Nigeria’s fintech scene, the largest in Africa, is now eyeing French-speaking markets, where a new frontier of customers awaits. Homegrown players like Flutterwave, Paystack (Stripe), PalmPay and others have announced moves into Côte d’Ivoire, Senegal, Cameroon and beyond.

Nigeria already accounts for about 217 fintech startups (32% of Africa’s total) as of 2023, but that number has supposedly increased to over 430 as of early 2025. That makes it a “breeding ground” for innovation.

Saturation at home and naira volatility are pushing firms abroad. As Flutterwave CEO GB Agboola puts it:

“It is necessary to make payments as easy as possible across Africa. The continent is brimming with business opportunities, and Senegal…has the potential to be at the forefront, radically contributing to the growth of Africa’s digital economy.”

Nigeria’s own digital market is enormous but crowded. Estimates show Nigeria’s fintech count has massively increased from 74 in 2017. In 2023, more than half of Africa’s big funding rounds went into Nigeria, and by mid-2025, Nigerian fintech entities had raised over $1 billion in the past two years.

About 63% of Nigerian adults now hold a financial account, a sharp increase from past years, but still leaving room for inclusion. The government has hailed Nigeria as the AfCFTA Digital Trade Champion, with Vice President Kashim Shettima noting that “our innovations in mobile payments have transformed cross-border payments, financial inclusion, and digital transactions across the continent.”

The African Continental Free Trade Area (AfCFTA) aims to raise intra-African trade from 18% (2022) to 50% by 2030, and initiatives like PAPSS (Pan-African Payment & Settlement System) are making remittances faster.

With Africa’s cross-border payments market projected to triple to $1 trillion by 2035, Nigeria’s fintech companies, already experts in domestic payments, see huge opportunities in facilitating regional commerce.

