Africa’s infrastructure challenges and investment opportunities will take centre stage when global leaders, financiers and development experts gather in Johannesburg for a high-level side event ahead of the G20 Summit in November, this year.

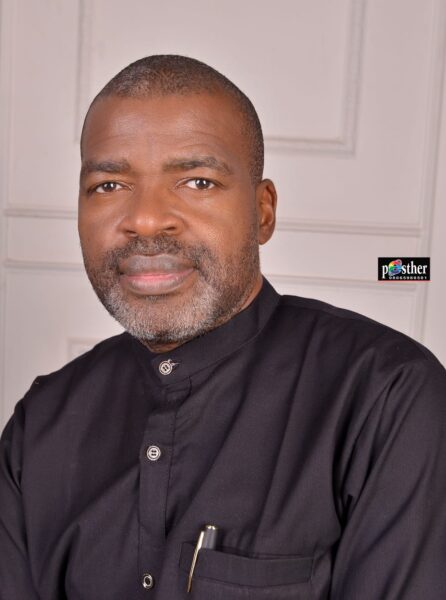

This was contained in a press statement released Thursday by the president/CEO, Africa Think Tank for Infrastructure Development (ATTID), Dr. Alfred Chiakor.

According to the statement, the event will host the Infrastructure and Sustainable Development Side Event from November 20–21 at the Capital Empire Hotel in Sandton.

It added that the meeting, themed, “Enhancing Africa’s Infrastructure Transformation Agenda through Investments and Partnership,” would “precede the November 22–23 G20 Summit of Industrialised Nations, South Africa, under the chairmanship of former President of the United Republic of Tanzania, His Excellency, Dr. Jakaya Mrisho Kikwete, with Nigeria’s President Bola Ahmed Tinubu as Special Guest of Honour and Irina Unkovski , international PPP and infrastructure specialist, as the Keynote speaker.”

The organisers said the forum would “bring together world leaders, executives of international development agencies, global banks, private investors and regional economic commissions to chart a roadmap for transforming Africa’s infrastructure backbone. The gathering is expected to set the tone for deeper global partnerships at the G20 and beyond.”

According to the statement, “Africa’s infrastructure deficit remains one of the continent’s biggest barriers to growth.”

It read, “The African Development Bank estimates that the region needs between $130 billion and $170 billion annually to meet its development goals in energy, transportation, water, sanitation, and urban systems. Poor infrastructure, officials note, has already cost African economies up to 40% in productivity losses and sliced two percentage points off annual growth.

“Despite these gaps, the investment picture is shifting. Foreign direct investment (FDI) flows to Africa climbed from $53 billion in 2023 to $97 billion in 2024, or about 6% of global FDI, UN Trade and Development data show. North Africa led the inflows, buoyed by energy and transport projects, while sub-Saharan Africa saw rising intra-regional investment from players such as Dangote Group, MTN, and leading Nigerian banks.”

It added, “ATTID leaders argue that innovative financing and partnerships are crucial. The side event will highlight successful models such as Egypt’s $10 billion Ras El Hekma megaproject with the United Arab Emirates, Ethiopia’s light rail system, and the AfDB-backed Enugu-Bamenda Highway linking Nigeria and Cameroon. Such initiatives, they say, prove Africa can deliver high returns for investors while addressing pressing development needs.

“The side event provides an auspicious window to deepen intra-African and global investment. It is a clarion call to investors to tap into Africa’s infrastructure transformation that promises enduring returns.

“By the close of the two-day summit, ATTID hopes to secure commitments that will accelerate Africa’s integration into global value chains and position infrastructure development as a pillar of sustainable growth.”