Eighteen years after shutting down its production plant in Port Harcourt, the oil-rich capital of Nigeria’s Rivers State, French tyre manufacturing giant Michelin is making a strategic comeback to a market it once dominated. While the company has not announced plans to reopen a factory, it wants to rebuild its brand visibility, strengthen local presence, and position Nigeria as a key growth hub in Sub-Saharan Africa.

Michelin’s shutdown of production in 2007 marked the end of an era in Nigeria’s tyre manufacturing history. Alongside Dunlop, the company once accounted for most of the country’s domestic tyre production. However, unfavourable business conditions, inconsistent government policies, and the influx of cheaper Asian imports forced both firms to close their local operations. By 2008, 90% of tyres sold in Nigeria were imported, up from just 25% in 2005, a shift that reshaped the industry entirely.

Today, Nigeria’s tyre market is worth an estimated $820 million, projected to hit $1.12 billion by 2030 at a 6.4% compound annual growth rate. Yet, despite growing demand, driven by the country’s 40 million-strong vehicle fleet and expanding road networks, the market remains dominated by low-cost brands. About 80% of Nigerian consumers buy budget tyres, mostly from Asia.

For Michelin, this represents both a challenge and an opportunity.

“It’s true that after the shutdown, many Nigerians thought Michelin had left the country,” said Amaury Vadon, Managing Director and Vice President of Sales for Michelin Sub-Saharan Africa, in an interview with TechCabal. “But Michelin never truly left. We may have stopped manufacturing, but we remained commercially active and are now more present than ever before.”

Rebuilding from the ground up

Michelin has restructured its operations in Nigeria, transitioning from an export model to a fully owned local agency. The company now maintains an office on Victoria Island, Lagos, staffed by Michelin employees who oversee direct sales, marketing, and customer engagement.

“We are not importers or distributors,” Vadon said. “We have Michelin employees in Nigeria. That’s a key difference. We believe in having people who can explain our value, our innovation, and why Michelin products matter.”

The company’s renewed focus is on two major growth segments: passenger car tyres and beyond-road activities such as agriculture, construction, and port operations. The size of the passenger car tyre market in Nigeria for 2025 is estimated at over $0.82 billion for producer and importer revenues, with passenger car tyres being the dominant segment in the nation’s overall tyre market.

Popular passenger car tyres in Nigeria, such as 195/65R15 and 205/70R15, measure about 195–205 millimetres in width and fit 15-inch wheels. Their proportions and related variants are valued for their strength and reliability on rough local roads.

Nigeria’s evolving automotive landscape, with a growing preference for larger, high-end vehicles, drives demand for premium tyres in the 18-inch-and-above category. Meanwhile, the government’s ongoing road construction and infrastructure projects have created new opportunities in heavy-duty and off-road segments.

“We see strong potential not only in Lagos but also in Abuja and Port Harcourt,” Vadon explained. “We’re already setting up partnerships and local stock in Abuja to reduce delivery times and better serve customers.”

Competing in a market flooded with low-cost tyres

One of Michelin’s biggest challenges in Nigeria is the dominance of cheaper and used tyres, known locally as tokunbo. Despite safety concerns, price remains the biggest driver of consumer choice.

Even though used tyres have been banned since 2007 due to their higher risk of blowouts and road accidents, they still account for a large share of Nigeria’s informal tyre market. By 2023, an estimated 40 million used tyres were in circulation, largely sustained by low-income motorists seeking affordability over safety. Enforcement of the ban remains inconsistent, and because used tyres are excluded from official trade data, their true market share is difficult to measure. Government crackdowns have curbed visibility in the formal market, but demand persists informally, where price continues to outweigh regulation.

“Let’s be honest, tyres are not something people buy with pleasure,” said Vadon.“For many drivers, they’re a burden. You see a round, black object and assume they’re all the same. What people notice is the price, not the performance or innovation behind it.”

To counter this, Michelin is prioritising awareness and education. Through marketing and consumer engagement campaigns planned for 2026, the company aims to show Nigerian drivers the long-term value of quality tyres, from shorter braking distances to greater durability and fuel efficiency.

“We can’t expect everyone to buy Michelin,” Vadon said. “But we can make sure that when Nigerians make a choice, they do so fully informed. If you know the difference in performance and safety, some will choose premium, and that’s a win.”

Innovation at the core

For Michelin, innovation is a core strength and its most significant investment. The company operates three global Research and Development (R&D) centres: in France, the U.S., and Japan, employing more than 15,000 engineers and chemists dedicated to advancing tyre technology.