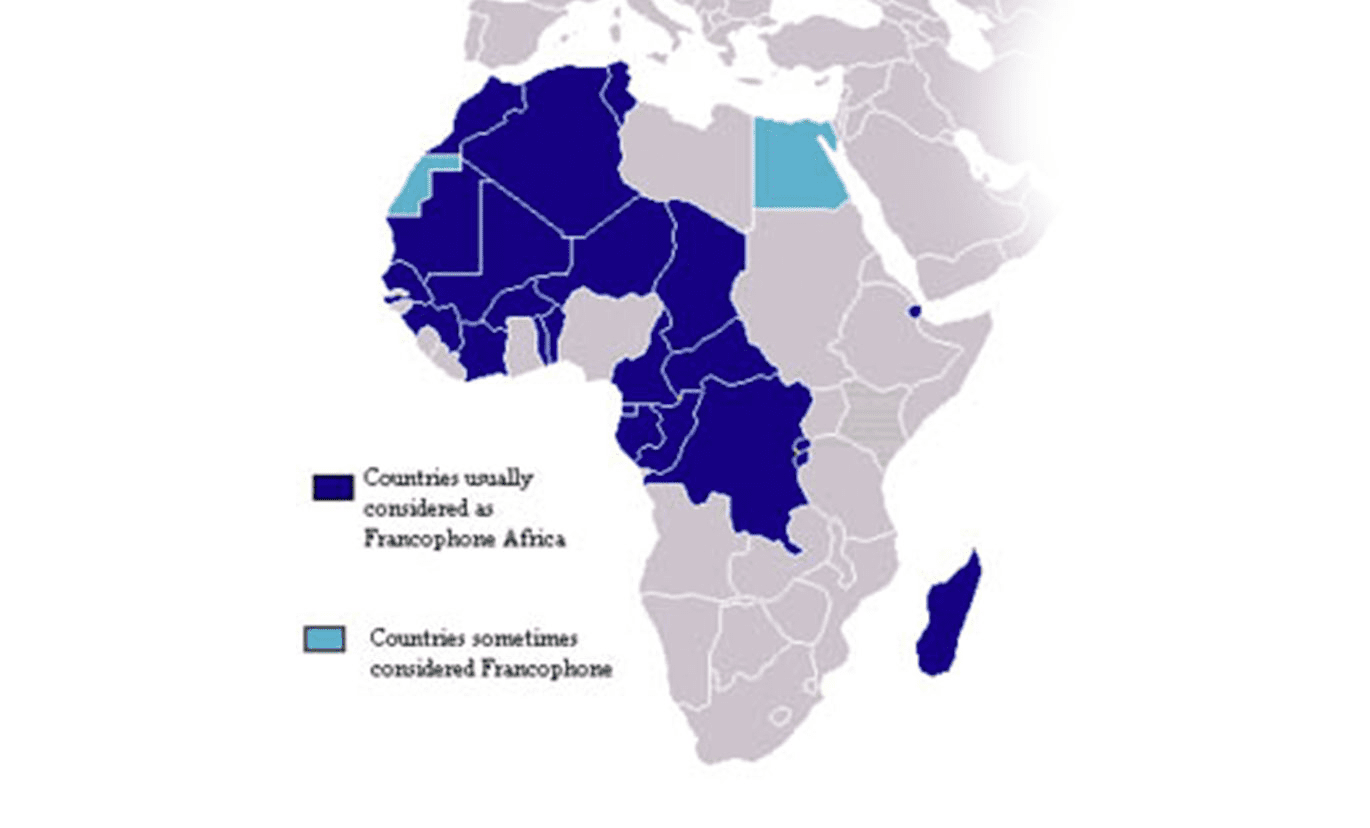

Economic and strategic appeal of Francophone fintech markets

Francophone Africa offers compelling economics. Countries like Senegal (pop. ~18.0 million) and Côte d’Ivoire (pop. ~31.9 million) are young and increasingly connected.

In Senegal, 60.0% of adults use the internet, and there are 21.9 million active mobile subscriptions – 122% of the population. Côte d’Ivoire’s internet penetration stood at 38.4% in early 2024, with a mobile connection rate of 149%.

Young demographics dominate: for example, about 75% of Senegalese are under age 34. These figures point to a tech-ready market: in Senegal, 73% of adults made digital payments and 87% own a mobile phone, while Nigeria’s overall account ownership is 63%.

In fact, Senegal is now one of the most “banked” countries in Africa (76.5% of adults have an account, surpassing Nigeria. The Common Central African and West African CFA francs – pegged 1:655.96 to the euro – also lend confidence. This fixed peg (backed by France) keeps inflation low (~3%), in stark contrast to Nigeria’s devaluing naira (over ₦1,400 NGN/USD by 2024.

Analysts note that the CFA zone’s currency stability “is rare in many African economies”, attracting trade and investment at Nigeria’s expense.

Regulators have been gradually opening doors. In 2015, the BCEAO (WAEMU central bank) allowed nonbanks to issue e-money and run agent networks, which helped fuel the Ivory Coast’s fintech boom.

More recently, new licensing rules (effective January 2024) now require payment providers to register in each WAEMU country. By mid-2025, Senegal and Côte d’Ivoire had begun issuing licences.

For example, five fintech entities (including Flutterwave Senegal) were approved in Senegal and three in Côte d’Ivoire. However, each country still enforces its own approvals.

