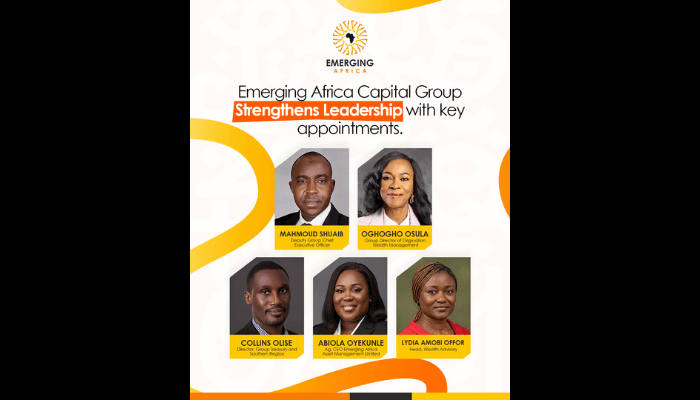

…Emerging Africa Capital appoints 5 additional leaders within the group

These strategic appointments reflect the Group’s commitment to strengthening leadership capacity and deepening impact across key markets.

These appointments span critical functions including executive leadership, wealth management, treasury, regional and asset management, positioning the Group for accelerated growth in 2025 and beyond.

Mahmoud Shuaib has been appointed Deputy Group Chief Executive Officer (Designate). With over 26 years of experience in capital market operations spanning Trustees, Asset Management, Investment Banking, and Securities Trading, Mahmoud joined Emerging Africa Group in 2021 as Group Executive Director. He has been instrumental in driving business growth and strengthening the Group’s presence in Northern Nigeria. In his new role, he will support the Group Chief Executive Officer in business origination across the Group while providing executive oversight for the Northern Region and the microfinance banks.

Oghogho Osula has been appointed as Group Director of Origination, Wealth Management. Bringing over 28 years of experience across Corporate Banking, Trusteeship, and Asset Management, Oghogho will focus on driving new and incremental deal origination in Asset Management, Trusts, and Family Office services, while continuing as a Non-Executive Director at Emerging Africa Trustees Limited. A member of the Chartered Institute of Stockbrokers and the Institute of Directors, she brings strong technical expertise and governance insight to her expanded role.

Collins Olise assumes the position of Director, Group Treasury and Southern Region. Since joining the Group in 2018, Collins has held several key positions including Group Treasury Officer, Fund Manager, Manager for the Southern Region, and Deputy Managing Director at Emerging Africa Asset Management Limited. With over 15 years of experience in Asset Management, Fixed Income Trading, Treasury Operations, and Asset & Liability Management, he will oversee the Group’s treasury strategy, manage liquidity, optimize capital deployment, and drive business development across the Southern region.

Abiola Oyekunle has been named Acting Chief Executive Officer of Emerging Africa Asset Management Limited. With over 20 years of banking experience, Abiola joined Emerging Africa Group in 2024 as Head of Wealth Management and quickly advanced to Chief Operations Officer of Emerging Africa Asset Management Limited. She brings dynamic, results-driven leadership focused on steering the company’s strategy, driving growth, and ensuring innovative asset management solutions aligned with the Group’s broader vision.

Lydia Amobi-Offor has been appointed Head, Wealth Advisory. Since joining Emerging Africa Group in 2020 as a Senior Personal Financial Planner, Lydia has delivered tailored financial solutions and managed diverse client portfolios. In her new role, she leads the team in designing innovative client solutions and deepening relationships that strengthen the Group’s Wealth Management business.

“We remain committed to strengthening leadership team for greater impact. These appointees are tried and trusted hands who have made exceptional contributions and would help to drive further growth to better serve our clients and stakeholders across Nigeria and beyond. The leaders have demonstrated not only technical competence but also a deep commitment to our mission of creating sustainable value”.

– Dr Oluwatoyin Sanni, Executive Vice-Chair of Emerging Africa Capital Group.

About Emerging Africa Group

Founded in January 2018, Emerging Africa Group is an impact-driven organization passionate about innovating and implementing unique capital solutions while upholding the highest sustainability standards.

The Group creates substantial value for stakeholders through strategic direct equity investments in subsidiary companies and by arranging comprehensive debt and equity capital financing solutions for corporate and institutional clients.

The Group’s diversified portfolio spans Investment Banking, Infrastructure Finance, Financial Technology, Microfinance Banking, and Capacity Building. Maintaining sector flexibility, investments strategically align with Sustainable Development Goals 1, 4, 5, 7, 8, and 9, reinforced by the Group’s ISO 26000 Social Responsibility Certification.