According to Arch.Law, the global legal technology market was valued at $27 billion in 2024 and projected to reach $65 billion in 2034. While the legal system, with its artificial intelligence adoption and footprints, is still an evolving space, it’s expected to solidify its usage and incorporation of tech in the coming years.

The global legal tech is evolving, and doing so on a fine run. The legal system is making a progressive use of digitising laws and court documents, where the goal lies in making it easily accessible to primary (legal experts) and secondary (society) consumers.

For a while now, the legal system has been viewed as a complex shape where the common man has little knowledge of how it operates. Such individuals don’t know basic civic rights that connect their daily lives, or whether such laws exist.

With a vast investment in technology and AI, legal firms and startups are creating a new shape that improves efficiency and provides equal access to justice.

While the global legal tech is experiencing a pivotal shift, Africa’s legal tech seems to be on a slow pace. Compared to the level of tech adoption in the healthcare, agricultural and financial industries, it’s safe to say legal tech is still behind, yet in an evolving stage.

Notably, the remarkable growth of fintech experience might be signalling a likeable green future for the African legal system. Since the post-COVID era, fintechs have not only made significant milestones in Africa but also outpaced it with the likes of Flutterwave, M-Kopa, Lemfi and so on, who have expanded their footprints beyond Africa.

Also, African fintechs have started cementing their place in the global space with the likes of Nigerian fintech giants, Moniepoint and Flutterwave, making the TIME100 Most Influential Companies list for 2025. In addition, Egypt’s MyFawry, PayMob, South Africa’s Yoco and Nigeria’s Piggyvest and Palmpay made the list of the 2025 CNBC and Statista’s World’s Top 250 Fintech Companies list.

Africa’s fintech sector has become a driver of innovation and financial inclusion. Reports show that revenues from fintech services are projected to reach $47 billion by 2028, almost a fivefold increase from the $10 billion in 2023.

But, going forward, will fintech be the only driver of rapid technology adoption and innovation in Africa? The answer lies within the rate at which its legal tech system evolves.

As fintechs are solving real-life issues by making local and cross-border payments more inclusive and seamless, the legal system will be aiming to transform legal services delivery across Africa with tech integration.

Beyond the trend and forecast, the concerns remain when and how. When will African legal tech reach the top stage, and what are the ingredients required for such?

Also Read: Like Google Search, Case Radar is using AI to make law accessible to the common man.

The current state of legal tech in Africa

The legal tech in Africa is agreed to be at an early stage, with a promising future. With platforms like Case Radar, there has been a recent spike in AI adoption for legal research and document reviews.

In addition, the African legal system is witnessing an influx of tech-savvy professionals who are active users of tech and finding ways to streamline their daily workflow. In the post-pandemic period, unemployment and societal structures have seen a new system of virtual law firms offering remote services.