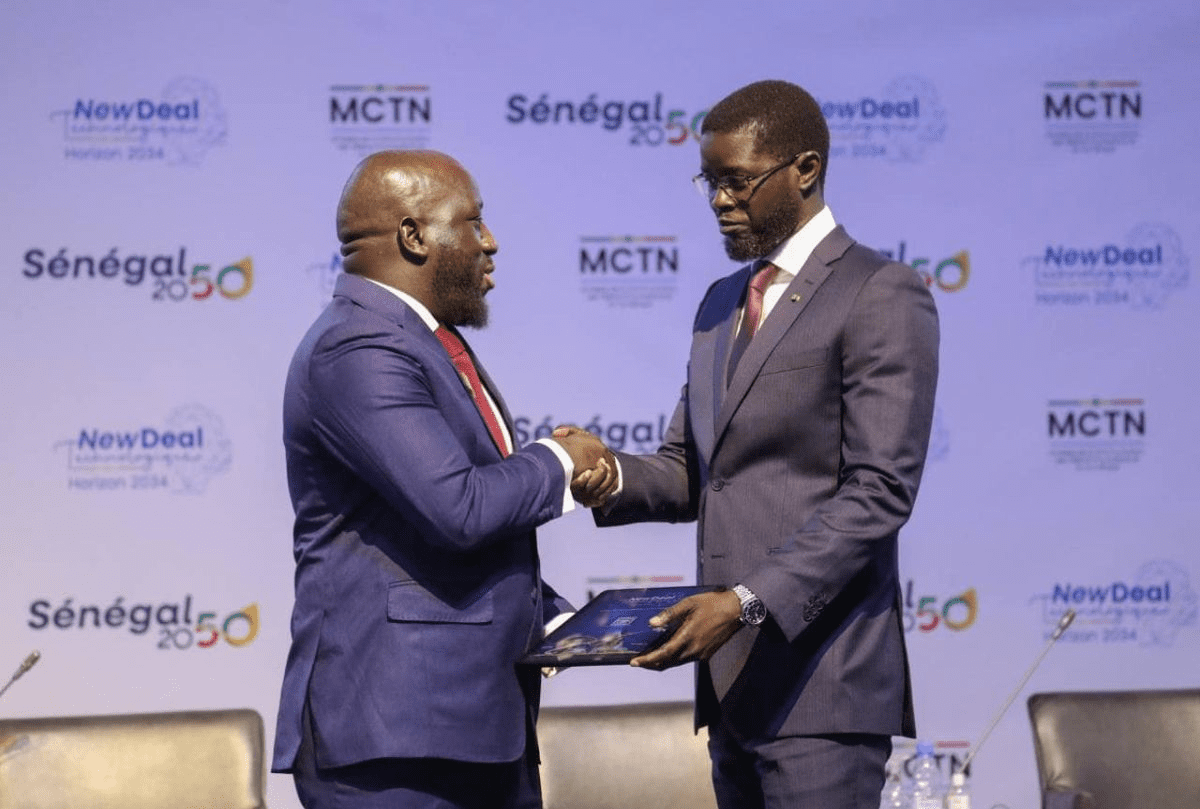

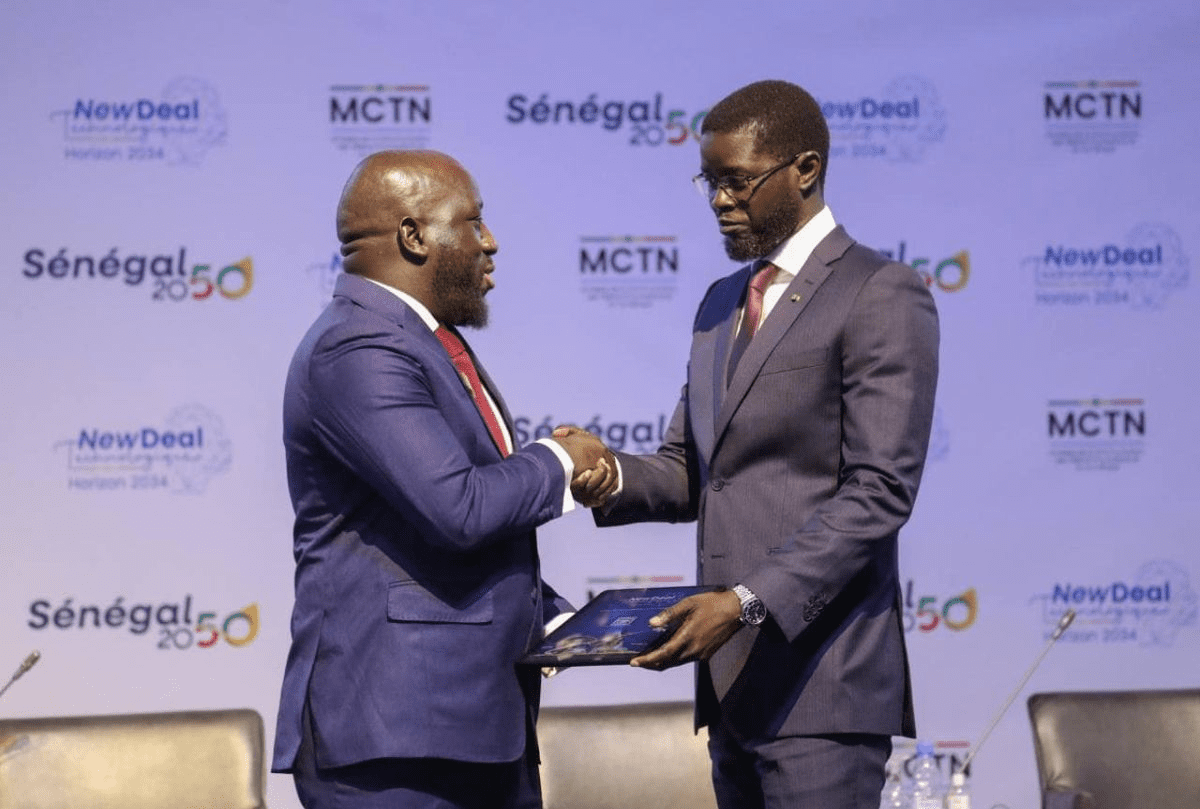

On the positive side, national regulators are promoting fintech. Senegal’s “New Deal Technologique” has invested in tech hubs and digital services, while Abidjan is building itself into a regional digital hub.

Industry veterans also point to growing trust in the region: Eloho Omame of TLcom Capital says Francophone Africa is “an opportunity to provide a platform” that can help the “entire region… grow more quickly”.

At the same time, challenges remain. Markets are fragmented by language, legal systems and two currency zones. “Although you have two central banks,” notes Verto CEO Ola Oyetayo, “WAEMU and CEMAC…each country tends to interpret [policy] differently,” complicating pan-African strategy.

Internet shutdowns (e.g. during political unrest in Senegal) are a risk: “it’s hard to innovate in markets [where] at the drop of a hat [they] will just shut down the internet,” warns Blaaiz CEO Ifelade Ayodele.

