Moniepoint Inc. has addressed reports of a £1.2 million loss by its UK arm, Moniepoint GB, explaining that the figure represents initial setup costs tied to its market entry rather than an operational failure.

The fintech firm said the figure captured administrative and infrastructure expenses incurred while establishing its UK base in 2024. A look into the financial filings shows that Moniepoint also made a $2.5 million equity deposit for the acquisition of Bancom Europe Ltd, a UK-licensed electronic money institution under the Financial Conduct Authority (FCA).

Moniepoint GB, incorporated in February 2024, did not generate any revenue for the year. However, the company said this was expected for a new entrant still building its foundation in a tightly regulated market.

“What has been reported as £1.2 million loss actually reflects set-up costs, not operational shortfall,” the company stated.

Moniepoint explained that the so-called UK loss is part of a deliberate early-stage investment phase, one that included heavy spending on technology infrastructure, compliance systems, and staffing to meet the stringent standards of the UK’s financial environment.

According to the company, these investments were necessary to ensure operational readiness and compliance before the full commercial rollout. “Moniepoint GB’s financial results for the period February to December 2024 reflect the expected early-stage investment phase common across financial services firms entering new regulated markets,” the company said.

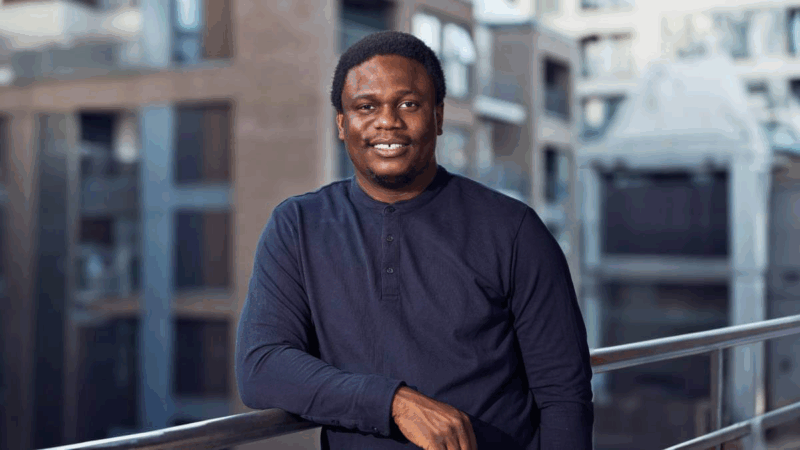

“The company’s focus is on serving the UK’s African diaspora and bringing financial happiness to a new market—an ambition that naturally requires upfront investment in compliance, infrastructure, and people.”

The acquisition of Bancom in July 2025 was a big part of this strategy. By acquiring an already-authorised electronic money institution, Moniepoint GB gained an immediate regulatory foothold, avoiding the lengthy and often complex process of securing its own FCA licence from scratch.

“This acquisition provides Moniepoint GB with an established, regulated entity through which we can operate, accelerating our ability to serve customers in the UK-Nigeria remittance corridor,” the company said.

“By acquiring an already-authorised firm, we secure a solid regulatory foundation, which is paramount for providing reliable and compliant financial services.”

Following the acquisition, Moniepoint launched MonieWorld in April 2025, its first UK-facing product that enables residents to send money directly to Nigerian bank accounts using British bank cards, Apple Pay, or Google Pay. The product reportedly recorded a 70% increase in transaction volume within months of launch, revealing early traction among the diaspora.

Moniepoint has since embarked on an aggressive marketing drive across UK trains and diaspora events to deepen brand visibility. The company said additional products are in the pipeline as it strengthens its presence among Africans living in the UK.

The UK currently hosts over 290,000 Nigerians, making it one of the busiest remittance corridors to Nigeria. In 2021 alone, Nigeria received £2.76 billion ($3.69 billion) in remittances from the UK, a figure that shows the scale of opportunity Moniepoint seeks to capture.

Backed by a $110 million investment secured in late 2024 from investors including Google and Visa, Moniepoint’s valuation rose to $1 billion. The funding, according to analysts, gives its UK expansion the financial muscle and runway needed to compete in one of the world’s most regulated fintech markets.