When Bujeti made it into Y Combinator’s Winter 2023 cohort, it joined a rare club, one of just a handful of African startups to break through that year, even as the famed accelerator quietly scaled back its presence in emerging markets.

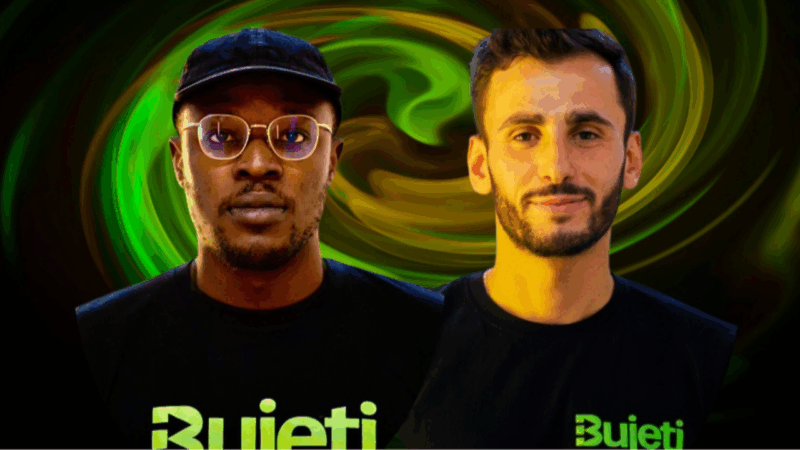

For founders Cossi Achille Arouko (CEO) and Samy Paul Chiba (COO), it wasn’t just a badge of honour; it was proof that Africa’s next big fintech story wouldn’t be about payments or digital wallets, but about powering how businesses run.

This is particularly interesting because in Africa, most financial tools often stop at “send” and “receive”, yet Bujeti is taking a bigger swing. The Lagos-based startup calls itself a financial control centre, a cockpit where every financial operation, from payroll and invoicing to taxes and compliance, happens in one place.

“Think of it as a cockpit,” Arouko said during my interview with the co-founders. “But instead of flying a plane, you’re steering your company’s finances, with automation helping you every step of the way.”

The vision is to give African founders, CFOs, and finance teams the kind of financial intelligence and control that global enterprises take for granted.

From expense tracker to financial co-pilot

Like many great products, Bujeti didn’t start as a super app.

“We started with an expense management tool,” Chiba recalled. “But the more we spoke to customers, the clearer it became that expense management alone wasn’t enough. Corporate finance customers always ask for more; you can’t stop there. You have to cover everything: payroll, invoicing, inventory, treasury.”

That realisation gave birth to what Bujeti now calls its financial co-pilot, a system that doesn’t just record transactions but helps businesses run smarter.

Arouko likens it to a space shuttle’s control panel:

“You sit down, give your inputs, and the system takes you where you need to go. That’s what Bujeti does for your finances. It enforces your company rules, automates workflows, flags risks, and even tells you when to delay or accelerate payments based on cash flow.”

Today, the platform handles everything from issuing cards and processing payroll to automating payments and managing compliance.

Solving Africa’s fragmentation problem

African SMEs waste hours every week juggling disconnected systems, spreadsheets, bank portals, HR tools, and tax dashboards just to stay afloat.

“The problem is fragmentation,” Chiba said. “People have tools for payroll, others for invoicing, and others for taxes. None of them talks to each other. We’re solving that.”

He added that Bujeti’s goal is to make financial management boring again, a single, integrated system that “just works”.

“Instead of ten people in your finance team,” Arouko explained, “you can hire five and add Bujeti as the sixth seat. It performs the same work, only faster, more accurately, and without complaining.”

Automation alone can’t fix everything; many African companies still lack the financial literacy to maximise modern tools. That’s where Bujeti Academy comes in. Led by Chiba, the initiative offers webinars and one-on-one sessions to help SMEs build better financial structures.

“We help businesses get it right, whether or not they use our platform,” he said. “Because when they grow, the ecosystem grows.” The academy has already trained dozens of small businesses to stay compliant with Nigeria’s evolving tax and e-invoicing laws.

Currency agnosticism and borderless business

Cross-border trade is booming across Africa, but moving money between countries remains painfully complex.

Bujeti’s answer is currency agnosticism, a feature that lets businesses operate seamlessly across borders.

“We built the platform to be ready for any currency,” Arouko said. “Right now, you can open USD, Naira, or Kenyan Shilling accounts. Soon, we’ll add more currencies so you can send, receive, and hold funds without switching platforms.”