Local competition is fierce. Established telco-backed wallets like MTN and Orange Money dominate much of Francophone Africa.

Even so, Nigerian fintech companies feel ready. Their heavy domestic fundraising and large user bases give them scale. Flutterwave, for instance, processes hundreds of millions of transactions (totalling ~$30 billion in 2024) across 30+ African countries.

The sector’s accumulated know-how is a selling point. Omame of TLcom notes that Nigerian startups have “learned a lot from their home market” and can export solutions.

Expanding footprints: Nigerian fintech examples

Flutterwave has been at the forefront. In July 2025, it announced it had won a payments licence from the West African central bank (BCEAO) to operate in Senegal. Flutterwave executives explain this step as part of bringing its Lagos-based platform to more of Africa.

In its official release, Agboola said Senegal could soon “be at the forefront” of the digital economy. Flutterwave’s SVP Bode Aregbesola added that the company will deploy “secure technology and an extensive suite of products” to help Senegalese businesses scale.

The company’s own reporting confirms it also launched a Cameroonian affiliate via a CEMAC licence last year, and in mid-2025 announced a Lagos office and Abidjan subsidiary to support Francophone operations. In Flutterwave’s words, it now serves over 60% of African countries, powering payments for Uber, Netflix and local firms alike.

Other Nigerian-born startups are joining the fray. Stripe’s Paystack has quietly rolled out services across West Africa. Its platform now supports merchants in Ghana, Kenya and Côte d’Ivoire.

PalmPay, a mobile wallet with Chinese backing but Nigerian roots, has publicly declared plans to expand into Côte d’Ivoire (alongside South Africa and others) in the coming months. Smaller players see niches, too.

Lemonade Finance, a Lagos startup focused on diaspora remittances, in 2022 announced it was integrating transfers into Senegal, Ivory Coast, Benin, Cameroon, Rwanda, and Uganda.

As Lemonade’s product head Afeez Gbotosho explained, adding “Senegal, Ivory Coast, Benin, [Cameroon]…” was “data-driven” because many nationals in Europe and North America need low-cost ways to send money home.

TeamApt (behind Nigeria’s Moniepoint) has likewise signalled interest. CEO Tosin Eniolorunda told reporters a few years ago that Francophone neighbours like Ivory Coast, Cameroon and Senegal were on his radar. And Moniepoint itself is already eyeing Kenya and other Anglophone markets, with plans for remittances and lending products beyond Nigeria.

These expansions reflect strategic choices. For many Nigerian fintech entities, local payment rails (like the NQR code system) and e-banking are now well-developed, but rural and informal segments remain underserved.

By contrast, Francophone countries often have younger user bases with fewer entrenched incumbents, plus the appeal of a stable currency regime.

In some cases, Nigerian firms can leverage cultural ties. For example, eastern Nigeria and Cameroon share ethnic Fula communities. And Nigeria’s fintech entrepreneurs highlight low-hanging fruit: remittances (many Nigeriens, Malians and others work in Nigeria), trade payments, and cross-border wallets that can seamlessly handle CFA currency, especially as AfCFTA lowers trade frictions.

Indeed, Nigeria’s Central Bank itself is promoting intra-African e-payments and even working on a naira/CFA stablecoin (BIXAF) to ease these transfers.

Still, expansion is no guarantee of success. Executives emphasise caution along with optimism. Aregbesola of Flutterwave said the company will “provide secure technology” to address local challenges in Senegal.

Lagos-based operators must hire French-speaking staff and tailor products (e.g. local payment methods, SMS codes). Regulatory risk is real as every new market demands fresh licences (as the BCEAO rollout shows) and compliance with EU-backed anti-money-laundering rules.

Competition is intensifying: while European banks have retrenched from Africa, Chinese players (Alipay’s Ant Group backing Wave, for example) and homegrown fintech entities like Senegal’s Wave and the Ivory Coast’s InTouch are hungry challengers.

Nonetheless, the broad consensus among founders and investors is that the rewards justify the hurdles. Nigeria’s fintech ecosystem is robust, but fundamentally built on a bedrock of youth and mobile penetration that extends to Francophone neighbours.

With combined populations of 70–100 million across West and Central Africa, these markets offer significant untapped volumes. And as Vice President Shettima reminded a digital-trade forum, Nigeria now has “over 109 million internet users and a thriving mobile economy”, providing the expertise to solve frontier-market problems.

In practice, Nigerian fintech companies are starting to follow the money, from Lagos up through Abidjan to Dakar and Yaoundém, helping stitch together a more integrated African financial market. If all goes well, their story will be one of regional ambition overcoming linguistic and regulatory divides: in Omame’s words, “a new financial future for the entire continent.”