As the 9th Ghana International Trade and Finance Conference (GITFIC) prepares to take place in Accra from October 29 to November 2, Africa’s debt reform, trade integration, and youth engagement are driving the agenda.

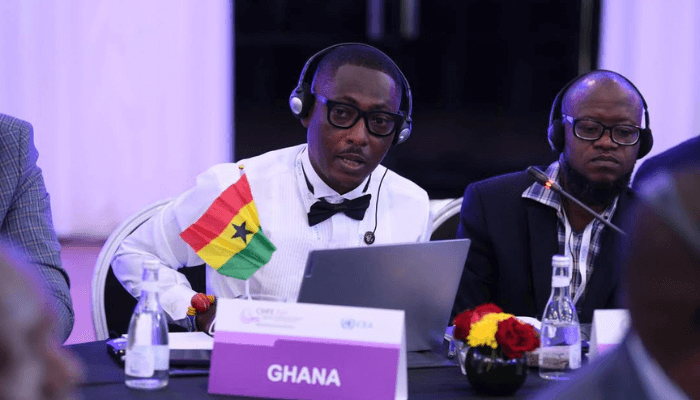

At the centre of this year’s discussions is the Global Debt Initiative, designed to create a sustainable, indigenous financial architecture. Alongside this, the inaugural AfCFTA Tertiary Student Congress. As part of the precursor leading up to the event, BusinessDay’s DAVID OLUJINMI spoke with SELASI KOFI ACKOM, the Chief Executive Officer of the Ghana International Trade and Finance Conference.

“But developing an African solution that gains global acceptance is no easy task. In one 45–50-minute session with Fitch, they made it clear that even the African Union cannot compel their participation. Such conversations, they said, are simply not in their interest.”

Let’s talk about the Global Debt Initiative, which is taking centre stage at GITFiC.

Over the past years, we noticed that solutions designed outside Africa for Africans were not helping the continent’s financial architecture.

This highlighted the need for an integrated, indigenous African financial architecture, cooked by Africans, made for Africans, and implemented by Africans. This vision gave birth to the Global Debt Initiative last year, bringing together specially invited stakeholders for its inaugural edition.

The process began with initial foresights, which we then presented to our stakeholders, organised in tiers. Our tier-four global stakeholders included the African Development Bank, engaged through a published position paper, the United Nations via the office of the Secretary-General, the ECOWAS Bank for Investment and Development, and other tier-one and tier-two partners. These discussions were fruitful, with the African Development Bank contributing significantly under the guidance of the then-president’s appointed vice president.

The Secretary-General also contributed, delegating UNECA’s West African Director to act on his behalf. Numerous other stakeholders provided input as well.

Today, this collaborative effort has resulted in a holistic position paper that laid the foundation for the entire Global Debt Initiative conversation.

One challenge Africa faces is the credit rating issue. Are we bringing both borrowers and lenders into the conversation? Are they part of what is happening here?

When we began this conversation last year, we reached out to major global credit rating agencies, S&P, Moody’s, and Fitch, inviting them multiple times to join the discussion.

But developing an African solution that gains global acceptance is no easy task. In one 45–50-minute session with Fitch, they made it clear that even the African Union cannot compel their participation. Such conversations, they said, are simply not in their interest.

Still, the African Union, through its F4 structure, plans to establish an African Credit Rating Agency, integrated with the African Stock Exchange and the African Central Bank. At the AU conference in Accra last year, Nigeria even presented the proposed headquarters for the Central Bank, signalling strong continental progress.

While we may eventually not need global agencies, we still rely on them now; they determine international borrowing limits and convey our economic performance to the world. Even when unfavourable, their assessments set the global narrative.

At GITFIC, we counter this by publishing monthly debt situation reports with robust statistics for all 54 African member states, challenging the conventional international narratives.

Let’s talk about the AfCFTA Tertiary Student Congress, which is a major highlight of what is going on during GITFIC.

If you have followed GITFIC closely, you would know that we have been part of the AfCFTA conversation since 2018 in Kigali. The very nomenclature of AfCFTA inspired the third edition of our conference at the African Union headquarters in Addis Ababa in 2019.

At that event, we pledged that we would never relent in our activities around the AfCFTA until it became impactful, until it reached the peak of its goals. We committed ourselves not to let go. Since then, we have carried out several sensitisation initiatives across Ghana and in other African countries, organising multiple international conferences. At these gatherings, we brought in experts, chief trade negotiators, and central as well as regional banks. For instance, when the Pan-African Payment and Settlement System (PAPSS) was launched, we brought stakeholders to Accra to discuss its implications. We have worked with every major actor you could think of in the ecosystem to ensure that education and sensitisation organising around the African Continental Free Trade Area became part and parcel of daily economic discourse.

