The Lagos State Government has reaffirmed that matters relating to taxation are best determined by the Lagos State Internal Revenue Service (LIRS).

The Governor’s Special Adviser on Tax and Revenue, Abdulkabir Ogungbo, made the remark in response to TikTok influencer Habeeb Hamzat, also known as Peller, who complained about an alleged N36 million tax notice he claimed to have received from Lagos State.

The young content creator and online streamer last week voiced his criticism of the state government, describing the taxation as excessive.

Advertisement

READ MORE: “My Exit From Mavin Records Was Premature” – Reekado Banks

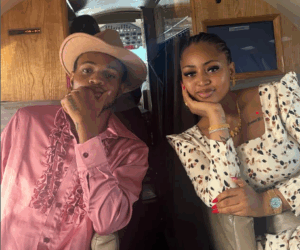

In a widely shared livestream video with singer Peruzzi (Tobechukwu Okoh), the 20-year-old TikTok influencer disclosed that he had been asked to pay N36 million in income tax by the government.

“The task force said I should pay N36m in tax. I swear to Almighty Allah, I don’t have anything. I only came into the limelight last year. Are you, Peruzzi, even paying tax, and how much is it? Why should I pay N36m? What does that even mean? Why will the government take money from me when it has never given me anything, not even TikTok support, let alone help from a task force member?” Peller lamented.

In an interview with PUNCH on Tuesday, Ogungbo stated that he would review the details of Peller’s case and respond later, while emphasising that anyone earning legally within the state is required to pay taxes.

“I need to take a look at this particular context in question. But generally, the LIRS is an autonomous body saddled with the responsibility of assessing and giving the best judgment on behalf of the government. We may need to engage the LIRS as an office to know about this particular case. But within the context of personal income, anybody who is legitimately earning, Section 24 of the Nigerian Constitution stipulates that when you earn your living and income legitimately, you are meant to declare that honestly to the authorities. So the context around the size, the quantum and what have you, needs to be properly investigated and we can revert,” the SA said.

When asked about taxation for content creators, the Special Adviser explained that recent reforms now govern digital assets and virtual transactions.

Ogungbo said, “Naturally, the law allows for personal income tax, meaning that when you earn a living or earn anything from what you do legitimately, you are supposed to pay tax. So from that context, irrespective of the location, either virtually or physically, you’re meant to remit your tax to the approved authority, which is the LIRS. But from the context of around digital assets and their complementary vocations, which mainly talk about this virtual transaction, the new reforms take care of that. But as it relates to personal income tax, irrespective, you’re meant to pay tax.”

He added, “So it’s about the legitimacy of your residence, where you stay. When you stay here, we assume that your infrastructure usage and otherwise, you earn it. You can be here and be having online business, so for that reason, if you earn honestly here, and there is no proof that you pay the same tax to another jurisdiction, for instance, maybe you’re based outside the country, you have to prove to the authority here that you were paying to the other state or other national. But if your income, which you earn here virtually or online and you stay here, and you want to do something with the Lagos State Government, then you’re bound to remit your tax here.

“But I do not have this particular case on my table for me to determine. Because we have a body (the LIRS) that is autonomous and that is very efficient in what they do. So Let me investigate and revert to you.”