Hello,

Here’s what I have for you today:

- The $19 billion crypto blood bath

- Nigerian creator lands on Cartoon Network after quitting his 9-5

- Absa to compete with Capitec Connect in the MVNO space

How the crypto market lost $19 billion

The crypto market went into free fall over the weekend, losing billions of dollars in just a few hours.

How? It started after the US President Donald Trump announced a 100% tariff on Chinese tech imports, a move that spooked investors already nervous about global markets.

The fear spread quickly, triggering a wave of sell-offs that wiped out more than $19 billion in leveraged trades, becoming one of the biggest liquidation events in crypto’s history.

Where did the money go? In plain terms, many traders had borrowed money to bet on rising prices. When the market turned, those positions were automatically closed to cover losses, causing prices to fall even further. Within a day, Bitcoin tumbled from over $125,000 to around $113,000, while Ethereum and other coins dropped by double digits.

Some traders complained that exchanges like Binance froze or delayed transactions during the chaos, adding to the frustration. Binance CEO Changpeng Zhao, also known as Richard Teng, apologised about the glitch in an X post and said users who lost money as a result will be compensated.

Some good news: The market is beginning to stabilise, but confidence has clearly been shaken. While this is a reminder that crypto is a very volatile asset, it should be noted that the stock market also saw a bloodbath.

The takeaway from this is that when Trump is in charge, anything can happen. If you lost some money to crypto, our hearts are with you.