In 2014, it invested €650 million ($864 million) in R&D through a network of 6,600 specialists across 25 facilities worldwide. By 2023, that figure had nearly doubled to €1.2 billion ($1.4 billion), reflecting Michelin’s deepening focus on next-generation technologies, from electric vehicle tyres and sustainable materials to digital mobility solutions. The company consistently allocates around 3% of its annual revenue to R&D, outpacing the industry average of 2–2.5%.

At its flagship research campus in Ladoux, France, more than 2,500 researchers work on product innovation and performance testing. In 2023 alone, Michelin filed 269 new patents, bringing its total active patents to over 11,000 worldwide.

“Innovation is the DNA of Michelin,” Vadon said.. “It’s what has kept us number one globally. Whether it’s a passenger car tyre designed for braking safety or a construction tyre built for durability, every product carries innovation tailored to its purpose.”

However, these innovations come at a price, a reality Michelin must navigate carefully in a price-sensitive market like Nigeria. The company wants to bridge that gap by aligning product value with awareness and long-term cost benefits.

Nigeria’s role in Michelin’s African vision

Nigeria now sits at the centre of Michelin’s Sub-Saharan Africa strategy, which is structured around three pillars: people, profit, and planet.

“Nigeria is one of our key countries in West Africa,” Vadon noted. “It’s a contributor to our business, a source of incredible talent, and a market where sustainability efforts are taking shape.”

On the “planet” front, Michelin is launching sustainability partnerships in Nigeria focused on tyre recycling and circular economy initiatives. Vadon revealed that the company will begin recycling tests in October 2025, converting old tyres into new products such as bags and industrial materials, part of Michelin’s long-term plan to reduce waste and promote responsible manufacturing.

Michelin’s 2026 roadmap

As Michelin prepares for a broader rollout in 2026, its immediate goal is to consolidate its foundation and scale up growth. The company plans to deepen its presence in key cities, expand its customer base, and build brand engagement through awareness and visibility campaigns.

“2026 will be the year when Nigerians truly see Michelin again,” Vadon said. “The groundwork is done. Now it’s about visibility and engagement.”

Longer term, Michelin hopes to remain an integral part of Nigeria’s mobility future, not just as a tyre brand but as a symbol of sustainable innovation.

“Success for us by 2050 means being present, profitable, sustainable, and developing Nigerian talent that leads Michelin in the future,” Vadon said. “If one day my successor is a Nigerian, that will be a proud moment.”

As Nigeria’s roads grow busier and its economy diversifies, the French manufacturer is betting that innovation, presence, and local commitment will put it back in the driver’s seat.

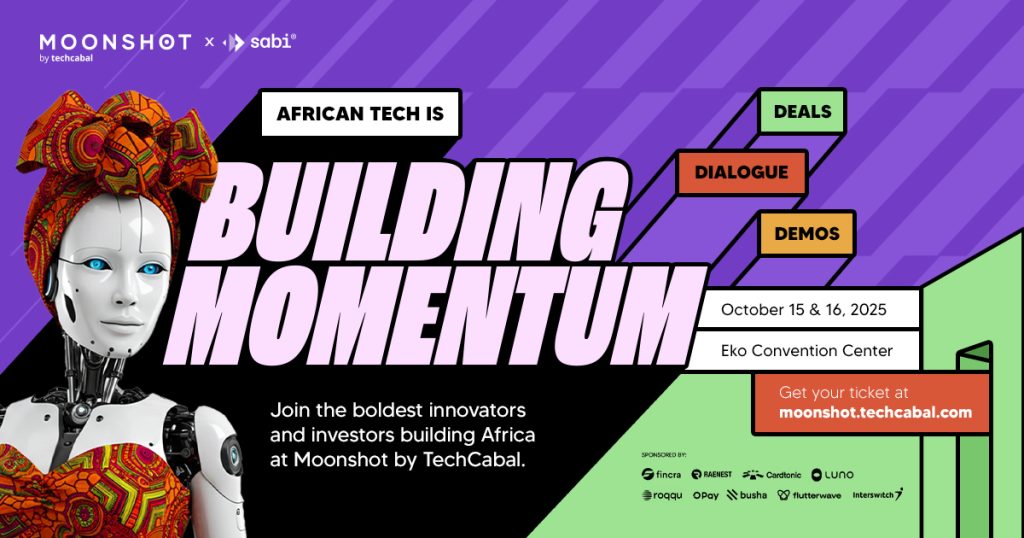

Mark your calendars! Moonshot by TechCabal is back in Lagos on October 15–16! Meet and learn from Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Get your tickets now: moonshot.techcabal.com