Africa’s debt era took shape in 2025, when venture funding on the continent passed a milestone. For the first time, debt crossed the $1 billion mark, narrowing the gap with equity and rewriting how capital flows across African startups, according to a comprehensive report by Briter.

This wasn’t a loud, headline-grabbing moment like a billion-dollar unicorn valuation. Instead, it was a quiet revolution, one where investors turned to debt to back Africa’s asset-heavy businesses, from solar energy to payments infrastructure, and in the process began reshaping the very foundations of startup finance.

For years, Africa’s venture story was written in equity. From seed rounds to Series funding, venture capital defined the growth trajectory of startups across fintech, healthtech, mobility, and more.

The high point came during the 2021–2022 funding bubble, when deal volumes peaked and investors placed hundreds of small bets across the continent. But the bubble burst. By 2023 and 2024, both the number of deals and the flow of capital had sharply declined, with early-stage rounds under $250,000 dropping year after year.

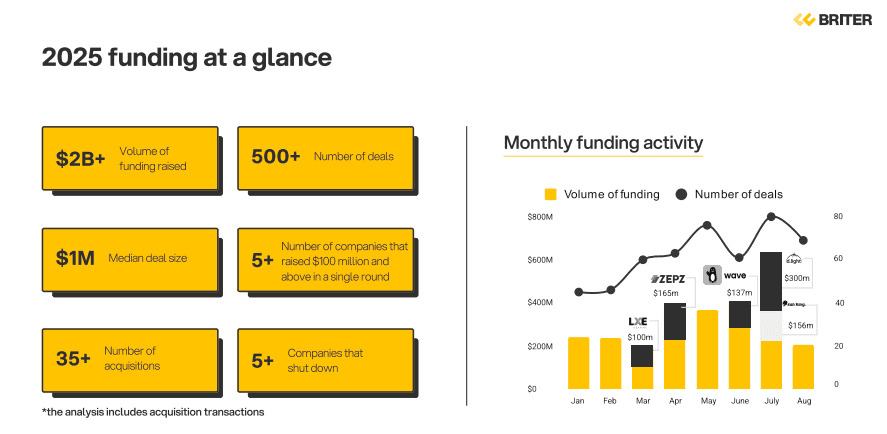

By 2025, the shift was clear. Fewer deals were closing, but they were larger in size, pushing median check sizes back up to 2022 levels.

Disclosed funding by August had already doubled compared to the same period last year, marking a recovery after two consecutive years of decline. Still, the days of scattershot equity bets were gone. Investors, scarred by the bubble, were rethinking how they put money to work, and debt was rising as the instrument of choice.