We also introduced the tertiary student clubs, which currently exist in universities across Ghana and Togo, and we are gradually expanding to other member states. The aim is to enhance youth involvement in AfCFTA through the educational sector.

That’s not all. Earlier this year, in March, at the World Bank office in Accra, we launched a curriculum on the AfCFTA. Stakeholders gathered to discuss and review the curriculum, which was designed to be adopted by universities across the African continent. At present, three universities are already teaching this curriculum, and more institutions are applying to adopt it. We are rolling out this adoption in phases.

The need to extend sensitisation further among the youth is what inspired the creation of the AfCFTA Tertiary Student Congress. This congress will provide a centralised platform every year for universities to send student representatives. These students will engage in deep discussions on policies and policy-related issues within Africa’s education sector, particularly how they intersect with the sustainability of the AfCFTA. Each congress will also serve as an opportunity to elect new executives for the various student clubs annually.

This is what led to the establishment of the inaugural Tertiary Student Congress, which is being integrated into the second Global Debt Initiative conversation this October.

What outcomes are you expecting from the students themselves?

The students will be directly involved in policy matters related to intra-African trade. They will participate in discussions around entrepreneurship and industrialisation, because young people are at the centre of Africa’s future. When they leave school and graduate, the question is: how can they incorporate these principles into their daily lives to strengthen intra-African and inter-African trade?

If you don’t involve students at this formative stage, if you don’t immerse them, and I use that word deliberately, into AfCFTA, you risk losing out on sustainability. You also risk limiting the initiative from reaching its full potential. So, these are the activities we want to instill in the students: policy on intra-African trade, policy on industrialisation, policy on entrepreneurship, policy on education, and policy coherence.

In short, policy is the recurring theme. We want students to own these discussions, benefit from them, and then use them to their advantage after graduation.

Invitations have already gone out through diplomatic channels to universities across the continent and even to African institutions in the diaspora. The students will come to Accra to discuss AfCFTA, explore its opportunities, and define their roles in ensuring its realisation. They must make sure that AfCFTA does not end up as another nine-day wonder or a myth.

Look at the European Union; it took them nearly 30 years to build their union into what it is today. However, in Africa, we believe that we can achieve progress much faster because we have an energetic, educated, and well-equipped youth population. This is why we are gathering students for the first-ever Tertiary Student Congress on the African continent: to instill ownership of AfCFTA in them, promote the expansion of student clubs, and support the adoption of the AfCFTA curriculum in more universities.

How will the outcomes of GITFIC be monitored after the conference?

We have a peer review team that handles follow-up. If you check our website, you’ll see that each year, after our annual meetings, we publish both an action plan and a communiqué. The action plan outlines responsibilities: who is to do what, which stakeholder or partner is expected to carry out which task, and timelines for delivery.

The peer review team monitors these activities closely and ensures implementation. For example, under our “GITFIC Agenda 2031”, which encompasses both the Global Debt Initiative and the AfCFTA Implementation Initiative, there is a dedicated committee serving as the peer review backbone. This committee ensures that every action plan under both initiatives is brought to its logical conclusion with tangible success stories and impact outcomes.

The point is to prevent our resolutions from ending up shelved in offices and libraries. And that approach has been successful year after year, which is why we continue to get concrete results.

How do you envision GITFIC’s role in shaping debt, trade, and finance policy, not just in Ghana, but across Africa, in the next five to ten years?

Well, as I mentioned earlier, we have the “GITFIC Agenda 2031”. It is a six-year development plan that has been formally adopted by the government and integrated into Ghana’s 50-year development plan. The National Development Planning Commission is leading its implementation, with full support to make it succeed.

Within these six years, we expect member states to drastically reduce their debt levels to create fiscal space for economic growth. That is the priority. Second, we aim to establish the most practicable debt sustainability mechanisms through the creation of debt clubs and creditor clubs. You asked earlier whether creditors themselves are engaged. Yes, they are.

For example, in a meeting we had just last week with the United Nations, organised by the Chief of Cabinet of the Secretary-General, we discussed how the UN could help facilitate meetings with creditors, including the Paris Club, multilateral creditors, bilateral creditors, and both private and public lenders. These engagements will continue in the coming weeks and months after the second conference, as we explore practical solutions.

Interestingly, when the Secretary-General himself joined the Global Debt Initiative, his call exceeded our expectations. He said, “Is it possible for us to have another round of 100 per cent debt cancellation?” and he believed our platform could serve as the pathway to that outcome. That is why the UN has aligned itself with the initiative, aiming to spearhead and champion a new wave of debt cancellation.

So, as we expand our engagements with both creditors and debtor nations, initially focused on Africa but now also including the Global South, our objectives are clear: reduce debt drastically, implement strong debt management practices, and ensure nations do not relapse into unsustainable borrowing.