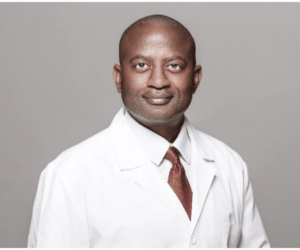

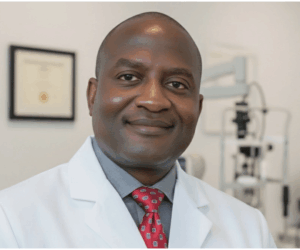

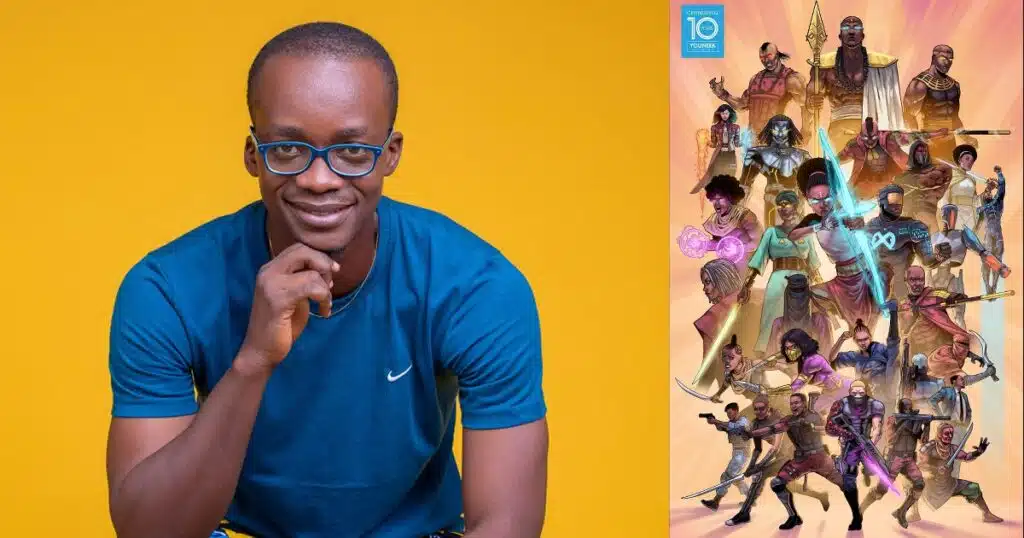

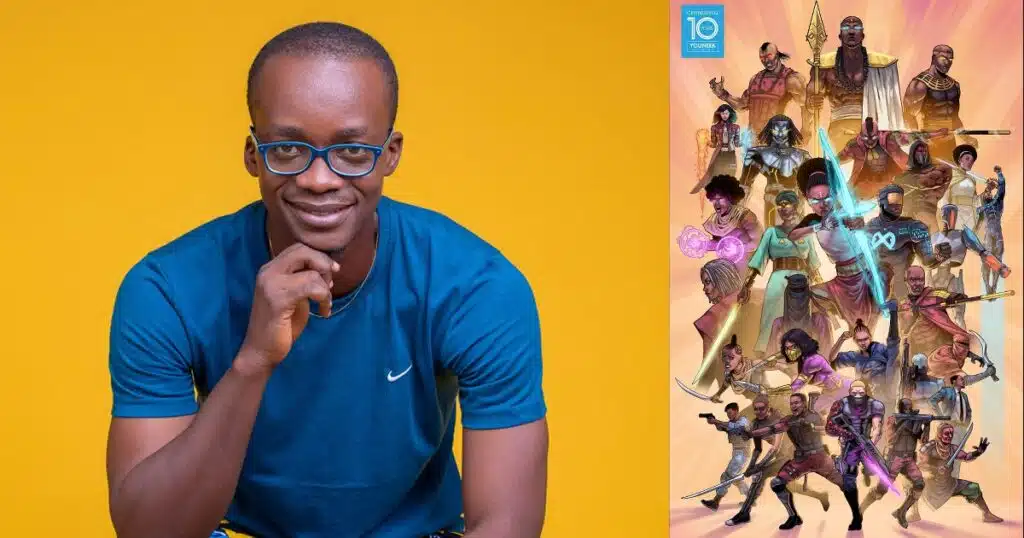

The Nigerian creator whose digital novels are now on Cartoon Network

Sunkanmi Akinboye is not your average artist. While most would hop on portraits and visualise landscape paintings and sketches, he imagined explosions and flying aliens. Back in boarding school, he sold his Mortal Kombat sketches to his friends in return for milk, and boy, did they love it.

So he decided to try out graphic design at the University of Benin after studying at Yaba College of Technology. And while many of us cracked our brains for projects, he presented one of his comics.

After graduating, reality hit, and Akinboye started working as a corporate communications officer at an accounting firm. Fast forward to 2014 when he heard Roye Okupe, CEO of YouNeek Studios, was starting out and he decided to jump wagon. He quit his job and dove into his passion for digital novel creation.

Now he has over 10 graphic novels, and his projects, which include an African-themed animated series called Iyanu: Child of Wonder, are featured on Cartoon Network and Home Box Office. After that came the ten-book deal with Dark Horse Studios, one of the largest publishers in America, and Lion Forge Animations. Now, he earns over $8000 for a 100-page digital novel.

How did he go from drawing Mortal Kombat for milk to featuring his projects on global cable networks? Follow Sunkanmi Akinboye’s story in Delight’s latest edition of After Hours.

Absa to compete in the MVNO space with Capitec Connect

Absa Bank is reportedly moving beyond the financial space. According to MyBroadband, the bank has shortlisted two companies (including Cell C) to provide wholesale services for its planned Mobile Virtual Network Operator (MVNO).

This positions Absa to compete directly with MVNO players like Capitec Connect and FNB Connect, two of South Africa’s emerging banking-telecom hybrids.

In his interview with Business Times, Cell C CEO Jorge Mendes revealed that Cell C is one of the shortlisted entities to serve as a Mobile Virtual Network Enabler (MVNE) for Absa, meaning Cell C would likely supply the network infrastructure layer for Absa’s MVNO.

Cell C has deepened its wholesale business strategy with its MVNO/wholesale business as a core revenue stream, generating about 10% of Cell C’s current revenue.

If Absa goes ahead, this adds to the bank + telecom convergence trend in South Africa’s market. However, this move depends on which MVNE is chosen and how their terms, regulatory approval, pricing and the transition risks.

In case you missed them

What I’m watching and reading

Opportunities

- Bolt is looking for a Senior General Manager in Nigeria and Ghana. Apply here.

- Standard Bank Group is looking for a Virtual Banker, Africa China Banking. Apply here.

- Fraud Analyst at Kuda Technologies. Apply here.

- Follow Techpoint Africa’s WhatsApp channel to stay on top of the latest trends and news in the African tech space here.

Have a productive week!Sunny Delight for Techpoint Africa.