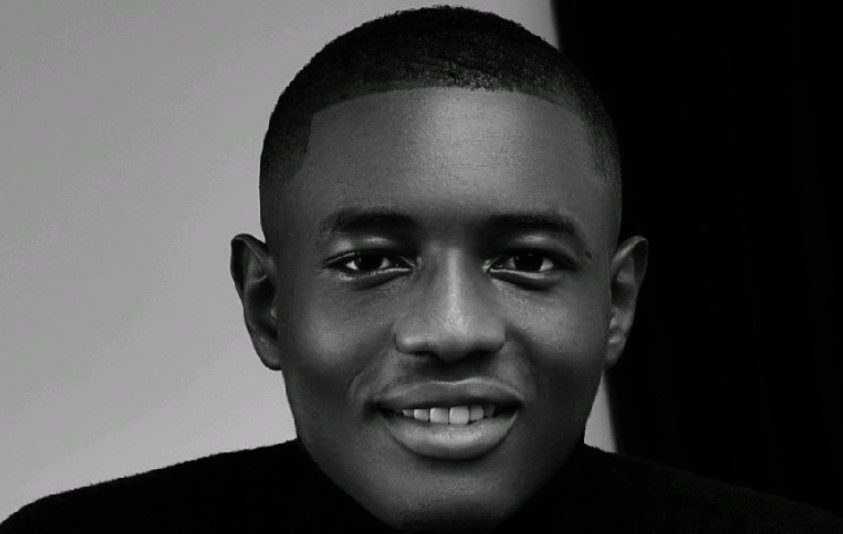

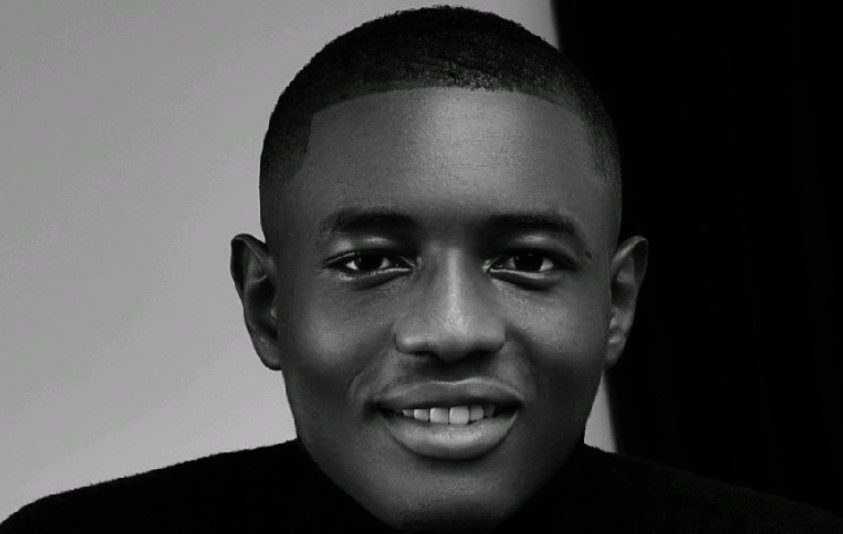

Together with the foregoing claims, Co-founder and CEO of Case Radar, Agbo Obinnaya, also attests that there’s a clear rise in the adoption of tech in Africa’s legal space. However, he highlighted that it’s still an early stage compared to fintechs.

While legal tech is still in its infancy, Agbo noted that the integration of technology might be slow at first due to the traditional structure of the African legal system. He pointed out that the growth will skyrocket once the adoption reaches a full acceptance stage.

“We are seeing law firms, courts, and even regulators beginning to embrace digital tools more. From case management systems to document generation and AI-powered legal assistants. For me, this is both inevitable and exciting, because legal systems are traditionally rigid, and once they start opening up to innovation, the ripple effect is massive,” he said.

As the system awaits its transition to full scale, there are processes that need to be put in place. The Case Radar boss highlighted a working formula where every stakeholder in the industry must collaborate for tech adoption.

According to him, lawyers and legal institutions must see tech as an “enabler” and not a “threat”. They must embrace AI and allow it to simplify their activities and open doors to innovations. Secondly, he pointed to a strategic partnership between key bodies in the industry.

“Stakeholders like regulators, law firms, startups, and even the Nigerian Bar Association need to work together instead of in silos. We spoke about this at the NBA Conference when I spoke on how disruptive AI can be in the legal industry,” Agbo said.

Thirdly, he raised the angle that lawyers and the general public must start seeing ways legal tech can make their lives better. Without trust and knowledge, the adoption and acceptance process might be difficult, according to him.

Also Read: Ngozi Nwabueze is building a ‘Shopify for lawyers’ with PocketLawyers.

What the future holds for legal tech in Africa

It’s still a first step for legal tech in Africa, and the future is promising. Meanwhile, the cloud isn’t clear on whether legal tech can grow at the pace fintech did in Africa.

Considerably, the number of legal tech platforms in Africa is still growing with notable startups such as Pocket Lawyers, Case Radar, Legarly, Judy, Afriwise and so on. Perhaps a stack of investments and fundraising in the industry will attract the needed attention, just like fintechs.

Agbo strongly holds that legal tech in Africa is on the path to dominating the region but requires patience and persistence. As fintech didn’t dominate Africa overnight, he said that it might take almost a decade of consistent innovation, regulation, and user adoption for legal tech to fly.

“I see the industry gaining serious traction within the next five to seven years, especially as AI makes legal services cheaper, faster, and more accessible to millions who were previously excluded from the justice system,” he added.

He didn’t stop there. Agbo was bold in his conviction when he said, “Legal tech could stand shoulder-to-shoulder with fintech as one of Africa’s most transformative industries.”