Africa’s debt era and the end of equity dominance

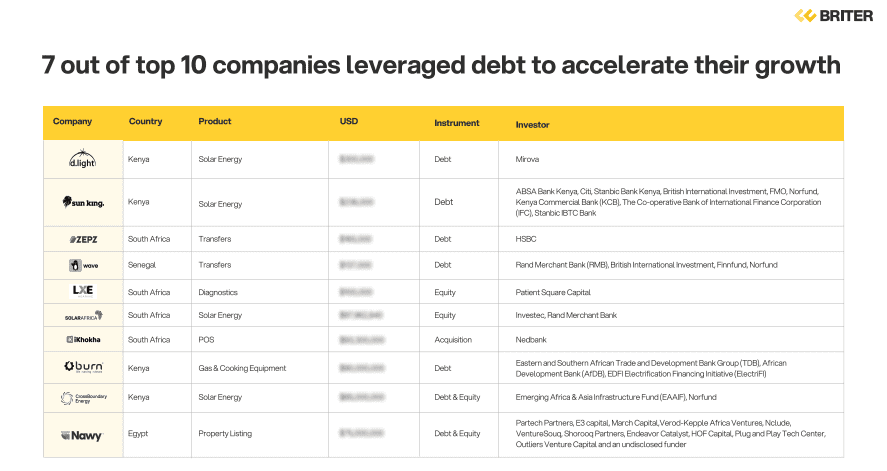

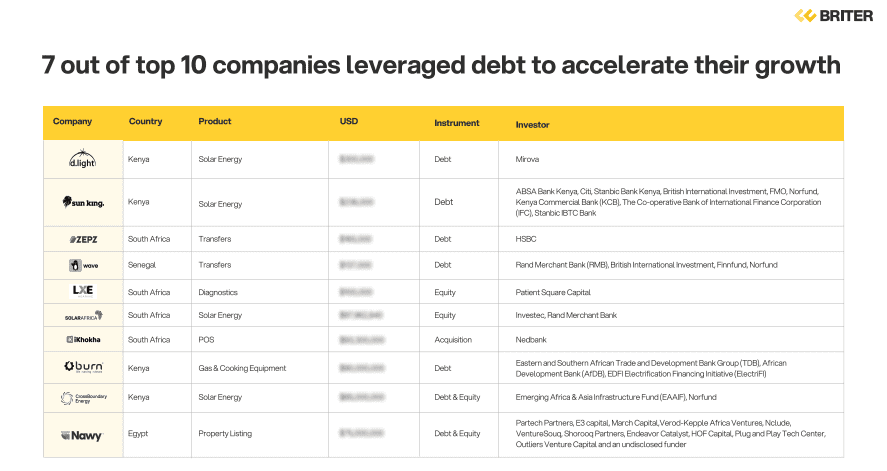

The clearest signal of this pivot came from the very top of the market. Seven of the ten largest companies in 2025 raised debt rather than equity, a reversal of the old playbook.

Cleantech led the way: Kenya’s solar energy firms drew hundreds of millions in loans from banks like ABSA, Citi, Stanbic, and Norfund, while gas and cooking equipment providers tapped development financiers including the AfDB and TDB Group.

Fintech wasn’t left behind. South African payments companies secured major debt deals from the likes of HSBC and Rand Merchant Bank.

The logic was simple. These are asset-heavy businesses, with real infrastructure on the ground and recurring customer revenues.

Solar companies, for instance, can point to thousands of installed systems and predictable repayments. Payments and transfer firms process flows that generate steady transaction fees.

Read also: 33 African startups raised $93 million in August led by Nigeria, Egypt and Kenya

For lenders, these models are less speculative than early-stage startups chasing scale, and more suited to debt instruments that prioritise repayment over explosive growth.

