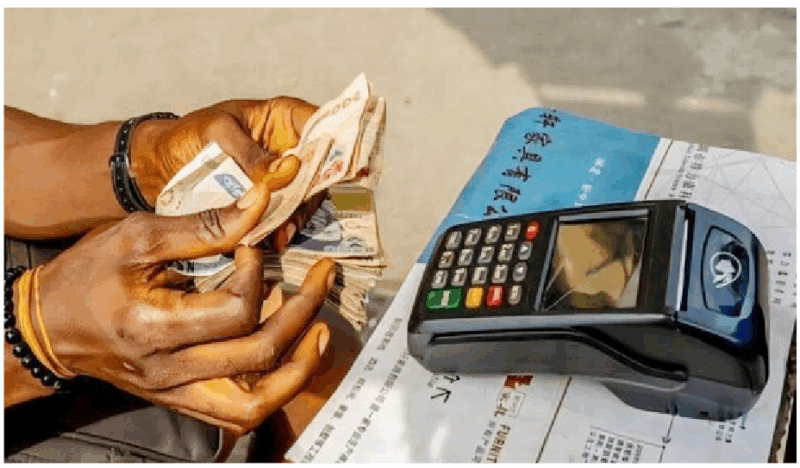

The House of Representatives has taken a step toward regulating cryptocurrency and Point-of-Sale (POS) operations in Nigeria, as Speaker Abbas Tajudeen on Monday inaugurated an ad hoc committee to review the economic, regulatory, and security implications of digital financial transactions.

Speaking during the inauguration in Abuja, the Speaker said the move became necessary amid growing concerns over fraud, cybercrime, terrorism financing, and consumer exploitation associated with cryptocurrency and POS activities. Abbas noted that Nigeria’s economy had shown remarkable resilience over the years, recovering from recessions and recording growth in non-oil sectors—conditions that could enable cryptocurrency trade to thrive. However, he warned that the vulnerabilities in the system could not be ignored.

“There are real concerns about the susceptibility of cryptocurrency to terrorism financing and money laundering, considering its opaque nature, dubious regulatory framework, and lack of accountability,” he said.

SPONSOR AD

According to him, the absence of clear rules, coupled with the volatility and complexity of the technology, makes it imperative for the National Assembly to establish appropriate regulations and consumer protection mechanisms.

“It is because of this absence of clear rules, coupled with the volatility and complexity of the technology, that the House found it imperative to establish regulations and consumer protection measures that will guide the activities of Virtual Assets Service Providers, including cryptocurrencies and crypto assets,” he said.

Abbas said the ad hoc committee would hold public hearings to gather input from relevant stakeholders to help the House develop legislation for a comprehensive regulatory framework on cryptocurrency and digital financial services.

He reaffirmed the commitment of the 10th House to safeguarding the country and its citizens from practices that could undermine President Bola Tinubu’s ongoing economic reforms.

In his remarks, the Chairman of the Committee, Rep. Olufemi Bamisile (APC–Ekiti), acknowledged that while cryptocurrency and POS systems had enhanced commerce, financial inclusion, and innovation, they also posed significant risks such as cybercrime, fraud, money laundering, and terrorism financing.

Bamisile said the committee’s work would focus on crafting a legislative and regulatory framework that encourages innovation while safeguarding citizens and the financial system’s integrity.

He disclosed that the committee would collaborate closely with key agencies including the Central Bank of Nigeria (CBN), Securities and Exchange Commission (SEC), Nigeria Deposit Insurance Corporation (NDIC), Nigerian Financial Intelligence Unit (NFIU), Economic and Financial Crimes Commission (EFCC), Independent Corrupt Practices and Other Related Offences Commission (ICPC), and the Nigeria Police Force.

Bamisile added that the committee would adopt a consultative and evidence-based approach by engaging regulators, financial institutions, fintech operators, civil society groups, and the security community through public hearings to ensure inclusive and informed outcomes.”