Chiba added, “If you’re in Nigeria and want to do business in Ghana or Kenya, currencies and borders shouldn’t be barriers. If infrastructure doesn’t support it, it’s our job to make it seamless.” Their focus isn’t on building new payment rails but on improving the experience across existing ones.

“When you use Bujeti, you become a global business automatically,” Arouko said. “You can pay and get paid anywhere.”

AI as Africa’s financial brain

Artificial intelligence is at the heart of Bujeti’s vision for smarter business finance.

“Imagine you’re about to pay a vendor,” Arouko said. “Our system instantly checks if the account is legitimate and flags suspicious ones before you send the money. It’s about protecting your business.”

Beyond fraud detection, Bujeti’s AI reads contracts, predicts cash flow issues, and sends real-time alerts before problems arise.

“If your payment is due in two days, the system warns you, ‘Hey, if you don’t pay by tomorrow, there’s a 3% penalty.’” Arouko explained. “You can then decide, do I pay now or borrow from another account?”

For Chiba, this is what separates Bujeti from traditional accounting software.

“Some clients haven’t changed their product or service at all,” he said, “but they’ve grown just by optimising their internal processes with AI. They now have more liquidity and capacity for innovation.”

Bujeti turns data into trust

African companies often underestimate the value of their financial data.

“They keep it scattered across banks, spreadsheets, and apps,” said Arouko. “We bring it all under one roof and turn that data into a goldmine for smarter decisions.”

Bujeti adheres to both NDPR and GDPR compliance standards, giving customers confidence that their data is secure. “We take compliance seriously,” Arouko laughed. “We don’t want to go to jail, so we follow every rule, for our sake and our customers’.”

But the real innovation lies in what the company calls Bujeti-certified data, financial records that can be shared with investors as verified, tamper-proof reports. “When investors see that your numbers come from Bujeti, they know they can trust them,” Arouko said.

While most fintechs thrive on transaction fees, Bujeti’s core model is subscription-based.

“We charge a flat rate for access to the full software suite,” Arouko said. “We keep transaction fees low because we don’t want to add to your expenses. Our goal is to reduce friction, not create it.”

Chiba added, “Transaction fees are blockers for growth. We believe the world is moving toward near-zero fees, and Africa should lead that charge.”

This subscription model makes Bujeti “sticky”.

“Using Bujeti is like hiring a strategic employee,” Chiba explained. “Once your company builds its workflows around it, it becomes part of your structure. Switching isn’t just hard; it’s unnecessary.”

When asked about their plans for scaling beyond Nigeria. The founders explain, Bujeti’s headquarters may be in Lagos, but its footprint already stretches across Abuja, Port Harcourt, Oyo, and even Paris.

Next up: Kenya, Côte d’Ivoire, Ghana, Morocco, and Congo.

“We see ourselves as an African company with a global mindset,” Arouko said. “We just started in Nigeria because the infrastructure, while not perfect, exists. But we’re scaling responsibly across the continent.”

The biggest barrier? Banking infrastructure.

“If money can’t move, business can’t move,” he said. “So we’re working with local partners and regulators to make sure we can scale responsibly.” Chiba agreed, noting that fragmentation across tax and compliance systems remains a challenge.

“Every market is different,” he said, “but solving that is what drives us.”

Beyond software: A partner in growth

For Bujeti, success isn’t just about building tools; it’s about building stronger businesses.

“Running a business isn’t just banking or getting paid,” Arouko said. “After you start earning, you start hiring, paying taxes, and expanding. That’s where Bujeti helps you grow.”

The startup partners with banks, development agencies, and public institutions, including SMEDAN and the Office of the Special Advisor to the President on Economic Development, to provide both digital and institutional support for SMEs.

“We’re not just a fintech app,” Chiba said. “We’re a growth partner for African businesses.”

He explained that many clients use Bujeti not just for financial management but also for funding access, compliance support, and advisory connections.

“We give businesses the software but also the ecosystem they need to thrive.”

For years, Africa’s fintech story has been centred on consumer payments. But as Arouko and Chiba see it, the next big wave is B2B financial infrastructure, the invisible plumbing that powers how companies actually operate.

“The first frontier of fintech was payments,” Arouko said. “The next frontier is operations, helping businesses run better. That’s where we come in.”

By combining automation, AI, and deep financial intelligence, Bujeti is quietly positioning itself as the operating system for African business finance.

“Our mission is simple,” Arouko concluded. “Help African businesses grow. Because when they grow, Africa grows.”