Regional winners in Africa’s debt era

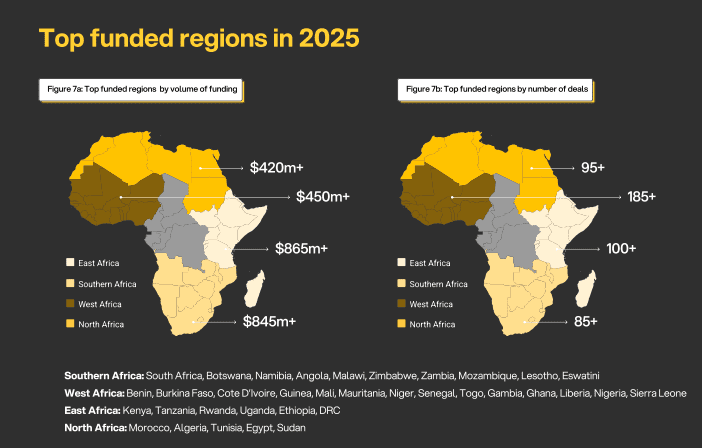

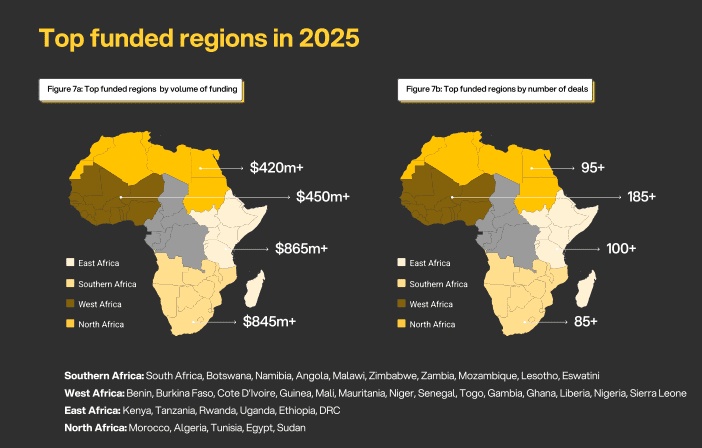

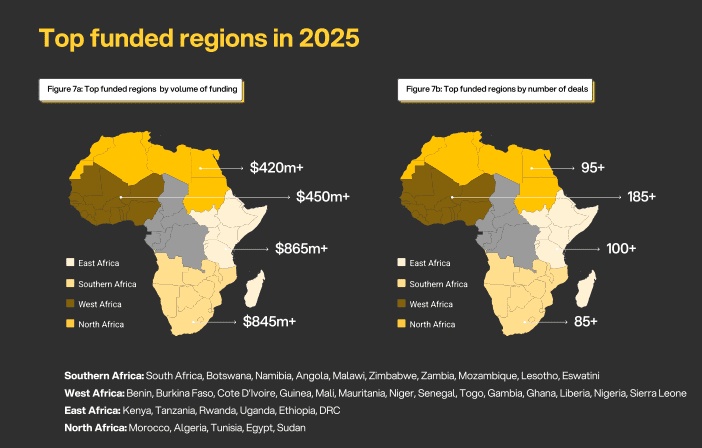

The tilt toward debt has also reshaped the geography of funding. East Africa and Southern Africa emerged as the top destinations for capital in 2025, pulling in $865 million and $845 million respectively. By contrast, West Africa attracted just $420 million, while North Africa followed closely at $450 million.

It is a notable reversal. For years, Nigeria anchored West Africa’s dominance in venture flows, but in 2025, the billion-dollar rounds increasingly bypassed Lagos for Nairobi and Johannesburg. Egypt managed to keep its funding levels steady, but with less capital flowing to other North African countries, its share of the region is shrinking.

Debt has played a role in this rebalancing. Many of the year’s biggest debt transactions – from Kenya’s solar energy projects backed by IFC, Norfund, and KCB, to South Africa’s payments and diagnostic firms raising from HSBC and Patient Square Capital – were concentrated in East and Southern Africa.

These regions, home to stronger banking sectors and infrastructure-heavy startups, became the natural magnets for debt financing, while West Africa’s equity-driven ecosystem lost momentum.

The numbers tell a story of maturity. In 2025, debt funding passed the $1B mark for the first time, while equity continued to dominate in volume of deals. Yet the balance is narrowing.

Debt accounted for some of the largest checks of the year, including $165 million raised by Zepz from HSBC and hundreds of millions flowing into Sun King and d.light through debt transactions. Even as total deal activity remained lower than in the bubble years, the median deal size rebounded to over $1 million, with Cleantech debt deals pushing above $5 million on average.

But this shift also signals where the risks lie. The sharpest drop in activity has been in the $250,000–$1 million range, which collapsed from 90 deals in 2022 to just 21 in 2025.

Early-stage companies that once relied on grants or small equity rounds are being left behind, as debt flows mainly to asset-heavy businesses with proven models. This trend reinforces another gap: all-male founding teams captured 70% of deals and an even greater share of total funding, while women-led startups remained stuck at the margins.

For investors, debt offers predictability in repayment and the security of tangible assets. For startups, it can mean faster growth without dilution. Yet the bet carries the risk of repayment schedules that can outpace revenue growth, and companies could be saddled with obligations that choke future expansion.

Read also: African insurtech startups raised $200k in Q2 as global funding declines by 21%

The continent’s venture ecosystem is, in effect, trading the volatility of equity for the discipline, and constraints, of leverage.

