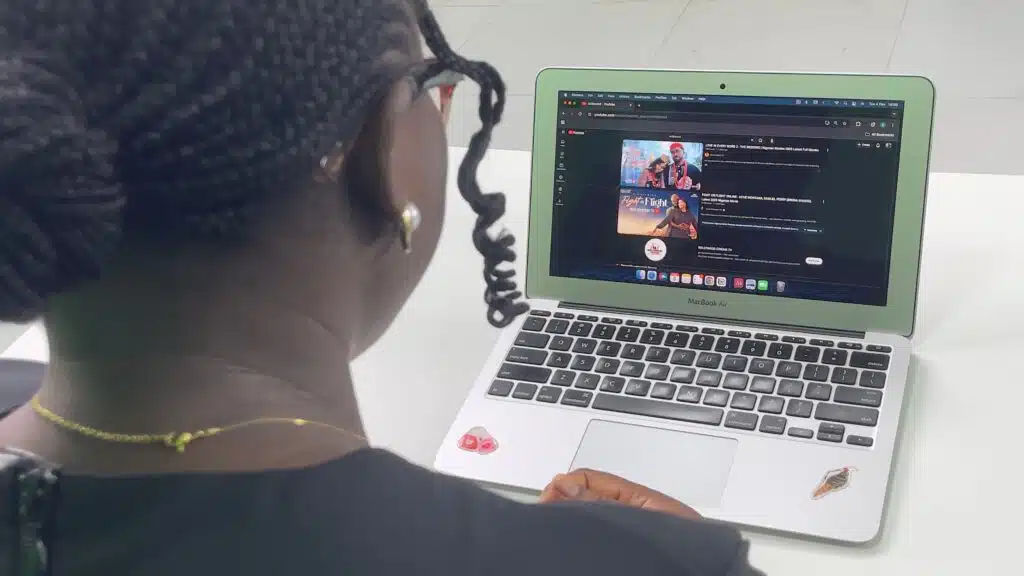

Omoni Oboli just changed the game for Nollywood

What’s better than watching a good Nollywood movie? Watching one that sneaks in your favourite brands and somehow makes it work. When Love in Every Word 2, the latest film from Omoni Oboli, rolled its credits, viewers noticed more than just familiar faces. UBA, MTN, Coca-Cola, GIG Logistics, Vaseline, and Close-Up all popped up as collaborators.

It’s a smart move, and maybe the start of something bigger. As Netflix and Prime Video pull back in Nigeria, filmmakers are getting creative about how to keep the lights on. YouTube has become their new playground. Why? Free to access, algorithm-driven, and always buzzing. But there’s a catch: the money doesn’t exactly flow like box office sales.

For most Nollywood creators, a million YouTube views might only fetch a few thousand dollars. Once you factor in production costs and crew pay, it’s easy to see why many release three films a month just to stay afloat. It’s quantity over comfort, and that’s not always sustainable.

That’s why Omoni’s brand collaborations matter. Instead of waiting for ad revenue to roll in, she’s baking marketing deals right into her films. It’s smart business, turning storytelling into subtle advertising that doesn’t feel forced. Think of it as Nollywood’s way of saying, if streaming won’t pay enough, the brands will.

Could this be how Nollywood finally cracks the YouTube code? Read Chimgozirim’s full story for the inside scoop on how brands and filmmakers are rewriting the business of Nollywood.

Orange takes the lead as Maroc Telecom loses ground

Morocco’s telecom market is finding its rhythm again. After a shaky start to the year, mobile subscriptions bounced back in the second quarter, rising to 58.75 million by June, up 3.2% from last year, according to fresh data from the regulator, ANRT.

It’s not a massive leap, but it’s enough to change the mood. Operators added about 1.36 million new lines since March, reversing the nearly 900,000 losses earlier in the year. Orange Morocco now leads the pack with 34.7% of all connections, pulling ahead of Inwi and Maroc Telecom, which continue to lose ground bit by bit.

Prepaid still rules the scene — 86% of all mobile lines — but postpaid plans are quietly creeping up. More households and small businesses are opting for fixed monthly plans to better manage their data use. That’s a small but telling sign that spending habits are getting more intentional.

The real story, though, is fibre. Fibre-to-the-home subscriptions jumped 26% year-on-year, hitting 1.2 million users, the fastest growth pace so far. Casablanca, Rabat, and Agadir are leading the charge, while smaller towns are slowly catching on. Fibre is now the hot battleground as mobile data starts to plateau in the big cities.

With Internet penetration now above 110%, Morocco’s telecom story is shifting. Growth isn’t just about adding new users anymore; it’s about deepening value. The big question now is which operator can deliver both reach and reliability as the country moves deeper into its digital future.

In case you missed it

What I’m watching

Opportunities

- Techpoint Africa is creating a video series where people discuss and debate policies and current events. If you enjoy thoughtful conversations, fill out this form. Apply here.

- Flutterwave is hiring a Manager, Pricing. Apply here.

- Kuda Technologie is recruiting a DevOps Engineer. Apply here.

- Ecobank Nigeria is looking for a Relationships Manager in South-South and South-East regions. Apply here,

- Western Union is recruiting a Business Development Associate Lagos, Nigeria. Apply here,

- TLP Advisory is surveying the listing potential of Nigerian venture-backed businesses on the NGX. Share your insights by completing this survey.

- Join Africa’s top female founders, investors & innovators at AWFS 2025. Register here.

- Are you building a startup can feel isolating, but with Equity Merchants CommunityConnect, you can network with fellow founders, experts, and investors, gaining valuable insights and exclusive resources to help you grow your business. Click here to join.

- Help us make Techpoint better for you! Your feedback shapes what comes next (your responses may potentially save my job. A bit dramatic, but still). It will only take 30 seconds to tell us what works and what doesn’t. Fill it here.

- To pitch your startup or product to a live audience, check out this link.

- Have any fresh products you’d like us to start selling? Check out this link here.

- Follow Techpoint Africa’s WhatsApp channel to stay on top of the latest trends and news in the African tech space here.

Have a wonderful Wednesday!

Victoria Fakiya for Techpoint Africa