Ewgi, a Nigerian crypto trader known as Ssaasquatch on X, narrowly escaped disaster today when a chilling phone call nearly cost him his crypto stash. The call, from a scammer posing as a Bybit representative, is part of a growing wave of voice phishing attacks fuelled by stolen data from Bybit’s massive $1.5 billion hack earlier this year.

Ewgi’s story, shared in a viral post on X, is a stark warning for crypto users worldwide: trust no one, verify everything.

According to the post, Ewgi’s phone lit up with an unfamiliar number; the caller, a woman with a polished tone, greeted him by his full name and Bybit account ID, claiming a hacker in Slovakia was targeting his wallet for 1 BTC. She even referenced his location in Lagos, tying it to a transaction he’d made hours earlier.

“My heart was racing,” Ewgi later shared on X. “It felt too real.”

But doubt crept in. When pressed for his current balance, the caller fumbled, offering vague excuses about only seeing “inflows and outflows”. Ewgi demanded her name. The line went dead. Realising it was a scam, he rushed to his Bybit app, transferred his funds to a Tangem hardware wallet, and sounded the alarm on X.

His post, warning of compromised Bybit data on the dark web, racked up thousands of views within an hour, sparking a flood of replies from traders with similar stories.

Months later, the aftermath of Bybit’s $1.5bn hack exposes new vulnerability

Ewgi’s ordeal takes us back to February 21, 2025, when Bybit, a Dubai-based crypto exchange with 70 million users, suffered the largest crypto heist in history.

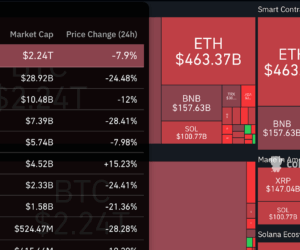

Hackers, linked to North Korea’s Lazarus Group, stole $1.5 billion in assets by exploiting a phishing attack that bypassed multi-signature safeguards. The breach compromised user data, names, KYC documents, and transaction logs, now circulating on dark web forums for pennies.

This stolen data powers sophisticated scams. Scammers use personal details to craft convincing phishing calls, building trust before pushing victims to transfer funds or share credentials.

A recent Calcalistech report highlighted AI-driven vishing rings targeting crypto execs, while a dark web post from August sought phone numbers of Italian Bybit users for fraud schemes.

“They knew just enough to scare me,” Ewgi said, noting the caller’s eerie accuracy about his profile.

A growing threat in crypto’s wild west

Ewgi’s story resonates in Nigeria’s booming crypto scene, where traders use platforms like Bybit for remittances and naira hedging. But the risks are universal. X is buzzing with tales of dodged scams: one Nigerian user reported a similar call days before Ewgi’s, while another swore off centralised exchanges (CEXes) entirely.

A THORChain co-founder lost $1.3 million in September to a DPRK-linked scam call, underscoring the global reach of these attacks.

Bybit has responded with anti-phishing codes, authenticity checkers, and P2P escrow protections, but traders remain wary.

X threads highlight frustrations, slow appeals, reversed payments penalising victims, and scammers exploiting dispute systems. One trader lost $460 to a “fraud flag” after funds were released; another saw $159 vanish in a fake P2P payment scam.

The hardware wallet lifeline

Ewgi’s quick move to a Tangem wallet, a card-like device with NFC tap-to-trade functionality, saved his funds. Hardware wallets like Tangem, Trezor, and Ledger keep private keys offline, shielding users from remote hacks.

“Get yourself a hardware wallet,” Ewgi urged on X, praising Tangem’s portability for traders on the go. His advice echoes expert calls for stronger security. Forbes, in a Bybit hack postmortem, urged users to avoid blind signing and treat unsolicited calls as red flags. The New York Times pinned the breach on a free wallet exploit, exposing gaps even giants overlook.

With Web3 losses hitting $1.6 billion in 2025, per The Hacker News, Ewgi’s story is a wake-up call. His X post, liked and reposted widely, has ignited a push for vigilance.

“In crypto, scepticism is your edge,” he told followers. Bybit’s warnings are clear: no legitimate rep will call unprompted or demand sensitive actions. Yet scammers keep evolving, leveraging stolen data to prey on fear.

For traders like Ewgi, the lesson is simple: verify through official channels, secure funds in cold storage, and stay sharp. As he signed off on X, “Stay safe out there.” In crypto’s high-stakes world, that’s more than advice; it’s survival.