Outlook of debt funding in Africa

By August 2025, deal volume had already nearly matched the full-year total of 2024, putting the market on track to reverse two years of post-bubble decline.

The report outlines three possible scenarios: if activity grows at the slowest pace, similar to 2023, the year would just slightly surpass last year’s levels. A mid-range increase, echoing 2022 or 2024, would mark a stronger recovery. And if the market gathers momentum as it did in 2021, 2025 could close as the most significant rebound year in recent history, with total funding approaching the highs of the bubble era.

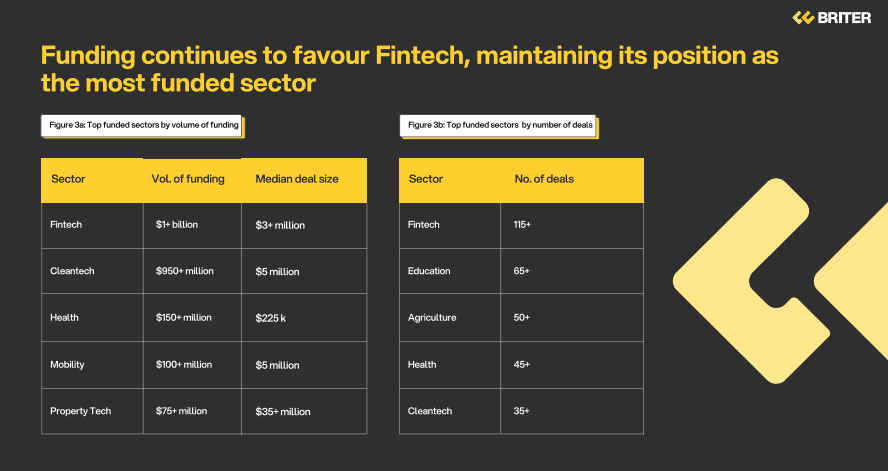

The shape of this rebound is what sets it apart. Where 2021 was defined by a rush of small equity checks, 2025 is being carried by fewer, bigger deals and the unprecedented weight of over $1B in debt financing.

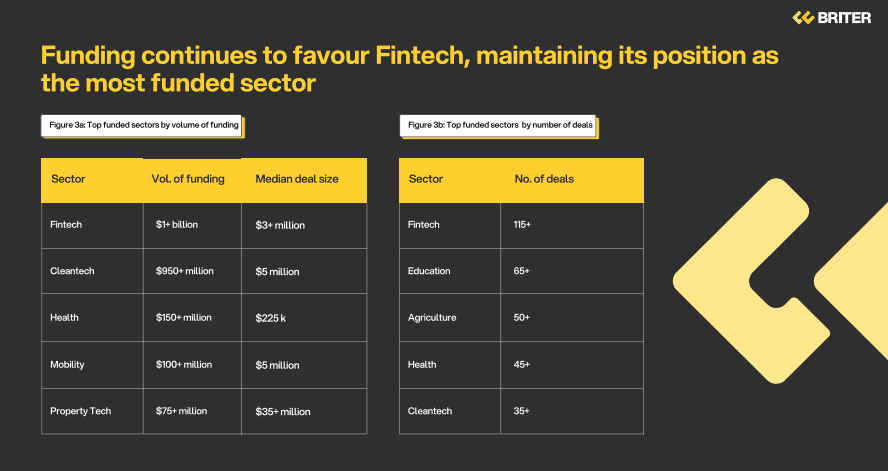

Cleantech alone attracted nearly $950 million, largely through debt, while Fintech kept its crown with over $1B in funding across 115+ deals. The underlying message is that Africa’s startup market is no longer chasing volume. It is consolidating, leveraging bigger checks, asset-heavy businesses, and a new reliance on debt.

If the trajectory holds, the continent’s next wave of breakout companies may not fit the classic VC script. Instead of equity-fuelled unicorns, Africa’s growth story could increasingly be powered by debt, disciplined, infrastructure-backed, and anchored in the realities of scale.