Manufactured goods exports in Africa’s most populous country surged 67.2 percent in the second quarter of 2025, an indication of a positive trend in the country’s industrial sector.

Data from the foreign trade report showed that the country’s exports for the period rose by 67.2 percent to N803.8 billion in Q2 2025 when compared to N480.8 billion recorded in the corresponding period of 2024 on a year-on-year basis.

On a quarter-on-quarter basis, the manufactured exports increased by 173 percent from N294 billion in first quarter of 2025.

A breakdown of the report shows that the value of manufactured goods traded in the second quarter of 2025 stood at N8.7 trillion, accounting for 22.8 percent of total trade for the period.

Read also: Nigeria posts N7.46tr trade surplus as exports rise, imports fall

According to the report, the main manufactured export commodity was Lightvessels, fire-floats, floating cranes and other vessels exported to the Netherlands and France worth N212.04 billion and N24.1 billion respectively.

This was followed by ‘Floating or submersible drilling or production platforms’ valued at N90.43 exported to Equatorial Guinea and ‘Unwrought aluminum alloys’ exported to Japan and India worth N55.71 billion and N7.62 billion respectively.

Further analysis revealed that manufactured goods were mainly exported to Europe valued at N357.70 billion, followed by exports to Africa, goods worth N254.07 billion and to Asia N168.53 billion.

The August Purchasers Manufacturing Index (PMI) released last week showed that business activity rose for ninth consecutive months in August, an indication of increased production.

The headline index rose to 54.2 from 54 in the previous month. Readings above 50.0 signal an improvement in business conditions, while those below show deterioration.

“At 54.2 in August, the headline PMI was above the 50.0 no-change mark for the ninth month running, signalling a sustained improvement in the health of the Nigerian private sector,” the report stated.

The latest reading marked the strongest expansion since April, supported by sharper growth in output and new orders, which reached four- and 19-month highs, respectively, the report said.

The foreign trade report also showed that manufactured goods imported were ‘Machines for reception, conversion and transmission of voice, images or data.’ imported from China, valued at ₦261.1 billion.

Read also: Kyari pushes for quality in exports to boost non-oil revenue

This was followed by ‘other herbicides, anti-sprouting products and planters from China and India with N144.1 billion and N5.9 billion respectively.

Other manufactured goods imported were new pneumatic tyres of a kind used on buses and lorries from China, with N135.9 billion and ‘Other medicaments not elsewhere specified’ imported from India and China, valued at N73.4 billion and N26.4 billion, respectively.

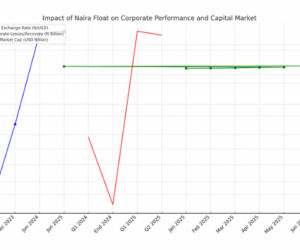

According to manufacturers, the high raw materials and machinery import bill is due to exchange volatility.

The country’s currency traded against the green bag during the period was 1,600/$ as against N1,550 in the corresponding period of 2024, according to BusinessDay’s analysis.

Manufacturers import their raw materials invoiced in dollars, which they must now purchase using the slumping naira.

Depending on the sector, exposure to the FX market in the Nigerian manufacturing sector averages about 40 percent, according to the Manufacturers Association of Nigeria (MAN).

But it differs from sector to sector. Sectors like pharmaceuticals and chemicals would naturally have higher FX exposure because most of their inputs are imported owing to the limited petrochemical industry in Africa’s most populous nation.

Read also: Non-oil exports emerging as Nigeria’s new source of FX – NOA

Products from inputs to machinery are imported into the country weekly by manufacturers. The fact that manufacturers are the biggest importers, however, ironically, given that the sector should naturally be at the forefront of exporting and repatriating FX into the economy.

“Due to the high and volatile foreign exchange rate and high import duties, the cost of importing needed raw materials has risen astronomically,” said Segun Ajayi-Kadir, director-general of the Manufacturers Association of Nigeria (MAN) at BusinessDay’s Manufacturing conference held in Lagos recently.

“Sadly, while most of these raw materials are not available locally, those that are available are scarce and becoming limited in supply,” he added.